ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

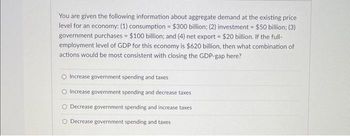

Transcribed Image Text:You are given the following information about aggregate demand at the existing price

level for an economy: (1) consumption = $300 billion; (2) investment = $50 billion; (3)

government purchases = $100 billion; and (4) net export = $20 billion. If the full-

employment level of GDP for this economy is $620 billion, then what combination of

actions would be most consistent with closing the GDP-gap here?

Increase government spending and taxes

Increase government spending and decrease taxes

O Decrease government spending and increase taxes

O Decrease government spending and taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2arrow_forwardIf taxes fall and government spending rises by the same amount, there is very little change in GDP. O True O Falsearrow_forward1. Aggregate expenditures and income The following table shows consumption (C), investment (1), government spending (G), and net exports (X-M) in a hypothetical economy for various levels of real GDP (Y). Assume that the price level remains unchanged at all levels of income. All figures are in billions of dollars. Compute aggregate expenditures for each income level and fill in the last column In the following table. Y с G 500 525 250 150 600 550 250 150 575 250 150 600 250 150 -200 900 625 250 150 -200 700 800 AL AGGREGATE EXPENDITURES (Billions of dollars) The following graph shows real GDP on the horizontal axis and aggregate expenditures (AE) on the vertical axis. The orange line (square symbols) represents a 45-degree (Y-AE) line. 1000 Use the blue points (circle symbol) to plot the aggregate expenditures line for this economy. Line segments will automatically connect the points. 900 300 I 700 X-M Aggregate Expenditures -200 725 -200 750 775 800 825 600 500 + -200 AE line *+…arrow_forward

- In the Graph, what is the equilibrium level of real GDP and equilibrium price? S 120 110 100 S 5,000 6,000 7,500 Real GDP (billions of dollars per year) $5,000 billion real GDP and price level of 120 $5,000 billion real GDP and price level of 110 $6,000 billion real GDP and price level of 110 $7,500 billion real GDP and price level of 100 O O O O Price Levelarrow_forwardWhich of the following changes in personal income tax would lead to the smallest increase in consumption? O a. O b. a $15 000 decrease in taxes, if MPC equals 0.6 O c. a $30 000 decrease in taxes, if MPC equals 0.25 Oe. a $20 000 decrease in taxes, if MPC equals 0.5 O d. a $12 000 decrease in taxes, if MPC equals 0.75 a $10 000 decrease in taxes, if MPC equals 0.2arrow_forward22arrow_forward

- Which of the following is true? O An increase in aggregate demand is the same as a downward shift in the total expenditure function O An increase in aggregate demand is the same as an increase in aggregate supply O An inward shift of the aggregate demand curve is the same as an upward shift in the total expenditure function O An increase in aggregate demand is the same as an upward shift in the total expenditure functionarrow_forwardSuppose that the investment demand curve in a certain economy is such that investment declines by $110 billion for every 1 percentage point increase in the real interest rate. Also, suppose that the investment demand curve shifts rightward by $190 billion at each real interest rate for every 1 percentage point increase in the expected rate of return from investment. If stimulus spending (an expansionary fiscal policy) by government increases the real interest rate by 2 percentage points, but also raises the expected rate of return on investment by 1 percentage point, how much investment, if any, will be crowded out? Instructions: Enter your answer as a whole number. billion %24arrow_forward#17arrow_forward

- Directions: click on the graph in the window on the right and select Time Series to graph the U.S. public (federal) net outstanding debt as a percentage of GDP for the years 1940-2005. For Y Axis1 select Net Federal Debt, percentage of GDP. Use the figure to help determine which of the following statements are true. O A. The U.S. net federal debt to GDP ratio has been, for the most part, decreasing since the end of World War II, despite the fact that the U.S. economy was expanding and could afford a larger debt to GDP ratio. OB. As a result of the exceptionally large increases in U.S. government military expenditures in the first half of the 1940's, that were needed to win World War II, the net U.S. public debt to GDP ratio increased substantially, surpassing 100%. Since the late 1950's however, U.S. net federal debt to GDP ratio has fluctuated within a relatively small bend around the 40% line. OC. The net U.S. federal debt to GDP ratio follows a pattern that cannot have a meaningful…arrow_forwardReal GDP Consumption (dollars) expenditure (dollars) 10 22.5 20 30 30 37.5 40 45 50 52.5 60 60 2 LAS 160 * SAS 150 140 130 120 AD 4 8 12 16 20 24 Real GDP (trillions of 2000 dollars) In the above table and figure, supposed that there is no import or proportional tax. To pull the economy back to the long-run equilibrium, the government can conduct a balanced budget operation by spending $ trillion. O 1) 1 O 2) 2 O 3) 4 4) 8 el (GDP deflator, 2000 = 100) Coarrow_forwardMoving to another question will save this response. Question 8 In an open mixed economy, the inflationary expenditure gap may be described as the O A. excess of GDP over Ca + lg +Xn +G at the full-employment output. O B. excess of Sa + M +T over lg +X+ G at the full-employment GDP. O C. excess of Ca + lg +Xn + G at the full-employment GDP. O D.extra consumption that occurs when investment increases in a full-employment economy. A Moving to another question will save this response.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education