Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively.

| UpAHill Corporation (an S Corporation) | ||

| Income Statement | ||

| December 31, Year 1 and Year 2 | ||

| Year 1 | Year 2 | |

|---|---|---|

| Sales revenue | $ 175,000 | $ 310,000 |

| Cost of goods sold | (60,000) | (85,000) |

| Salary to owners Jack and Jill | (40,000) | (50,000) |

| Employee wages | (15,000) | (20,000) |

| (10,000) | (15,000) | |

| Miscellaneous expenses | (7,500) | (9,000) |

| Interest income (unrelated to business) | 2,000 | 2,500 |

| Qualified dividend income | 500 | 1,000 |

| Overall net income | $ 45,000 | $ 134,500 |

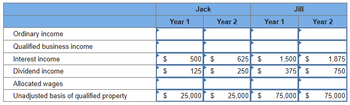

a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years.

Transcribed Image Text:Year 1

Jack

Jill

Year 2

Year 1

Year 2

Ordinary income

Qualified business income

Interest income

$

500 $

625

$

1,500

Dividend income

$

125 $

250 $

375

Allocated wages

Unadjusted basis of qualified property

$

25,000 $

25,000 $ 75,000

$

$

6 6

1,875

750

69

$

75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- $ O- Taxable Income 50,000 50,001- 75,001- Y 100,001- 75,000 100,000 335,000 335,001- 10,000,000 Tax Rate 15% 25 34 39 34 Bait and Tackle has taxable income of $411,562. How much do a. $128,603.33 b. $134,611.27 c. $138,542.79 d. $139,931.08 e. $141,35674.82 tinarrow_forward↑ (Corporate income tax) G. R. Edwin Inc had sales of $6.09 million during the past year. The cost of goods sold amounted to $2.5 million Operating expenses totaled $2.54 million, and interest expense was $25,000. Use the corporate tax rates shown in the popup window to determine the firm's tax liability What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar)arrow_forwardConsider the information for AGL provided in the two tables below and answer the following questions. (Note: numbers in red are negative) Balance Sheet $'m cash Receivables Inventory Other assets Total Current Assets Inventory Financial Assets & Investments Plant Intangibles Other assets Total Non-Current Assets Total Assets Trade payables Borrowings Other liabilities Total Current Liabilities Debt Other liabilities Total non-current liabilities Total Liabilities Net Assets Issued Capital Reserves Retained earnings Total Equity 2021 88 1,889 418 1,280 3,675 46 950 6,283 3,302 1,194 11,775 15,450 1,838 305 832 2,975 2,880 4,089 6,969 9,944 5,506 5,601 20 (115) 5,506 2020 141 1,571 400 1,010 3,122 59 688 6,640 3,638 460 11,485 14,607 1,351 38 999 2,388 3,070 1,177 4,247 6,635 7,972 5,603 (80) 2,449 7,972arrow_forward

- GENERAL JOURNAL ACCOUNT TITLE ✓ Dec. 31 Deferred Tax Asset 1 DATE 2 Income Tax Benefit from Operating Loss Carryforward POST. REF. DEBIT 45,000.00 Score: 21/25 CREDIT 45,000.00arrow_forwardINCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses…arrow_forwardhr.2arrow_forward

- Instructions Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill's data are expressed in X. dollars. The electronics industry averages are expressed in percentages. Tannenhill Electronics Company Industry Average 2 Sales $4,580 000.00 100,0% Cost of goods sold 2,581,600.00 59.0 4 Gross profit $2,198,400.00 41.0% 5 Selling expenses $1,213,70000. 22.5% Administrative expenses 752,800.00 14.0 7 Total operating expenses $1,946,500.00 36.5% 4:Operating incOme $251,900.00 4.5% Previous Next Check My Work 2 more Check My Work uses remaining. 2.arrow_forwardТаx rate Assessed value Amount of property tax due $42.50 per $1,000 $ 105,000arrow_forwardLO.2 Oak Corporation has the following general business credit carryovers. If the general business credit generated by activities during 2019 equals 36,000 and the total credit allowed during the current year is 60,000 (based on tax liability), what amounts of the current general business credit and carryovers are utilized against the 2019 income tax liability? What is the amount of unused credit carried forward to 2020?arrow_forward

- Tax Rate Single 10% up to $9275 15% $9276 to $37,650 25% $37,651 to $91,150 28% $91,151 to $190,150 33% $190,151 to $413,350 35% $413,351 to $415,050 39.6% more than $415,050 Standard Deduction $6300 Exemptions (per person) $4050 You would like to have $550,000 in 39 years by making regular deposits at the end of each month in an annuity that pays 6% compounded monthly. The table below shows the 2016 marginal tax rates, standard deduction, and exemptions for a single person. Complete parts (a) through (c). a. Determine the deposit at the end of each month. In order to have 550,000 in 39 years, you should deposit ____ each month. (Round up to the nearest dollar.) b. Assume that the annuity in part (a) is a tax-deferred IRA belonging to a man whose gross income in 2005 was $52,000. Use the table on the left to calculate his 2005 taxes first with and then without the IRA. Assume the man…arrow_forwardPROBLEM 1 Xavier Company provided the following information for its first year of operations ended December 31, 2021 in connection with the preparation of its income tax return:Taxable income P 4,000,000Non-deductible expenses 200,000Non-taxable revenue 300,000Deferred income on installment saleincluded in financial income but taxable in 2022 450,000Doubtful accounts recorded 100,000Financial depreciation 300,000Tax depreciation 350,000Estimated warranty cost accrued in2021 but not deductible for tax purposes until paid…arrow_forwardPlease answer all questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT