Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give me Answer

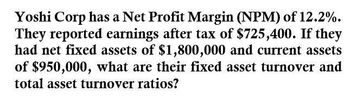

Transcribed Image Text:Yoshi Corp has a Net Profit Margin (NPM) of 12.2%.

They reported earnings after tax of $725,400. If they

had net fixed assets of $1,800,000 and current assets

of $950,000, what are their fixed asset turnover and

total asset turnover ratios?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ACME Corp’s balance sheet reported that it had $650,000 in liabilities and $275,000 in equity. On the income statement the company had revenues of $867,030 and expenses (excluding depreciation) of $356,240. Depreciation was $103,456 and interest expense of $52,423. Assuming a 40% tax rate, what was the company's return on assets?arrow_forwardWhat is Jordan ROE ?arrow_forwardGiven the following information for the Vanderbilt Tire Company, find ROA (Return on Assets): Debt ratio (D/A) = 0.33 (expressed as a decimal) Total asset turnover ratio (S/A) = 1.88 Sales (S) = $10,000 Net profit margin = 0.08 (expressed as a decimal)arrow_forward

- What is net income? answerarrow_forwardWhat was it's charge for depreciation and amortization of this financial accounting question?arrow_forwardTrevi Corporation recently reported an EBITDA of $32,800 and $9,500 of net income. The company has $6,700 interest expense, and the corporate tax rate is 35 percent. What was the company’s depreciation and amortization expense? Round to the nearest cent.arrow_forward

- What was green wave's 2020 percentage return on assets of this financial accounting question?arrow_forwardHamilton Corp. recently reported an EBITDA of $18.5 million and a net income of $3.6 million. The company had $2.8 million in interest expense, and its corporate tax rate was 35%. Compute Depreciation and Amortization (D&A).arrow_forwardUse the following selected balance sheet and income statement information for Stevens Co. to compute asset turnover, to the nearest hundredth of a percent. Operating profit before tax Net Income Average total assets Sales Tax rate on operating profit $120,000 $192,500 $653,000 $1,250,000 35% a. 1.34 b. 1.91 c. 0.52 d. 0.29arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning