FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

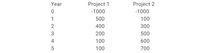

Solve the following problem applying the method Problem. Assume the following cash flow for 2 projects.Assuming that the

Transcribed Image Text:Year

Project 1

Project 2

-1000

-1000

1

500

100

2

400

300

3

200

500

4

100

600

100

700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. They payback period of project A is ___ years (round to two decimal places) The payback period of project B is ____ years. (round to two decimal places) According to the payback method, which project should the firm choose? b. The NPV of project A is $___ The NPV of project B is $___ c. The IRR of project A is ___ The IRR of project B is ___ d. Make a reccomendationarrow_forwardThe initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? 5.77 years 4.25 years 3.33 years 2.66 yearsarrow_forwardDraw a cash flow diagram of any investment that exhibits both of the following properties: The investment has a 4-year life. The investment has a 10 percent/year internal rate of return.arrow_forward

- When calculating the annual rate of return, the average investment is equal to initial investment divided by life of project. (initial investment plus $0) divided by 2. (initial investment plus salvage value) divided by 2. initial investment divided by 2.arrow_forwardTwo projects, Alpha and Beta, are being considered using the payback method. Each has an initial cost of $100,000. The annual cash flows for each project are listed below. a) What is the pay back period in years for Alpha? (round to two decimal places) b) What is the pay back period in years for Beta? (round to two decimal places) Year Project Alpha Project Beta 1 25,000 15,000 2 25,000 25,000 3 25,000 45,000 4 25,000 30,000 5 25,000 20,000 25,000 15,000arrow_forwardA project has the following cash flows. It costs $15,000. It briongs in $22,000 after one year, and costs an adittional $6,500 after two years. The Required rate of return is 11%. Calculate the MIRR using the combination approach.arrow_forward

- What is the payback period for project E? Data Table - X years (Round to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flow Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow year 6 $46,000 $100,000 $20,000 $9,200 $9,200 $10,000 $9,200 $40,000 $9,200 $30,000 $9,200 $0 $9,200 $0 Print Donearrow_forwardWhen an investment’s annual net cash inflows are equal every year, the investment’s payback period can be calculated as: (See your Chapter 25 notes, page 2) When an investment’s annual net cash inflows are equal every year, the investment’s payback period can be calculated as: (See your Chapter 25 notes, page 2) Initial cost of the investment minus the annual net cash inflow Average amount of the investment divided by the average annual net income Initial cost of the investment divided by the annual net cash inflow Present value of net cash inflow divided by the initial cost of the investment Future value of net cash inflow divided by the initial cost of the investment Present value of the net cash inflow minus the initial cost of the investment Annual net cash inflow minus the initial cost of the investment Average annual net income divided by the average amount of the investmentarrow_forwardThe Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $7,000 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,250 0.2 $0 0.6 $7,000 0.6 $7,000 0.2 $7,750 0.2 $19,000 BPC has decided to evaluate the riskier project at 12% and the less-risky project at 10%. a. What is each project's expected annual cash flow? Round your answers to two decimal places. Project A: $ Project B: $ Project B's standard deviation (σB) is $6,131.88 and its coefficient of variation (CVB) is 0.77. What are the values of (σA) and (CVA)? Round your answers to two decimal places. σA = $ CVA = b. Based on the risk-adjusted NPVs, which project should BPC choose? c. If you knew that Project B's cash flows were negatively correlated with the firm's other cash flow, but Project A's cash flows…arrow_forward

- (Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects are found below: a. Calculate the IRR for each of the projects. b. If the discount rate for all three projects is 13 percent, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 13 percent? a. The IRR of Project A is%. (Round to two decimal places.) Data table Year 0 (Initial investment) Year 1 Year 2 Year 3 Year 4 Year 5 Project A $(70,000) $12,000 18,000 19,000 28,000 33,000 Project B $(110,000) $28,000 28,000 28,000 28,000 28,000 Project C $(420,000) $240,000 240,000 240,000arrow_forward(c) Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.) (Round answers to 2 decimal places, e.g. 10.50%.) Annual rate of return Project Bono % Project Edge % Project Clayton %arrow_forwardcalculate the net present value of the following: Project A requires an initial investment of $1,000 and is expected to generate cash flows of $400 per year for 3 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education