FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

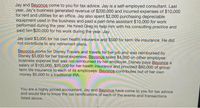

Transcribed Image Text:Jay and Bevonce come to you for tax advice. Jay is a self-employed consultant. Last

year, Jay's business generated revenue of $200,000 and incurred expenses of $10,000

for rent and utilities for an office. Jay also spent $2,000 purchasing depreciable

equipment used in the business and paid a part-time assistant $10,000 for work

performed during the year. He hired Greg to help him with his consulting practice and

paid him $20,000 for his work during the year. Jay

Jay paid $3,000 for his own health insurance and $500 for term life insurance. He did

not contribute to any retirement plans.

Bevonce works for Disney Travels and travels for her job and was reimbursed by

Disney $3,000 for her travel expenses. Beyonce spent $4,000 on other employee

business expense that was not reimbursed by her employer. Disney pays Beyonce a

salary of $100,000, $20,000 for her health insurance and provided $60,000 of group

term life insurance to each of its employees. Beyonce contributes out of her own

money $5,000 to a traditional IRA.

You are a highly priced accountant. Jay and Beyonce have come to you for tax advice

and would like to know the tax ramifications of each of the events and transactions

listed above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jamareo has found a "favorable" authority directly on point for his tax question. Required: a. If the authority is an administrative authority, which specific type of authority would he prefer to answer his question b. Which administrative authority would he least prefer to answer his question? Complete this question by entering your answers in the tabs below. Required A Required B If the authority is an administrative authority, which specific type of authority would he prefer to answer his question? M Revenue Ruling Private Letter Ruling Revenue Procedure Treasury Department Regulation Required A Required B >arrow_forwardWhich of the following is NOT an option to file a federal tax return? Fill out the paper version of the IRS tax form and mail it in. File taxes online using tax program. Hire a human tax preparer to complete the return and assist with filing. Fill out a paper version of the IRS tax form and fax it in. Next Mark For Reviewarrow_forwardThe AICPA has issued standards for CPAs in tax practice, called Statements on Standards for Tax Services (SSTS). Download the Statement on Standards for Tax Services No. 1-7Links to an external site.. What does the SSTS say about a CPA relying on information supplied by the client (see SSTS #3)? Are estimates ever permitted to be used in preparing a tax return (see SSTS #4)?arrow_forward

- Individual tax filing requirements and circumstances can change, so it is important to be familiar with the research tools available to you as a tax practitioner. In this discussion, you will consider research resources available for tax preparers and how they can be used in the field. What are the available commercial and noncommercial tax resources that you could utilize as a tax practitioner? Refer to Section 2-2A through 2-2C (specifically, exhibit 2-7) in your textbook for options. Which commercial resource do you think is the most beneficial to a tax practitioner? (Note that you will not be able to access the commercial resources but can find their features on their website.) Which noncommercial resource do you think is the most beneficial to a tax practitioner? How might you use the tax research process (refer to Section 2-3 in your textbook) for utilizing tax resources in preparing individual tax returns. (Think about ways you could use this process to support you in…arrow_forwardMary(58) comes into your office to have her tax return prepared. She states that she wants to use the head of household filing status and claim the Earned Income Tax Credit (EITC). She also tells you that her dependent child is her granddaughter, Julie (12), who currently lives with her. You as a paid tax preparer, all of the following are appropriate questions to ask or actions to take EXCEPT: 1). Ask Mary how long Julie has lived with her and inquire into the whereabouts of Julie's parents. 2). Ask Mary who paid most of the expenses of maintaining her home. 3). Inform Mary that she must show you documentation proving Julie lived with her before you can prepare the return. 4) Inquire as to whether anyone else can possibly claim Julie as a dependent.arrow_forwardTax preparers often have a difference of opinion with their clients as to how some transactions should be treated on a tax return. If a client of yours does not wish to report information on their tax return that you feel should be reported, how would you handle the situation? Write in at least 300 words with two scholarly sources.arrow_forward

- A paid tax preparer must demonstrate due diligence. Review the following scenario, and then choose the appropriate response. Cherylynn Johnson (58) comes in to your office to have her tax return prepared. She states that she wants to use the head of household filing status and claim the Earned Income Tax Credit (EITC). She also tells you that her dependent child is her granddaughter, Alana (12), who currently lives with her. All of the following are appropriate questions to ask or actions to take EXCEPT: Ask Cherylynn how long Alana has lived with her and inquire into the whereabouts of Alana's parents. Ask Cherylynn who paid most of the expenses of maintaining her home. Inform Cherylynn that she must provide you with documentation proving Alana lived with her before you can prepare the return. Inquire whether the IRS has ever denied or reduced Cherylynn's EITC in a prior year.arrow_forwardAssume your client wants to include travel and entertainment expenses in their tax deductions. Explain the type of documentation needed to support your client’s claim for including travel expense as business expense.Provide a circumstance where such a claim could trigger an IRS audit. Make sure you support your argument with clear tax rules and regulations.Your client is claiming the concert tickets he purchased as a business expense.Use your understanding of the tax laws to explain a situation where your client can claim the expense deduction as a business expense and another example where your client cannot.arrow_forwardThere are many tax rules and regulations you should be aware of when investing-whether it be in stocks; bonds; mutual funds; real estate; or collectibles such as artwork, antiques, gems, memorabilia, stamps, and coins. Capital gains are proceeds derived from these types of investments. Unless they are specified as being tax-free, such as municipal bonds, you must pay capital gains taxes on these proceeds. Capital gains are taxed in one of two ways. If the investment is held for one year or less, this is considered short-term and is taxed as ordinary income at your regular income tax rate. As this is written, if the investment is held for more than one year, it is considered long-term and qualifies for various tax discounts, as follows for single taxpayers with earnings as shown below. Stocks Held Capital Gains Rates Up to $38,700 $38,700–$426,700 Over $426,700 Over 1 year(long-term) 0% 15% 20% (a) If you are in the 23% tax bracket for ordinary income and have a 15% capital…arrow_forward

- Distinguish between tax avoidance and tax evasion. What are the ethical responsibilities of the tax practitioner in dealing with tax avoidance? What are the ethical responsibilities of the tax practitioner in dealing with tax evasion?arrow_forwardAll tax practitioners who prepare tax returns for a fee are subject to whichof the following?I. IRS Circular 230 II. AICPA Code of Professional Conduct III. Statements on Standards for Tax Services IV. American Bar Association Code of Professional Conduct Only statement I is correct.Statements I, II, and III are correct.Statements II and III are correct. Statements II and IV are correct. Statements I, II, III, and IV are correct.arrow_forwardWhich of the following would be a good question to ask before advising a client to move from a Schedule C to S corporation tax treatment? Review Later How does moving to S corp tax treatment impact the ability to pump tons of money into a tax-deferred retirement plan? What really are the net savings, after accounting for all the extra fees attached to operating an S corporation? Is this client likely to actually do the compliance stuff associated with operating an S corporation, or is the "extra red tape" possibly (read: probably) going to become a nightmare for the client?.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education