Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:ces

с

raw

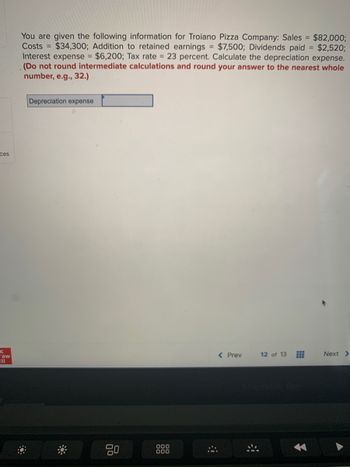

You are given the following information for Troiano Pizza Company: Sales = $82,000;

Costs $34,300; Addition to retained earnings = $7,500; Dividends paid = $2,520;

Interest expense = $6,200; Tax rate = 23 percent. Calculate the depreciation expense.

(Do not round intermediate calculations and round your answer to the nearest whole

number, e.g., 32.)

Depreciation expense

80

000

000

< Prev

12 of 13

E

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- a. Know: Identify the three major financial statements. b. Understand: Company B has assets totaling $100,000, but liabilities of $70,000. Calculate Company B's owner's equity? c. Apply: In 2022, Company A had net sales of $465,000, cost of goods sold at $260,000, total operating expenses at 100,000 with taxes of 16,000. In 2022, Company B hadnet sales of 440,000, cost of goods sold at $247,000 total operating expenses at 40,000 with taxes of 12,000. Write three sentences or more in which you calculate and compare the bottom line of two companies.arrow_forwardDuring August, 2022, Sheffield's Supply Store generated revenues of $60100. The company's expenses were as follows: cost of goods sold of $35000 and operating expenses of $4200. The company also had rent revenue of $1100 and a gain on the sale of a delivery truck of $2100. Sheffield's net income for August, 2022 is O $25100. O $24100. O $20900. O $22000. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardUse the information below to answer the questions that follow. Enter your answers using digits only - no dollar signs, commas, or decimal points. The business's year-end is December 31. Cost of equipment = 110000 Useful life in years = 4 Residual value 8000 %3D Date purchased = March 1 What is the depreciation expense per year? What is the depreciation expense per month? What is the depreciation expense in the year of purchase?arrow_forward

- Use the following information for questions 1 to 7. The Income Statement for the year 2021 of Mira Co. contains the following information: Revenue P70,000 Expenses: Salary Expense P45,000 Rent Expense 12,000 Advertising Expense 6,000 Supplies Expense Utilities Expense Insurance Expense Total Expenses Net Income (Loss) 6,000 2,500 2,000 73,500 (P3,500)arrow_forward= Listen Industrial Incorporated has the following account balances: COGS = 4,800; Depreciation = 600; Interest = 300; rent = 1,200; Salaries= 3,600; Sales = 12,000, Taxes = 420. Industrial Incorporated's Operating Cash Flow is_ $1,980 $1,450 $1,800 $1,680 O $1,080arrow_forwardNot use ai please don'tarrow_forward

- Please just complete income statement, and the following blanks.arrow_forwardWant Answer please provide Solutions with explanationarrow_forwardBest Feeds, Inc. has the following information on their income statement: Sales $2,000,000 Cash Costs 1,200,000 Depreciation 100,000 EBIT 700,000 Interest Expense 200,000 EBT 500,000 Taxes (25%) 125,000 Net Income $ 375,000 What is their NOPAT? Group of answer choices $427,620 $450,120 $375,000 $498,750 $525,000arrow_forward

- Sales = $1,000; Cost of Goods Sold = $500; Depreciation Expense = $100; Administrative Expenses = $100; Interest Expense = $20; Marketing Expenses = $80; and Taxes = $100. The Co's net income is equal to A) $100. B) $150. C) $220. D) $200.arrow_forwardang Services has annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. The firm paid $700 in dividends, $280 in interest, and has a total tax rate of 21 percent. The firm will add $2,810 to retained earnings. What is the depreciation expense? Multiple Choice a. $2,300 b. $3,709 c. $2,640 d. $780 e. $3,577arrow_forwardwhat is the income...arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education