You are managing an investment portfolio and sell an “inflation-protected”

If you earn 4.17% APR (monthly compounding) nominal terms on your investments, how much do you need to invest today to fully fund the annuity?

The present value is the value of the sum received at time 0 or the current period. It is the value of the sum that will be received in the future period.

The annual payment of annuity is $3,862 per month. The time period is 7 years and the annual percentage rate is 4.17%. The inflation rate is 0.45% per month.

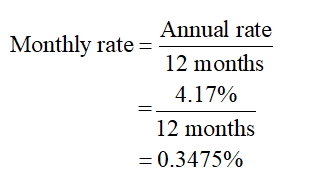

Compute the monthly interest rate, using the equation as shown below:

Hence, the monthly interest rate is 0.3475%.

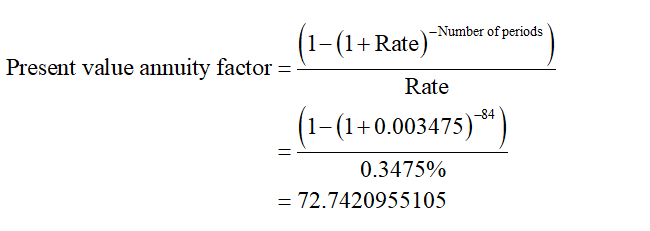

Compute the present value annuity factor (PVIFA), using the equation as shown below:

Hence, the present value annuity factor is 72.7420955105.

Step by stepSolved in 5 steps with 3 images

- You are looking at an investment that will make annual payments of $28,000, $32,000, $66,000, and $99,000 to you each year over the next four years, respectively. All payments will be made at the end of the year. If the appropriate interest rate is 3.6 percent, what is the value of the investment offer today?arrow_forwardAn investment you have will mature in 6 months and will give you $13,000 at that time if your initial deposit is $12,000. What is the nominal annual interest rate and what is the effective interest rate?arrow_forwardYou are offered an annuity that will pay $5,420 per quarter for 8 years (first payment made today). If you feel that the appropriate discount rate is 13%, what is the annuity worth to you today?arrow_forward

- A growing monthly perpetuity will start 6 months from today. If the discount rate is 6% APR compounded monthly, what is the value of the perpetuity today (at time t=0) if the growth rate is 1.2% APR compounded monthly and the first payment is $100?arrow_forwardAn investment offers $966 per year for 11 years, with the first payment occurring Zyears from now. If the required return is 9 percent, what is the value of the investment? (HINT: Remember that when you calculate the PV of the annuity, the claculator gives you the present value of the annuity 1 period before the annuity starts. So if the annuity starts in year 7, that calculator will to give you the persent value of annuity in year 6. Now you have to bring this number to period O by inputting: N=6 (1 period before the annuity starts, in your case it would be a different number depending when your annuity starts) R=9 FV=Present value of annuity you found in step 1. And you solve for PV)arrow_forwardYou have just received a windfall from an investment you made in a friend's business. She will be paying you $26,016 at the end of this year, $52,032 at the end of next year, and $78,048 at the end of the year after that (three years from today). The interest rate is 11.4% per year. a. What is the present value of your windfall? b. What is the future value of your windfall in three years (on the date of the last payment)?arrow_forward

- An investment promises to pay $7,000 at the end of each year for the next six years and $3,000 at the end of each year for years 7 through 10. Use Table II and Table IV or a financial calculator to answer the questions. Round your answers to the nearest cent. If you require a 15 percent rate of return on an investment of this sort, what is the maximum amount you would pay for this investment?$ Assuming that the payments are received at the beginning of each year, what is the maximum amount you would pay for this investment, given a 15 percent required rate of return?$arrow_forwardYou are trying to value the following investment opportunity: The investment will cost you $22151 today. In exchange for your investment you will receive monthly cash payments of $5195 for 9 months. The first payment will occur at the end of the first month. The applicable effective annual interest rate for this investment opportunity is 7%. Calculate the NPV of this investment opportunity. Round to two decimals (do not include the $-sign in your answer).arrow_forwardYou want to begin saving for your retirement. You plan to contribute $12,000 to the account at the end of this year. You anticipate you will be able to increase your annual contributions by 3% each year for the next 45 years. If your expected annual return is 8%, how much do you expect to have in your retirement account when you retire in 45 years? If current interest rate is 28%, a Treasury Bill with 91 days to maturity, and a face value of GH¢ 50,000 should have a market value of? Assuming you bought a 182-day Treasury Bill with a face value GH¢20,000.00 and held it for 45 days. If you want to sell it and interest rate is currently at 25%, at what price will you sell it? A Treasurer buys a 6-month CD issued by a top-class bank with a tenor of 180 days at a yield of 16%. The face value at issue is GH¢10m. In 90-days time the buyer sells the CD when the 3-month secondary market for CDs issued in the names of top-class banks is 40/14.50. The buyer has held the CD for 90days, but now…arrow_forward

- Your retirement policy lets you receive in 35 years equal annual payments of $10,000 for 10 years. The relevant interest rate is 6%. What is its PV? (Hint: this is a two step problem; find what the value of the retirement annuity will be 35 years from now and THEN find the present value of that sum in today’s dollars.arrow_forwardYou want to receive $5000 per month for 20 years in real dollars in an account when you retire in 35 years. The first monthly payment to be received 1 month after you retire. The nominal return on your investment is 9.94 percent and the inflation rate is 3.2 percent. What is the real amount you must deposit each year for 35 years to achieve your goal? Pls do using Excelarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education