FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

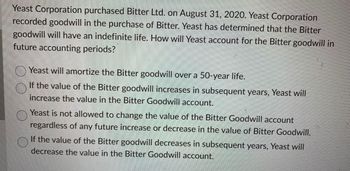

Transcribed Image Text:Yeast Corporation purchased Bitter Ltd. on August 31, 2020. Yeast Corporation

recorded goodwill in the purchase of Bitter. Yeast has determined that the Bitter

goodwill will have an indefinite life. How will Yeast account for the Bitter goodwill in

future accounting periods?

Yeast will amortize the Bitter goodwill over a 50-year life.

If the value of the Bitter goodwill increases in subsequent years, Yeast will

increase the value in the Bitter Goodwill account.

Yeast is not allowed to change the value of the Bitter Goodwill account

regardless of any future increase or decrease in the value of Bitter Goodwill.

If the value of the Bitter goodwill decreases in subsequent years, Yeast will

decrease the value in the Bitter Goodwill account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below is selected information for Sheridan Company. Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.) 1. Sheridan purchased a patent from Vania Co. for $1,160,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Sheridan determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? The amount to be reported $ 2. Sheridan bought a franchise from Alexander Co. on January 1, 2019, for $330,000. The carrying amount of the franchise on Alexander's books on January 1, 2019, was $330,000. The franchise agreement had an estimated useful life of 30 years. Because Sheridan must enter a competitive bidding at the end of 2021, it is unlikely that the…arrow_forwardOn January 1, 2021, Moo Company sold an asset with a carrying amount of P6,000,000 to Boo Company for P8,000,000. The asset had a fair value of P7,500,000 and a remaining useful life of six years. The asset was immediately leased back to Moo Company for a term of four years and annual rentals of P1,500,000 payable every yearend. The transfer qualified for as a sale and the lease was accounted for as a finance lease with an implicit interest rate of 12%. How much is the 2021 net income/loss of Moo Company relating to the sale and leaseback transaction? [Indicate whether it is a gain or loss] How much is the 2021 net income/loss of BooCompany relating to the sale and leaseback transaction? [Indicate whether it is a gain or loss] How much is the carrying amount of Moo Company's asset as of yearend 2021? How much is the 2022 net income/loss of Moo Company relating to the sale and leaseback transaction? [Indicate whether it is a gain or loss] How much is the 2022 net income/loss of Boo…arrow_forwardPlease show your solution.arrow_forward

- Kingbird Corp. sells idle machinery to Enyart Company on July 1, 2020, for $46,000. Kingbird agrees to repurchase this equipment from Enyart on June 30, 2021, for a price of $49,680 (an imputed interest rate of 8%). (a) Prepare the journal entry for Kingbird for the transfer of the asset to Enyart on July 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardAyayai Corporation purchases a patent from Blossom Company on January 1, 2025, for $63,000. The patent has a remaining legal life of 14 years. Ayayai estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Ayayai's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record purchase of patents) (To record amortization of patents) Debit Creditarrow_forwardChristina Co. has a factory equipment with a carrying amount of P700,000 and has a remaining useful life of 7 years. On January 1, 2020, Christina agreed to an exchange transaction with Kat & Inc. to transfer the equipment to the latter. The transfer satisfied the requirements of PFRS 15 to be a sale and Christina immediately leased it back for a lease term equal to the remaining life of the equipment. The sales price amounted to P500,000 while annual rental payable at the end of each year is P100,000 for an implicit rate of 10%. Selling price is equal to fair value. How much loss shall Christina recognize in relation to the sale and leaseback transaction? a. 681,578.63 b. 200,000 c. 194,736.75 d. 5,263.25arrow_forward

- Aqua Corporation purchases nonresidential real property on May 8, 2019, for $1,650,000. Straight-line cost recovery is taken in the amount of $165,000 before the property is sold on November 27, 2022, for $2,475,000. Question Content Area a. Compute the amount of Aqua's recognized gain on the sale of the realty $_______________ Determine the amount of the recognized gain that is treated as § 1231 gain and the amount that is treated as § 1250 recapture (ordinary income due to § 291). b. § 1231 gain: $_____________ § 1250 recapture (ordinary income due to § 291): $_______________________arrow_forwardOn January 1, 2024, Nguyen Electronics leased equipment from Nevels Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Nevels. The equipment cost Nevels $779,677 and has an expected economic life of five years. Nevels expects the residual value on December 31, 2027, will be $103,000. Negotiations led to the lessee guaranteeing a $146,000 residual value. Equal payments under the lease are $203,000 and are due on December 31 of each year with the first payment being made on December 31, 2024. Nguyen is aware that Nevels used a 8% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for both Nguyen and Nevels on January 1, 2024, to record the lease. Prepare all appropriate entries for both Nguyen and Nevels on December 31, 2024, related to the lease.arrow_forwardPlease read and answer questions carefully using the table providedarrow_forward

- R Company registered a patent on January 1, 2015. P Company purchased the patent from R Company for $450,000 on January 1, 2020, and began to amortize the patent over its remaining legal life. In early 2021, P Company determined that the patent's economic benefits would last only until the end of 2025. What amount should P Company record for patent amortization in 2021? $30,000 $70,000 $90,000 $84,000arrow_forwardBennet Company purchased a patent from Arnold Company on January 1, 2021 for $450,000. Arnold Company had used the patent for five years prior to selling it to Bennet Company. Assuming Bennet Company plans to use the patent for its full useful life, what amount of amortization expense would Bennet Company record on its 2021 income statement? $22,500 O $30,000 O $25.000 O $37,500 O There is not enough information to answer the question.arrow_forward1. Pharoah purchased a patent from Vania Co. for $2,700,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Pharoah determined that the economic benefits of the patent would not last longer than 7 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? The amount to be reported 2$ 2. Pharoah bought a franchise from Alexander Co. on January 1, 2019, for $979,000. The carrying amount of the franchise on Alexander's books on January 1, 2019, was $635,000. The franchise agreement had an estimated useful life of 20 years. Because Pharoah must enter a competitive bidding at the end of 2028, it is unlikely that the franchise will be retained beyond 2028. What amount should be amortized for the year ended December 31, 2020? The amount to be amortized 3. On January 1, 2020, Pharoah incurred organization…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education