Fundraising Opportunity

You are in your second year in the BCom program at York University and came back home for the summer. In past summers you have hold several part time jobs. In your spare time, you are a very active fundraiser for Paws Support and their international missions.

You had the fundraising idea of operating a booth to sell soft drinks, coffee, croissants, and other baked goods in the library park where all community events are held between May and August. They include all sorts of neighbourhood parties that showcase local street art dealers, performers, local shoppes and artists.

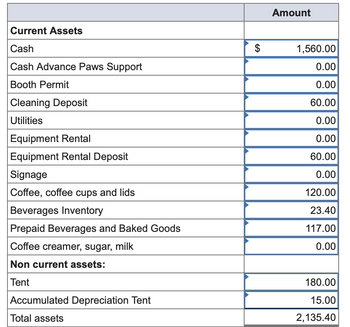

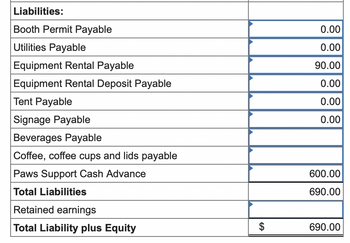

You approached Paws Support with the idea and a week later you got the approval to create the booth and were given a $600 advancement to cover the start up costs. Once you got the funds on May 1st, planning started. Among the activities performed you got donations, permits, signage, tent, display cases, water, electrical connections and the municipal permit for the booth.

One of the first steps is to pay in cash on May 1st to the Municipality for the booth permit (cost $120 for the season, 1 day or 4 months same cost, so it is expensed in May) and cleaning fees (pay for a refundable deposit of $60 that will be returned on August 31st if the boot receives no ticket from the municipality inspectors).

You were elated because the Library will allow your booth to conect and use the Library utilities. Water, Drain, and Electricity connections, use and dismantle after the event had a cost of $150 per month paid in cash on the last day of each month, first payment on May 31st. This fee includes safe storage of the booth and equipment during week days.

Next stop was at Equipment Rental to rent display cases, portable sink, warming oven, refrigerator, tables, two coffee markers, and a cash register for $90 per month. For the month of May add $60 for a refundable deposit that will be reimbursed after all the equipment has been returned in good shape (reduce the rent payable on Sep 5th). Rent is due on the fifth day of the following month (May payment and the deposit are due on June 5th).

On May 1st you ordered a Booth Tent that will last three summers (12 months) for $180 and signage for the booth for $60 that is immediately expensed, paid for both with your MasterCard whose balance will be due on July 2nd. A total of $450 has been pre-order on May 1st for coffee, coffee cups, lids, and stir Stix. Delivery scheduled for May 10th, one third of the total purchase has been used in the month of July. Payment of 50% each are due on May 15th and July 15th.

At General Drinks you ordered on account a total of 30 cases of soft drinks per month, to be delivered on the first of each month, for a $3.9 a case. Payment for the total of four months is due on June 30th. At the end of the month there were 6 cases in inventory.

You spoke to the owner of the local bakery to source Croissants and other assorted baked goods to sell for the fundraiser. You agreed on daily deliveries on Fridays, Saturdays and Sundays for a total of 90 units per month. You will pay $1.0 for each item on the last day of the month. If demand is high, you will phone the bakery and more units will be delivered on site after 8pm for free.

When needed you go to the local supermarket to purchase Coffee Creamer, Sugar and Milk, paying $30 cash during the month. All is used in the month.

Every Friday morning you start setting everything up. You have been lucky to recruit other volunteers that will help you set up, manage and dismantle the booth every weekend. You got a schedule that guarantees a minimum of 2 people in the booth at any time.

The events during July were successful, everything was sold with only six full cases of soft drinks left. Sales of items for the month was $1,200, there was a donation jar that had $360 which was deposited at month end in the bank. The cash advance will be returned on September 10th together with the total funds raised in the summer.

To solve the problem assume the opening balance for the month is $840 for cash, $270 for Coffee, coffee cups and lids and $459.00 for

