Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

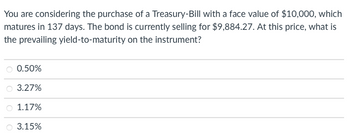

Transcribed Image Text:You are considering the purchase of a Treasury-Bill with a face value of $10,000, which matures in 137 days. The bond is currently selling for $9,884.27. At this price, what is the prevailing yield-to-maturity on the instrument?

- ○ 0.50%

- ○ 3.27%

- ○ 1.17%

- ○ 3.15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the YTM based on the information provided and explainthe difference between the Yield to Maturity rate and the originalcoupon rate. YTM Bond Details: A bond is currently selling for $850 with 15 years until it matures.The bond has a current coupon rate of 6% and makes paymentssemi-annually. You purchase the bond today 1/1/2023 as yoursettlement date and you are interested in knowing what the YTMwill be. **Note, when calculating the YTM the bond price (% of par)and face value (% of par) will not be percentages, please usenumbers for their respective section. The Yield Calculation is alreadybuilt into excel, all you have to do is type is =yield.arrow_forwardSuppose a ten-year, $1,000 bond with an 8.9% coupon rate and semiannual coupons is trading for $1,035.96. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.7% APR, what will be the bond's price? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? The bond's yield to maturity is%. (Round to two decimal places.)arrow_forwardA bond presently has a price of $1,030. The present yield on the bond is 8.00%. If the yield changes from 8.00% to 8.10%, the price of the bond will go down to $1,020. The duration of this bond is __________. -10.5 -8.5 9.7 10.5 11arrow_forward

- A bond sells for $894.17 and has a coupon rate of 6.20 percent. If the bond has 13 years until maturity, what is the yield to maturity of the bond? Assume semiannual compounding. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardPlease include the excel formula You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the dollar price of the bond? Assume semiannual compounding periods. Input area: Settlement date 1/1/2020 Maturity date 1/1/2044 Coupon rate 0.00% Coupons per year 2 Redemption value (% of par) 100 Yield to maturity 4.20% Par value $10,000 (Use cells A6 to B12 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the “Basis” input blank in the function. You may enter a constant as a hard coded value.) Output area: Price (% of par) Pricearrow_forwardA zero-coupon bond with face value $1,000 and maturity of five years sells for $741.22. a. What is its yield to maturity? (Round your answer to 2 decimal places.) Yield to maturity % b. What will the yield to maturity be if the price falls to $725? (Round your answer to 2 decimal places.) Yield to maturity %arrow_forward

- Consider a bond selling at par with a coupon rate of 6% and 10 years to maturity. The issuer makes semi-annual coupon payments. What is the price of this bond if the required yield is 15%? What if the yield is 16%? $563.34 for 15%, and $591.87 for 16% $541.25 for 15%, and $509.09 for 16% $509.09 for 15%, and $541.25 for 16% $525.41 for 15%, and $590.90 for 16%arrow_forwardA Treasury bond with the longest maturity (30 years) has an ask price quoted at 101.9375. The coupon rate is 4.10 percent, paid semiannually. What is the yield to maturity of this bond? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturity %arrow_forwardConsider a government bond that pays coupon semi-annually on 15 February and 15 August each year, where the annual coupon rate is 7%. The face value of the bond is $100 and the bond is redeemable at par on 15 August 2030. If the current date is 27 March 2021 and the bond yield is quoted as 7.5% per annum compounded semi-annually, calculate the market price (which is also known as the clean price) with the help of the RBA formula.arrow_forward

- A bond with 15 years to maturity, a face value of $1000, pays a coupon rate of 14% APR compounded semi-annually. If this bond is priced at $1,093.34. What is the yield-to-maturity stated as an APR with semi-annual compounding?arrow_forwardYou are purchasing a 10-year, zero–coupon bond. The yield to maturity is 8.69 percent and the face value is $1,000. What is the current market price? Assume semiannual compoundingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education