Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

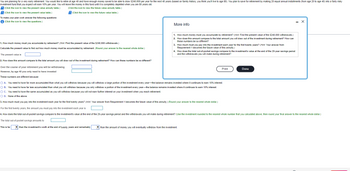

Transcribed Image Text:Reference

Present Value of $1

12% 14% 16% 18% 20%

Periods 1%

2% 3% 4%

Period 1 0.990 0.980 0.971 0.962

Period 2

Period 3

Period 4

Period 5

Period 6

Period 7

5% 6% 8% 10%

0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833

0.980 0.961 0.943 0.925 0.907 0.890 0.857 0.826 0.797

0.826 0.797 0.769 0.743 0.718 0.694

0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579

0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482

0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402

0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335

0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279

Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233

Period 9 0.914 0.837 0.766 0.703 0.645 0.592 0.500

0.703 0.645 0.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194

Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162

Period 11 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135

Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112

Period 13 0.879 0.773 0.681

0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093

Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078

Period 15 0.861 0.743 0.642 0.555

0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.065

Period 20 0.820 0.673 0.554 0.456 0.377 0.312 0.215 0.149 0.104 0.073 0.051 0.037 0.026

Period 25 0.780 0.610 0.478 0.375 0.295 0.233 0.146 0.092 0.059 0.038 0.024 0.016 0.010

Period 30 0.742 0.552 0.412 0.308 0.231 0.174 0.099 0.057 0.033 0.020 0.012 0.007 0.004

Period 40 0.672

0.142 0.097 0.046 0.022 0.011 0.005 0.003 0.001 0.001

0.453 0.307 0.208

[0

Print

Done

Reference

Future Value of $1

Period 20

Period 25

Period 30

Period 40

4%

5%

6% 8% 10%

Periods 1% 2% 3%

12% 14% 16% 18% 20%

Period 1 1.010 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.140 1.160 1.180 1.200

Period 2 1.020 1.040 1.061 1.082 1.103 1.124 1.166 1.210 1.254 1.300 1.346 1.392 1.440

Period 3 1.030 1.061 1.093 1.125 1.158 1.191 1.260 1.331 1.405 1.482 1.561 1.643 1.728

Period 4 1.041 1.082 1.126 1.170 1.216 1.262 1.360 1.464 1.574 1.689 1.811 1.939 2.074

Period 5 1.051 1.104 1.159

1.217 1.276 1.338 1.469 1.611 1.762 1.925 2.100 2.288 2.488

Period 6

1.062 1.126 1.194 1.265 1.340 1.419 1.587

1.772 1.974 2.195

2.436 2.700 2.986

Period 7 1.072 1.149 1.230 1.316 1.407 1.504 1.714 1.949 2.211 2.502 2.826 3.185 3.583

Period 8 1.083 1.172 1.267 1.369 1.477 1.594 1.851 2.144 2.476 2.853 3.278 3.759 4.300

Period 9 1.094 1.195 1.305 1.423 1.551 1.689 1.999 2.358 2.773 3.252 3.803 4.435 5.160

Period 10 1.105 1.219 1.344 1.480 1.629 1.791 2.159 2.594 3.106 3.707 4.411 5.234 6.192

Period 11 1.116 1.243 1.384 1.539 1.710 1.898 2.332 2.853 3.479 4.226 5.117 6.176 7.430

Period 12 1.127 1.268 1.426 1.601 1.796 2.012

2.012 2.518 3.138 3.896 4.818 5.936 7.288 8.916

Period 13 1.138 1.294

1.469 1.665 1.886 2.133

2.133 2.720 3.452 4.363 5.492 6.886 8.599 10.699

Period 14

1.149 1.319

1.513 1.732 1.980 2.261 2.937 3.797 4.887 6.261 7.988

7.988 10.147 12.839

Period 15 1.161 1.346 1.558 1.801 2.079 2.397 3.172 4.177 5.474 7.138 9.266 11.974 15.407

1.220 1.486 1.806 2.191 2.653 3.207 4.661 6.727 9.646 13.743 19.461 27.393 38.338

1.282 1.641 2.094 2.666 3.386 4.292 6.848 10.835 17.000 26.462 40.874 62.669 95.396

