FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ok

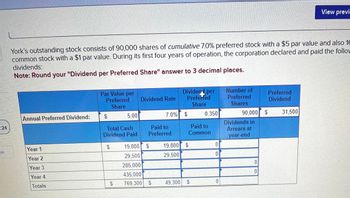

York's outstanding stock consists of 90,000 shares of cumulative 7.0% preferred stock with a $5 par value and also 16

common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the follow

dividends:

Note: Round your "Dividend per Preferred Share" answer to 3 decimal places.

Annual Preferred Dividend:

Year 1

Year 2

Year 3

Year 4

Totals

Par Value per

Preferred

Share

$

Total Cash

Dividend Paid

$

5.00

$

Dividend Rate

Paid to

Preferred

19,800 $

29,500

285,000

435,000

769,300 $

Divident per

Preferred

Share

7.0% $

19,800 $

29,500

0.350

Paid to

Common

49,300 $

0

0

0

Number of

Preferred

Shares

90,000 $

Dividends in

Arrears at

year-end

0

0

Preferred

Dividend

View previ

31,500

Transcribed Image Text:York's outstanding stock consists of 90, 000 shares of cumulative 7.0% preferred stock with a $5 par value and also 1 common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the

follo dividends: Note: Round your "Dividend per Preferred Share" answer to 3 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Similar questions

- Sanchez Company has 38,000 shares of 5% preferred stock of $100 par and 112,000 shares of $50 par common stock issued and outstanding. The following amounts were distributed as dividends: Year 1 $538,000 Year 2 $440,000 Year 3 $510,000 Determine the dividends per share for preferred and common stock for each year. Round the dividends per share to the nearest cent. Year 1 Year 2 Year 3 Amount distributed $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Preferred dividend $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Common dividend $fill in the blank 7 $fill in the blank 8 $fill in the blank 9 Dividends per share: Preferred stock $fill in the blank 10 $fill in the blank 11 $fill in the blank 12 Common stock $fill in the blank 13 $fill in the blank 14 $fill in the blank 15arrow_forwardA company had stock outstanding as follows during each of its first three years of operations: 4,000 shares of 8%, $100 par, cumulative preferred stock and 60,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Preferred Common Year Dividends Total Per Share Total Per Share 1 $24,000 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 2 32,000 fill in the blank 5 fill in the blank 6 fill in the blank 7 fill in the blank 8 3 73,000 fill in the blank 9 fill in the blank 10 fill in the blank 11 fill in the blank 12arrow_forwardA company had stock outstanding as follows during each of its first 3 years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented in the following schedule. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Year 1 2 3 Dividends $10,000 25,000 60,000 Preferred Total Preferred Per Share Common Total Common Per Sharearrow_forward

- Halverstein Company's outstanding stock consists of 10,850 shares of cumulative 5% preferred stock with a $10 par value and 4,650 shares of common stock with a $1 par value. During the first three years of operation, the corporation declared and paid the following total cash dividends. Dividends Declared & Paid Year 1 $ 0 Year 2 $ 9,300 Year 3 $ 40,000 The amount of dividends paid to preferred and common shareholders in Year 2 is:arrow_forwardA company had stock outstanding as follows during each of its first 3 years of operations: 4,000 shares of 8%, $100 par, cumulative preferred stock and 44,000 shares of $10 par common stock. The amounts distributed as dividends are presented in the following schedule. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Year 1 2 3 Dividends $24,000 32,000 38,280 Preferred Total Preferred Per Share $ Common Total Common Per Sharearrow_forwardSanchez Company has 34,000 shares of 2% preferred stock of $100 par and 115,000 shares of $50 par common stock. The following amounts were distributed as dividends: Year 1 $558,000 Year 2 $441,000 Year 3 $501,000 Determine the dividends per share for preferred and common stock for each year. Round the dividends per share to the nearest cent. Year 1 Year 2 Year 3 Amount distributed $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Preferred dividend $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Common dividend $fill in the blank 7 $fill in the blank 8 $fill in the blank 9 Dividends per share: Preferred stock $fill in the blank 10 $fill in the blank 11 $fill in the blank 12 Common stock $fill in the blank 13 $fill in the blank 14 $fill in the blank 15arrow_forward

- A-7arrow_forwardA company had stock outstanding as follows during each of its first three years of operations: 3,000 shares of 10%, $100 par, cumulative preferred stock and 55,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Year 1 2 3 Dividends $22,500 30,000 59,400 $ Total Preferred Per Share Total Common Per Sharearrow_forwardWindborn Company has 20,000 shares of cumulative preferred 2% stock, $100 par and 50,000 shares of $20 par common stock. The following amounts were distributed as dividends: 20Y1 $80,000 20Y2 20,000 20Y3 120,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education