Prepare the

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

- Give typing answer with explanation and conclusionarrow_forwardImagine you are a philanthropist who would like to donate to a charity that provides shelter and assistance to homeless individuals. You would like to donate enough money to the charity to ensure that they can provide shelter for 12 homeless individuals every year in perpetuity. The cost of providing shelter per individual is $60 per day. If your investment fund pays a return of 2% per year, how much do you need to donate to the charity now so that they can provide shelter for 1200 individuals every day in perpetuity? Enter your answer to the nearest cent (two decimal places)arrow_forwardA volunteer has been asked to drop off some supplies at a facility housing victims of a hurricane evacuation. The volunteer would like to bring at least 240 bottles of water, 117 first aid kits, and 83 security blankets on his visit. The relief organization has a standing agreement with two companies that provide victim packages. Company A can provide packages of 21 water bottles, 9 first aid kits, and 7 security blankets at a cost of $2. Company B can provide packages of 8 water bottles, 5 first aid kits, and 3 security blankets at a cost of $1.50. How many of each package should the volunteer pick up to minimize the cost? What amount does the relief organization pay? Answer Enter the value in the first box and the ordered pair in the second box. Minimum Cost of S Minimum Cost at Tables Keypad Keyboard Shortcutsarrow_forward

- FASTER BIKE SHOP Phil Murphy liked bikes. During a recent period of unemployment, he decided to turn his hobby into a business by opening: FASTER BIKE SHOP where he both would sell and repair bikes. Phil opened up an account at the local bank for FASTER BIKE SHOP and deposited all of his retirement money, $20,000, into the business. His friend, Sue Long, gave Phil a two-year lease on a building she owned for Phil to use as his bike shop for $12,000. To receive such a good deal on rent, he was required to pay the $12,000 up front. In addition, Phil bought some store fixtures and bicycle repair equipment for $10,000. He expected these to last for 5 years before they needed to be replaced. Phil spent $2,700 for hand tools. Because of heavy use Phil expected to need to replace the hand tools in 3 years. To get the business started Phil advertised heavily in the local newspaper. He spent $5,000 advertising Faster Bike Shop in the first month, including the grand opening. He spent…arrow_forwardNate and Joe have been friends since grade school and decided to go on a skiing trip to Stowe, Vermont this January.The estimated the following for the trip: Expense Estimated Costs Allocation Base Activity Allocation (Nate) Activity Allocation (Joe) Food $580.00 Number of meals eaten 10 18 Skiing $210.00 Number of lift tickets 3 0 Lodging $810.00 Number of nights 5 5 Total $1,600.00 (Round your answers to two decimal places when needed and use rounded answers for all future calculations). Total estimated cost / Total Individuals = Cost per person / =arrow_forwardsity in Philadelphia used a biplane to pull a sign promoting its evening program, and one in Mississippi you 5-38 Advertising Expenditures and Nonprofit Organizations Many colleges and universities have been extensively advertising their services. For example, a upiu sity in Philadelphia used a biplane to pull a sign promoting its evening program, and one in Mississin designed bumper stickers and slogans as well as innovative programs. Suppose Hilliard College charges a comprehensive annual fee of $14,800 for tuition, To and board, and it has capacity for 2,000 students. The admissions department predicts enrollmento 1,700 students for 20X1. Costs per student for the 20X1 academic year are as follows: Variable Fixed Total Educational programs $5,200 $ 3,900 $ 9,100 Room 1,100 2,300 3,400 Board 2,500 500 3,000 $8,800 $ 6,700" $15,500 *Based on 1,700-2,000 students for the year. The assistant director of admissions has proposed a 2-month advertising campaign using radio and television…arrow_forward

- A country club wants to exam the effects of a new marketing campaign that attempts to get more people within the community to become members. In many communities, when people buy a house in the area, they receive a “Welcome Wagon” gift basket containing coupons to local restaurants. The idea of the marketing campaign is to include a free two month membership to the country club in the gift basket with the hope that once “new” residents try the country club then at least a certain proportion will want to become real members. One member of the Club’s Executive Council believes that at least 81% of the people who receive the coupons for the free membership will use the coupon. In a sample of 192 new residents who received the coupon for the two month free membership, there were 138 people who actually took advantage of the free two month membership. When testing the hypothesis that at least 81% of the people that receive the coupon actually use it, what is the test statistic?arrow_forwardThe University of Cincinnati Center for Business Analytics is an outreach center that collaborates with industry partners on applied research and continuing education in business analytics. One of the programs offered by the center is a quarterly Business Intelligence Symposium. Each symposium features three speakers on the real-world use of analytics. Each corporate member of the center (there are currently 10) receives five free seats to each symposium. Nonmembers wishing to attend must pay $75 per person. Each attendee receives breakfast, lunch, and free parking. The following are the costs incurred for putting on this event: Rental cost for the auditorium: Registration Processing: Speaker Costs: Continental Breakfast: Lunch: Parking: (a) The Center for Business Analytics is considering a refund policy for no-shows. No refund would be given for members who do not attend, but nonmembers who do not attend will be refunded 50% of the price. Build a spreadsheet model that calculates a…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education