1.348 1.811 2.427 3.243 4.322 5.743 10.063 17.449 29.960 50.950 85.850 143.371 237.376

1.489 2.208 3.262 4.801 7.040 10.286 21.725 45.259 93.051 188.884 378.721 750.378 1,469.772

Print

- X

Done

Reference

Present Value of Annuity of $1

Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20%

Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862

0.862 0.847 0.833

Period 2 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528

Period 3 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106

Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798

2.798 2.690 2.589

Period 5 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991

Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.685 3.498 3.326

Period 7 6.728 6.472 6.230 6.002 5.786 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605

Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837

Period 9 8.566 8.162 7.786 7.435 7.108 6.802 6.247 5.759 5.328 4.946 4.607 4.303 4.031

Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192

Period 11 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327

Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197

4.793 4.439

Period 13 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 4.910 4.533

Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 5.468 5.008 4.611

Period 15 13.865 12.849 11.938 11.118 10.380 9.712 8.559 7.606 6.811 6.142 5.575

6.142 5.575 5.092 4.675

Period 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 5.929 5.353 4.870

Period 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 6.097 5.467 4.948

Period 30 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.427 8.055 7.003 6.177 5.517 4.979

Period 40 32.835 27.355 23.115 19.793 17.159 15.046 11.925 9.779 8.244 7.105 6.233 5.548 4.997

Print

Done

Transcribed Image Text:You are planning for a very early retirement. You would like to retire at age 40 and have enough money saved to be able to draw $240,000 per year for the next 40 years (based on family history, you think you'll live to age 80). You plan to save for retirement by making 20 equal annual installments (from age 20 to age 40) into a fairly risky

investment fund that you expect will earn 10% per year. You will leave the money in this fund until it is completely depleted when you are 80 years old.

(Click the icon to view the present value annuity table.)

(Click the icon to view the future value annuity table.)

(Click the icon to view the present value table.)

(Click the icon to view the future value table.)

To make your plan work answer the following questions:

i (Click the icon to view the questions.)

1. How much money must you accumulate by retirement? (Hint: Find the present value of the $240,000 withdrawals.)

Calculate the present value to find out how much money must be accumulated by retirement. (Round your answer to the nearest whole dollar.)

The present value is

2. How does this amount compare to the total amount you will draw out of the investment during retirement? How can these numbers be so different?

Over the course of your retirement you will be withdrawing

However, by age 40 you only need to have invested

These numbers are different because:

This is far

More info

▼than the investment's worth at the end of twenty years and remarkably

1. How much money must you accumulate by retirement? (Hint: Find the present value of the $240,000 withdrawals.)

2. How does this amount compare to the total amount you will draw out of the investment during retirement? How can

these numbers be so different?

3. How much must you pay into the investment each year for the first twenty years? (Hint: Your answer from

Requirement 1 becomes the future value of this annuity.)

4. How does the total out-of-pocket savings compare to the investment's value at the end of the 20-year savings period

and the withdrawals you will make during retirement?

O A. You need to have far more accumulated than what you will withdraw because you will withdraw a large portion of the investment every year the balance remains invested where it continues to earn 10% interest.

O B. You need to have far less accumulated than what you will withdraw because you only withdraw a portion of the investment every year the balance remains invested where it continues to earn 10% interest.

You need to have the same accumulated as you will withdraw because you will not earn further interest on your investment when you reach retirement.

O C.

O D. None of the above.

3. How much must you pay into the investment each year for the first twenty years? (Hint: Your answer from Requirement 1 becomes the future value of this annuity.) (Round your answer to the nearest whole dollar.)

For the first twenty years, the amount you must pay into the investment each year is

4. How does the total out-of-pocket savings compare to the investment's value at the end of the 20-year savings period and the withdrawals you will make during retirement? (Use the investment rounded to the nearest whole number that you calculated above, then round your final answer to the nearest whole dollar.)

The total out-of-pocket savings amounts to

Print

than the amount of money you will eventually withdraw from the investment.

