Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Radhubhai

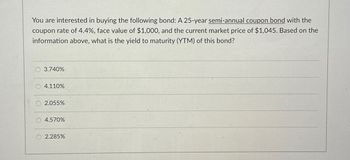

Transcribed Image Text:You are interested in buying the following bond: A 25-year semi-annual coupon bond with the

coupon rate of 4.4%, face value of $1,000, and the current market price of $1,045. Based on the

information above, what is the yield to maturity (YTM) of this bond?

3.740%

O4.110%

2.055%

4.570%

2.285%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?arrow_forwardBond Yields and Rates of Return A 10-year, 12% semiannual coupon bond with a par value of 1,000 may be called in 4 years at a call price of 1,060. The bond sells for 1,100. (Assume that the bond has just been issued.) a. What is the bonds yield to maturity? b. What is the bonds current yield? c. What is the bonds capital gain or loss yield? d. What is the bonds yield to call?arrow_forwardRarrow_forward

- What is the duration of the following bond:$1,000par value,6%annual coupon, 4 years to maturity, and yield to maturity of6.5%? You will need your answer for the next question. In the prior question, what is the present value of the bond?arrow_forwardConsider a risk-free zero-coupon bond with face value $1000, 20 years to maturity. If the yield to maturity (YTM) is 6%, the price at which this bond will trade is closest to: A. $167.44 B. $312 C. $214.55 D. $174arrow_forward← Suppose a ten-year, $1,000 bond with an 8.6% coupon rate and semiannual coupons is trading for $1,034.51. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.7% APR, what will be the bond's price? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? The bond's yield to maturity is%. (Round to two decimal places.)arrow_forward

- Suppose a 10-year, $1,000 bond with an 8.0% coupon rate and semi-annual coupons is trading for a price of $1,034.74. a. What is the bond's yield to maturity (expressed as an APR with semi-annual compounding)? b. If the bond's yield to maturity changes to 9.0% APR, what will the bond's price be? a. What is the bond's yield to maturity (expressed as an APR with semi-annual compounding)? The bond's yield to maturity is %. (Round to two decimal places.)arrow_forwardConsider a bond with a coupon rate of 7%. The bond has a par value of $1,000, a current price of $850, and it will mature in 20 years. What is the yield to maturity YTM using:A- the exact method andB- the approximate methodarrow_forwardSuppose a ten-year, $1,000 bond with a 8.9% coupon rate and semiannual coupons is trading for$1,035.32. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.4% APR, what will be the bond's price? The bond's yield to maturity is ______%. (Round to two decimal places.)arrow_forward

- Consider a 25-year bond with a face value of $1,000 that has a coupon rate of 5.8%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. a. What is the coupon payment for this bond? The coupon payment for this bond is $ *** (Round to the nearest cent.)arrow_forwardConsider a zero-coupon bond with a $1,000 face value and 10 years to maturity. The price this bond will trade if the Yield To Maturity is 7.1% is closest to: A) $604.35 B) $805.8 C) $705.07 D) $503.62arrow_forwardSuppose a 10-year, $1,000 bond with a coupon rate of 8.7% and semiannual coupons is trading for $ 1,034.28 a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b If the bond's yield to maturity changes to 9.9% APRwhat will be the bond's price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning