Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

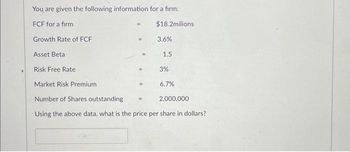

Transcribed Image Text:You are given the following information for a firm:

FCF for a firm

Growth Rate of FCF

Asset Beta

Risk Free Rate

=

$18.2milions

3.6%

1.5

3%

6.7%

Market Risk Premium

Number of Shares outstanding

Using the above data, what is the price per share in dollars?

2,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You know that the return of Sandhill Cyclicals common shares is 1.2 times as sensitive to macroeconomic information as the return of the market. If the risk-free rate of return is 5.00 percent and market risk premium is 5.71 percent, what is Sandhill Cyclicals’ cost of common equity capital? - Cost of common equity capital =?%arrow_forwardThe share price of a company is shs100. Its expected next dividend is shs3. The dividend and share price growth rate is expected to be 4% p.a. The risk-free interest rate is 5% p.a. The share has a beta of 0.8 and the expected yield on the stock market as a whole is 8% p.a. Use the Gordon Growth Model and the Security Market Line to form an opinion as to whether the share is correctly priced.arrow_forwardRoundall dollar answers to 2 decimal places and record all interest rate, coupon rate and growth rate answers as a percentrounded to one decimal place 50. Suppose the risk-free rate is 2.20% and analysts estimate that the market risk premium is 5.50%. Firm A justpaid a dividend of $1.80 per share. The analyst estimates the β of Firm A to be 1.22 and estimates the dividendgrowth rate to be 4.36% forever. If Firm A has 200,000 shares of common stock outstanding, what is the totalmarket value of Firm A’s equity (i.e., price per share times number of shares outstanding)? (Round youranswer up to the nearest whole number (i.e., no decimal places); for example, enter 112,304.874 or112,304.128 as 112305).arrow_forward

- The cost of equity using the CAPM approach The current risk-free rate of return (rRF) is 3.86%, while the market risk premium is 6.63%. the Monroe Company has a beta of 0.92. Using the Capital Asset Pricing Model (CAPM) approach, Monroe's cost of equity isarrow_forwardYou are given the following expected returns for a share under various scenarios. Scenario Probability Expected returnBoom16 % 34.6%Normal41 % 4.4% Recession 43% - 5.2% Calculate the expected return as a percent. Please enter the number as a percentage without the % sign (as you do for the interest rate in the calculator). For example, if your answer is 7.89%, then simply answer "7.89".arrow_forwardWild Swings, Inc.'s stock has a beta of 2.09. If the risk-free rate is 5.99% and the market risk premium is 7.11%, what is an estimate of Wild Swings' cost of equity? Wild Swings's cost of equity capital is __ % ? (Round to two decimal places.)arrow_forward

- Vijayarrow_forwardSuppose the risk-free rate is 3.91% and an analyst assumes a market risk premium of 6.52%. Firm A just paid a dividend of $1.11 per share. The analyst estimates the β of Firm A to be 1.20 and estimates the dividend growth rate to be 4.27% forever. Firm A has 264.00 million shares outstanding. Firm B just paid a dividend of $1.83 per share. The analyst estimates the β of Firm B to be 0.70 and believes that dividends will grow at 2.86% forever. Firm B has 197.00 million shares outstanding. What is the value of Firm B? Answer format: Currency: Round to: 2 decimal places.arrow_forwardThe Swanson Corporation's common stock has a beta of 1.8. If the risk-free rate is 4.9 percent and the expected return on the market is 11 percent, what is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity capital %arrow_forward

- The Rhaegel Corporation's common stock has a beta of 1.2.f the risk-free rate is 5 percent and the expected return on the market is 14 percent, what is the company's cost of equity capital? Multiple Choice 15.8% 16.59% 15.01% 16.43% 21.8%arrow_forwardBarton Industries estimates its cost of common equity by using three approaches: the CAPM, the bond-yield-plus-risk-premium approach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2.10 and it expects dividends to grow at a constant rate g = 4.4%. The firm's current common stock price, P0, is $25.00. The current risk-free rate, rRF, = 4.7%; the market risk premium, RPM, = 6.0%, and the firm's stock has a current beta, b, = 1.15. Assume that the firm's cost of debt, rd, is 11.00%. The firm uses a 3.0% risk premium when arriving at a ballpark estimate of its cost of equity using the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: % Bond yield plus risk premium: % DCF cost of equity: % What is your best estimate of the firm's cost of equity?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education