Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

How do you do this?

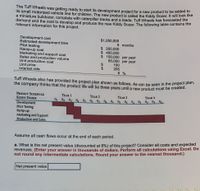

Transcribed Image Text:The Tuff Wheels was getting ready to start its development project for a new product to be added to

its small motorized vehicle line for children. The new product is called the Kiddy Dozer. It will look like

a miniature bulldozer, complete with caterpillar tracks and a blade. Tuff Wheels has forecasted the

demand and the cost to develop and produce the new Kiddy Dozer. The following table contains the

relevant information for this project.

Development cost

Estimated development time

Pilot testing

Ramp-up cost

Marketing and support cost

Sales and production volume

Unit production cost

Unit price

Interest rate

$1,250,000

9 months

$ 200,000

$ 400,000

$ 150,000 per year

60,000 per year

$

100

2$

205

8 %

Tuff Wheels also has provided the project plan shown as follows, As can be seen in the project pilam

the company thinks that the product life will be three years until a new product must be created.

PROJECT SCHEDULE

KIDDY DOZER

YEAR 1

YEAR 2

YEAR 3

YEAR 4

Development

Pilot Testing

Ramp-up

Marketing and Support

Production and Sales

Assume all cash flows occur at the end of each period.

a. What is the net present value (discounted at 8%) of this project? Consider all costs and expected

revenues. (Enter your answer in thousands of dollars. Perform all calculations using Excel. Do

not round any intermediate calculations. Round your answer to the nearest thousand.)

Net present value

Transcribed Image Text:4

year? (Enter your answer in thousands of dollars. Perform all calculations using Excel. Do not

round any intermediate calculations. Round your answer to the nearest thousand.)

NPV 50,000

NPV 70,000

c. Based on the original sales level of 60,000, what is the effect on NPV caused by changing the

discount rate to 9%, 10%, or 11%? (Enter your answer in thousands of dollars. Perform all

calculations using Excel. Do not round any intermediate calculations. Round your answer to

the nearest thousand.)

NPV 9%

NPV 10%

NPV 11%

rev: 09_11_2020_QC_CS-227775

References

Worksheet

Difficulty: 3 Hard

Learning Objective:

03-05 Illustrate how

product development

is measured in a

Problem 3-10

(Algo)

company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education