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investment will generate $12,000 a year for 30 years. If you can earn 12 percent on your funds and the investment costs $100,000, calculate the present value of investment. Use Appendix D to answer the question. Round your answer to the nearest dollar.$ Should you buy it?-Select-YesNoItem 2 Calculate the present value of investment, if you could earn only 9 percent. Use Appendix D to answer the question. Round your answer to the nearest dollar.$ Should you buy it in this case?arrow_forwardMateo and Klaus would like to buy a house and their dream starter home costs $650,000. Their goal is then to save $65,000 for a down payment and then would take out a mortgage loan for the rest. They plan to put their monthly saved amount in a conservative mutual fund that has a track record of a 4.25% rate of return, compounded quarterly. To be sure they don't go spending this money on other things, they are going to move it into their investment account at the beginning of each month. Their hope is to be able to buy this home in 7 years. What would their monthly savings amount have to be to reach this goal? What will be the total interest earned? Mateo and Klaus have now saved up their down payment to buy a home, but they still need to borrow to cover the rest. For the home they want this will require a mortgage of $585,000 to cover the remaining amount and they're not sure whether they could afford the monthly loan payments. The bank has offered them a mortgage interest…arrow_forwardYou are thinking about investing $5,000 in your friend's landscaping business. Even though you know the investment is risky and you can't be sure, you expect your investment to be worth $5,750 next year. You notice that the rate for one-year Treasury bills is 1%. However, you feel that other investments of equal risk to your friend's landscape business offer an expected return of 10% for the year. What should you do? Answer: The intrinsic value of the investment in the landscaping business is $ two decimal places. No dollar sign, no comma) You (answer either "should" or "should not") invest in this landscaping business because the intrinsic value is (answer "greater" or "less") than $ (Round to (round to the nearest dollar. No dollar sign, no comma).arrow_forward

- You want to buy a house within 3 years, and you are currently saving for the down payment. You plan to save $10,000 at the end of the first year, and you anticipate that your annual savings will increase by 20% annually thereafter. Your expected annual return is 12%. How much will you have for a down payment at the end of Year 3? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardPlease provide solutions to the following problems: You receive a cash bonus, but your employer gives you two options: receive $8,000 right now or $10,000 two years from now. Assuming an interest rate of 12% what would be the best option. Show all calculations. Find the future value of $500 in 6 years at 9%. What is the present value of an investment that will generate $300 per year for 15 years at 6%? If your grandparents decide to give you $30,000 when you complete your degree what might you offer to them today as an amount as opposed to waiting the 4 years (assume a 5% interest rate). Calculations must be shown for full credit. Also they help in awarding partial credit at the instructors discretion. If using formulas, a financial calculator, or online calculator is used, what value is entered for each variable must be given. If Excel is used the spreadsheet with the formula must be submitted.arrow_forwardYou want to purchase a new car and you are willing to pay $20,000. If you can invest at 10% per year and you currently have $15,000, how long will it be before you have enough money to pay cash for the car?arrow_forward

- Using the time value of money You are planning for an early retirement. You would like to retire at age 40 and have enough money saved to be able to withdraw $220,000 per year for the next 30 years (based on family history, you think you will live to age 70). You plan to save by making 20 equal annual installments (from age 20 to age 40) into a fairly risky investment fund that you expect will earn 8% per year. You will leave the money in this fund until it is completely depleted when you are 70 years old. Requirements How much money must you accumulate by retirement to make your plan work? (Hint: Find the present value of the $220,000 withdrawals.) How does this amount compare to the total amount you will withdraw from the investment during retirement? How can these numbers be so different?arrow_forwardYou are thinking about investing $4,953 in your friend's landscaping business. Even though you know the investment is risky and you can't be sure, you expect your investment to be worth $5,650 next year. You notice that the rate for one-year Treasury bills is 1%. However, you feel that other investments of equal risk to your friend's landscape business offer an expected return of 10% for the year. What should you do? The present value of the return is $ (Round to the nearest cent.)arrow_forwardLet us develop a savings plan for your retirement. We will assume that you will be fin-ished with your schooling by age 25, and work for 40 years to retire at age 65. Let us (verygenerously and optimistically) imagine that you will receive a substantial graduation giftof $10,000, and will open an investment account with it that (again, quiteoptimistically) can be expected to reliably pay 8% interest, compounded continuously. Inaddition, you will plan to save a portion of your paycheck each week, for a total of D dollarsper year, every year. Determine D, i.e how much you need to add to your account from yourearnings every year, in order to retire with a princely sum of $2,000,000 in your retirementaccount.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education