ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

3

Transcribed Image Text:# Economic Analysis of New Equipment Investment

## Problem Statement

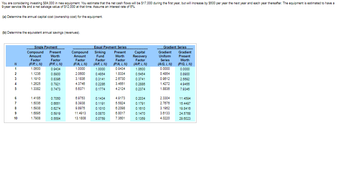

You are considering investing $84,000 in new equipment. You estimate that the net cash flows will be $17,000 during the first year, but will increase by $500 per year the next year and each year thereafter. The equipment is estimated to have a 9-year service life and a net salvage value of $12,000 at that time. Assume an interest rate of 6%.

### Objectives:

(a) Determine the annual capital cost (ownership cost) for the equipment.

(b) Determine the equivalent annual savings (revenues).

### Factor and Value Table:

Below is the provided table that includes various factors used to calculate present worth, future value, sinking fund factor, and others. The values are given for an interest rate of 6% over periods from 1 to 10 years.

| \( N \) | \text{Single Payment} Compound Amount Factor \( (F/P, i, N) \) | \text{Present Worth Factor} \( (P/F, i, N) \) | \text{Compound Amount Factor} \( (F/A, i, N) \) | \text{Equal Payment Series} Sinking Fund Factor \( (A/F, i, N) \) | \text{Present Worth Factor} \( (P/A, i, N) \) | \text{Capital Recovery Factor} \( (A/P, i, N) \) | \text{Gradient Series} Compound Amount Factor \( (F/A, G, i, N) \) | \text{Gradient Uniform Payment Series} \( (A/G, i, N) \) | \text{Gradient Present Worth} \( (P/G, i, N) \) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.0600 | 0.9434 | 1.0000 | 1.0000 | 0.9434 | 1.0600 | 0.0000 | 0.0000 | 0.0000 |

| 2 | 1.1236 | 0.8900 | 2.0600 | 0.4854 | 1.8334 | 0.5480 | 1.0600 | 0.4854 | 0.8900 |

|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Define the term Expenses?arrow_forwarduestion 3 If you want to minimize interest payments on a loan, you'll need one that has a simple interest rate so that yo John opened an account, and knew exactly how much it would be worth at the end of the year, because it used year. What is simple interest? Oa. Interest only on original amount saved or borrowed Ob. interest on original amount saved, borrowed and other interest earned Oc. a fee paid for the use of someone else's money Od. taxes on the original amount saved or borrowed L A Moving to another question will save this response. →arrow_forwardhow did u get 0.92Y in the brackets ?arrow_forward

- ctors) on of es 1. Relationship of data usage and bill Data Usage(GB/month) 0 10 20 30 Bill($/month) 10 30 50 70 A. Draw the graph, placing data usage horizontally(on the X axis) and bill vertically(On the Y axis). B. How much is the monthly fixed fee? C. How much is the charge per GB? D. What is the Equation that describes the relationship, where data usage is denoted by D, and bill by B? E. How much would be the charge for 50 GB use per month?arrow_forwardB. The late Anne Collins had 3 children, Mary, John and Hana who unfortunately all predeceased Anne leaving several Anne's grandchildren and great grandchildren. Unfortunately, Anne died intestate without a will or trust. She is survived by: Mary's daughters Emma and Joan John's son Patrick who has 2 children Joe and Frank; Frank has 1 child Eddy. Hana's daughter Elizabeth is also deceased leaving 2 children Jim and Eva. (i) Please fill in the table taking into consideration that Anne died without a will/trust and therefore the distribution shall be according to the CA intestacy laws (Modified Per Stirpes PC 240). Each Emma and Joan Mary's spouse Each of Patrick's 2 children Joe and Frank Each of Elizabeth's 2 children Jim and Eva Patrick's grandchild Eddy Patrick MPS Øarrow_forwardFigure A Q Figure B Figure C Price (dollars per unit) 15- Price (dollars per unit) 15 Price (dollars per unit) 15- 14- 13- 12- 11- 10- MC MC 14- 14- 13- 12- 11- 10- „MC ATC 13- 12- 11- 10- ATC ATC MR MR MR 9- 9- 9- 8- 8- 8- 7- 7- 6- 90 100 100 100 1i0 Quantity (units) 90 110 90 110 15 Qua Quantity (units) Quantity (units) Consider a perfectly competitive firm in a short-run equilibrium. Figure shows a firm in bad times because the firm produces units and makes a(n) O A. A; 100; economic loss O B. B; 90; economic profit O C. A; 110; economic loss O D. C; 100; economic loss O E. C; 100; normal profitarrow_forward

- Please no written by hand and no emagearrow_forwardExercise: 01 Issue a promissory note: ⑴Amount £3,026.00 ⑵Date and place of issue 8/August/2009,Guangzhou, China ⑶Tenor At 90 days after date ⑷Maker Guangdong Imp. & Exp. Co., Guangzhou ⑸Payee Chemicals Import & Export Company London ⑴Drawer Thames Enterprises Ltd., London ⑵Drawee The National Westminster Bank Ltd., London ⑶Payee Philips Hong Kong ⑷Date and place of issue 07/01/2001,London ⑸Amount GBP79,014 Exercise: 02 Issue a check:arrow_forwardhelparrow_forward

- please fill out a-narrow_forwardE2arrow_forwardBusinesses that offer repayment plans for purchases are required by law to disclose the interest rate. But that dosent mean they let you go out of there way to let you know what it is. you have to read all the paper work. Find the interest rate for the follwing purchase. For a 312 square- foot family room, you choose carpert that costs $1.44 per square foot. The tax rate is 6.1% and youre offered 24 payemnts of 27.61. Round to one decimal, if necessary.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education