FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

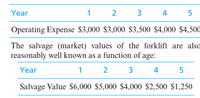

A manufacturer moves pallets of materials with a forklift truck. He has consistently used the same make and model of forklift over the past several years. The purchase price has been relatively constant at $8,000 each. Records of operation and maintenance indicate these average expenses per year as a function of age of the vehicle: Find the best time to replace a forklift truck when the MARR = 15% per year.

Transcribed Image Text:Year

1 2 3 4 5

Operating Expense $3,000 $3,000 $3,500 $4,000 $4,500

The salvage (market) values of the forklift are also

reasonably well known as a function of age:

Year

1

2

3

4

5

Salvage Value $6,000 $5,000 $4,000 $2,500 $1,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I could use a hand with thisarrow_forwardCalculate the hourly operating cost (under average conditions) for a 180- horsepower motor grader which costs $230,000 and is used in general contracting for 1500 hours per year for 10 years. The per gallon price of diesel fuel is $2.90. Salvage value is estimated to be $85,000 and a set of tires costs $5,000 for 2000 hours of average useful life. Assume a repair factor of 40% based on 10,000 hours of useful life as a percentage of hourly straight-line depreciation. (Use discount rate of 8%).arrow_forwardA 3 year-old a computer-controlled fabric cutting machine, which had a $20,000 purchasing price, has a current market (trade- in) value of $12,000 and expected O&M costs of $8,000, increasing by $1,000 per year. The machine is required to have an immediate repair that costs $2,000. The estimated market values are expected to decline by 20% annually (going forward). The machine can be used for another 7 years at most. The new machine has a $40,000 purchasing price. The new machine's O&M cost is estimated to be $4,000 for the first year, decreasing at an annual rate of $100 thereafter. The firm's MARR is 20%. Assume a unique minimum AEC(20%) for both machines (both the current and replacement machine). Using the information above, determine the economic service life along with the optimum annual equivalent cost of the defender (This is an infinite Horizon decision problem).arrow_forward

- A company engaging in selling of laboratory equipment estimates that profit from sales should increase by *2,00, 000 per year if a mobile demonstration unit is built. A large unit with sleeping accommodation for the driver will cost 9, 70,000 while a smaller unit without sleeping cabin will be Rs. 6,30,000. Salvage values for the large and small units after 5 years will be, 197,000 and Rs.35000 respectively. Lodging costs saved by the larger unit should amount 1, 10,000 annually, but its transportation costs will exceed those of the smaller unit by 31, 000. With the money at 9% should a mobile demonstration unit be built? And if so which size is preferable? Use net annual worth to determine which is better and show all the steps and workingarrow_forwardMilliken uses a digitally controlled dyer for placing intricate patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. Its market value will be $310,000 at the end of the 1st year and drop by $48,000 per year thereafter to a minimum of $30,000. Operating costs are $20,000 the 1st year, increasing by 10% per year. Maintenance costs are only $8,000 the 1st year but will increase by 37% each year thereafter. Milliken's MARR is 18%. Determine the optimum replacement interval for the dyer. Year(s)arrow_forwardVijay shiyalarrow_forward

- Answer what total relevant cost is for the keep old?arrow_forwardThomasville Furniture Industries offers several types of high-performance fabrics that are capable of withstanding chemicals as harsh as chlorine. A Midwestern manufacturing company that uses fabric in several products has a report showing that the present worth of fabric purchases over a specified 5-year period was $900,000. If the costs are known to have increased geometrically by 5% per year during that time and the company uses an interest rate of 15% per year for investments, what was the cost of the fabric in year 1?arrow_forwardEV Box is a manufacturer of electric vehicle charging stations and charging software. The initial cost of one part of their manufacturing process was $130,000 with annual costs of $49,000. Revenues were $78,000 in year 1, increasing by $1000 per year. A salvage value of $23,000 was realized when the process was discontinued after 8 years. Determine the rate of return the company made on the process.arrow_forward

- Kane Running Shoes is considering the manufacture of a special shoe for race walking, which will indicate if an athlete is running (that is, both legs are not touching the ground). The chief economist of the company presented the following calculation for the Smart Walking Shoe (SWS):• R&D: $200,000 annually in each of the next four yearsFor the manufacturing project:• Expected life span: ten yearsInvestment in machinery: $250,000 (at t = 4) expected life span of the machine ten years• Expected annual sales: 5.000 pairs of shoes at the expected price of $150 per pair. Fixed cost: $300,000 annually• Variable cost: $50 per pair of shoesKane's discount rate is 12%, the corporate tax rate is 40%, and R&D expenses are tax deductible against other profits of the company. Assume that at the end of project that is, after fourteenyears) the new technology will have been superseded by other technologies and therefore willhave no value.(a) What is the NPV of the project?(b) The…arrow_forwardAngie Silva has recently opened The Sandal Shop in Brisbane, Australia, a store that specializes in fashionable sandals. In time, she hopes to open a chain of sandal shops. As a first step, she has gathered the following data for her new store: Sales price per pair of sandals $ 30 Variable expenses per pair of sandals 15 Contribution margin per pair of sandals $ 15 Fixed expenses per year: Building rental $ 11,300 Equipment depreciation 11,300 Selling 9,000 Administrative 13,400 Total fixed expenses $ 45,000 1. What is the break-even point in unit sales and dollar sales? (Do not round intermediate calculations.)arrow_forwardMilliken uses a digitally controlled dyer for placing intricate patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. Its market value will be $310,000 at the end of the 1st year and drop by $44,000 per year thereafter to a minimum of $30,000. Operating costs are $20,000 the 1st year, increasing by 7% per year. Maintenance costs are only $8,000 the 1st year but will increase by 37% each year thereafter. Milliken’s MARR is 20%. Determine the optimum replacement interval (years) for the dyerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education