Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

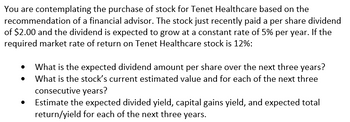

Transcribed Image Text:You are contemplating the purchase of stock for Tenet Healthcare based on the

recommendation of a financial advisor. The stock just recently paid a per share dividend

of $2.00 and the dividend is expected to grow at a constant rate of 5% per year. If the

required market rate of return on Tenet Healthcare stock is 12%:

What is the expected dividend amount per share over the next three years?

What is the stock's current estimated value and for each of the next three

consecutive years?

Estimate the expected divided yield, capital gains yield, and expected total

return/yield for each of the next three years.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- You are thinking about buying a stock and holding it for 3 years. You expect that the stock will pay a dividend of $1.37 in 1 year, $2.12 in two years, and $3.18 in three years. You expect to sell for $94.57 in 3 years. If the required return is 13.67%, what is the value of the stock.arrow_forwardsteady As She Goes Inc. will pay a year-end dividend of $2.70 per share. Investors expect the dividend to grow at a rate of 5% indefinitely. a. If the stock currently sells for $27.00 per share, what is the expected rate of return on the stock? b. If the expected rate of return on the stock is 17.50%, what is the stock price?arrow_forwardYou are considering the purchase of a stock that yesterday announced EPS of $6.24. You feel that earnings will grow at 23% for the next three years. After that growth in earnings should level-off to 3% per year into the future. You require a return of 13%. Based on these assumptions, what would you pay for the stock today? $105.12 $141.83 $95.59 $119.50arrow_forward

- You are evaluating the purchase of Bell, Inc. common stock that just paid a dividend of $4.60. You expect the dividend to grow at a rate of 10% for the next four years. You plan to hold the stock for four years and then sell it. You estimate the price of the company’s stock to rise to $59.37 at the end of your four-year holding period. A required rate of return of 13% will be adequate compensation for this investment. Given your assumptions, what is the current value of Bell stock? Round to the nearest $0.01 (allow a couple of pennies of rounding). answer is 26.57 , please dont use excelarrow_forwardTim Burr Wolff believes that Builtrite will pay the following dividends over the next 3 years: $3.30, $3.50 and $3.70. The current stock price is $49 and it is expected to sell at $61 by the end of the three years. Tim's required rate of return is 12%. What is the AYTM for Builtrite stock? 14.2% 15.2% 16.6% 21.7%arrow_forwardYou have just purchased a share of stock for $20.29.The company is expected to pay a dividend of $0.52 per share in exactly one year. If you want to earn a 9.1% return on your investment, what price do you need if you expect to sell the share immediately after it pays the dividend? The price one year from now should be $_______.(Round to the nearest cent.)arrow_forward

- Simco is planning to pay dividends on its common stock in the next four years as follows; $3.00 next year, $3.50 the following year, $0 in year 3, and $4.50 in year 4. After that, Simco has an expectation that their dividends will grow at 6.5% indefinitely. What should be the price of the stock today at a 10% discount rate?arrow_forwardYou are evaluating the purchase of Bell, Inc. common stock that just paid a dividend of $4.60. You expect the dividend to grow at a rate of 10% for the next four years. You plan to hold the stock for four years and then sell it. You estimate the price of the company’s stock to rise to $59.37 at the end of your four-year holding period. A required rate of return of 13% will be adequate compensation for this investment. Given your assumptions, what is the current value of Bell stock? Round to the nearest $0.01 (allow a couple of pennies of rounding). answer is 53.62arrow_forwardSuppose you think AppX stock is going to appreciate substantially in value in the next year. Say the stock's current price, Sø. is $75, and a call option expiring in one year has an exercise price, X, of $75 and is selling at a price, C, of $21. With $21,000 to invest, you are considering three alternatives. a. Invest all $21,000 in the stock, buying 280 shares. b. Invest all $21,000 in 1,000 options (10 contracts). c. Buy 100 options (one contract) for $2,100, and invest the remaining $18,900 in a money market fund paying 6% in interest over 6 months (12% per year). What is your rate of return for each alternative for the following four stock prices in 6 months? (Leave no cells blank - be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign. Round the "Percentage return of your portfolio (Bills + 100 options)" answers to 2 decimal places.) The total value of your portfolio in six months for each of the following stock prices is: Stock Price All…arrow_forward

- (Common stock valuation) The common stock of NCP paid $1.35 in dividends last year. Dividends are expected to grow at an annual rate of 9.50 percent for an indefinite number of years. a. If your required rate of return is 11.60 percent, what is the value of the stock for you? b. Should you make the investment? a. If your required rate of return is 11.60 percent, the value of the stock for you is $ (Round to the nearest cent.)arrow_forwardMelissa Cutt is thinking about buying some shares of EZLawn Equipment, at $36.44 per share. She expects the price of the stock to rise to $43.62 over the next 3 years. During that time she also expects to receive annual dividends of $4.28 per share. a. What is the intrinsic worth of this stock, given a required rate of return of 11%? b. What is its expected return? a. The intrinsic worth of this stock is $ (Round to the nearest cent.)arrow_forwardYou intend to buy Berrymore Inc.’s common stock at $100 per share, hold it one year and sell after that. The firm paid a $5 per share dividend last year and its dividends are expected to grow at an annual rate of 7% for indefinite number of years. If you can sell the stock at $110, what is your expected rate of return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education