Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

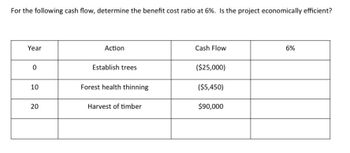

Transcribed Image Text:For the following cash flow, determine the benefit cost ratio at 6%. Is the project economically efficient?

Year

0

10

20

Action

Establish trees

Forest health thinning

Harvest of timber

Cash Flow

($25,000)

($5,450)

$90,000

6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- k algo 10-31 Cash Flows And NPV The Bruin's Den Outdoor Gear is considering a new 6-year project to produce a new tent line. The equipment necessary would cost $1.29 million and be depreciated using straight-line depreciation to a book value of zero. At the end of the project, the equipment can be sold for 15 percent of its initial cost. The company believes that it can sell 23,500 tents per year at a price of $64 and variable costs of $25 per tent. The fixed costs will be $395,000 per year. The project will require an initial investment in net working capital of $193,000 that will be recovered at the end of the project. The required rate of return is 10.7 percent and the tax rate is 21 percent. What is the NPV?arrow_forwardDogarrow_forwardB C D E F G H 1 Problem 9-6 Internal Rate of Return and Taxes-See Textbook page 9-30 2 The Boston Culinary Institute is evaluating a classroom remodeling project. The cost of the remodel will be 3 $350,000 and will be depreciated over six years using the straight-line method. The remodeled room will 4 accommodate five extra students per year. Additional information relating to the project follows: 5 10 11 12 13 14 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 15 Required 16 Assuming a six-year time horizon, what is the internal rate of return of the remodeling project? Calculate 17 using both present value factors and separately using Excel's IRR function 18 19 39 40 Cost of the remodel project Useful life of project in years Annual number of extra accommodated students Annual tuition per student 41 42 43 Before-tax incremental cost of a student Company's income tax rate Required rate of retur Annual cash flow Revenue Less costs: Other than depreciation Depreciation…arrow_forward

- 11:13 AM Fri Dec 10 @ 80% Exit Problem 1 Four alternative designs are being considered for a pet-exercising treadmill. The company's MARR is 18%. The cash flows associated with each are given in the following table. The Judas The Lancelot The Bella The Lilo Capital Investment Annual Revenues $120,000 Annual Expenses Refurbishment Cost at EOY 5 Market Value after 10 years $50,000 $20,000 $23,000 $4,000 $130,000 $50,000 $15,000 $23,000 $4,000 $141,000 $50,000 $13,000 $18,000 $5,000 $160,000 $50,000 $14,000 $15,000 $15,000 IRR ??? 21.8% 21.6% 17.7% Here are various interest tables you can use to look up factor values. 10% Interest Table , Table 12% Interest Table , 15% Interest Table , 18% Interest 20% Interest Table , 25% Interest Table ,arrow_forwardInsmginps Problem 12 The Tree Line Inn has purchased a shuttle bus to transport guests to and from a local ski lodge. The cost of the bus is $40,000; its salvage value is $4,000; and its life is five years with expected usable mileage of 100,000. nousioonqob launna orh otsluols barliom soncled ginibab oldaob atil ort 19vo Required: Calculate the first year's depreciation under each of the following methods: 1. Straight-line. 000.0082 to eslna bad insucies 2. Units of production, assuming the bus traveled 15,000 miles in year 1. gnib 000(001 3. Sum-of-the-years' digits. 4. Double declining balance.arrow_forwardPls pls pls pls pls pls pls help ASAP plsarrow_forward

- 4 points 00:49:56 eBook Het Print References The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Investment Cash Inflow $ 6,000 $ 12,000 Year 1 2 3 4 10 $71,000 $4,000 $ 21,000 $ 22,000 $ 25,000 $ 23,000 $ 21,000 $ 19,000 $ 18,000 $ 18,000 Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the payback period of the investment. (Round your answer to 1 decimal place.) Payback period years Required 1 Required 2 >arrow_forwardExercise 16-26 Internal Rate of Return; Uneven Cash Flows (Section 1) (LO 16-1) The trustees of the Danube School of Art and Music, located in Tuttlingen, Germany, are considering a major overhaul of the school's audio system. With or without the overhaul, the system will be replaced in two years. If an overhaul is done now, the trustees expect to save the following repair costs during the next two years: year 1, 3,900 euros; year 2, 5,900 euros. The overhaul will cost 7,957 euros. (The euro is used in most European markets.) Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Use trial and error to compute the Internal rate of return on the proposed overhaul. (Hint: The NPV of the overhaul is positive if an 10 percent discount rate is used, but the NPV is negative if a 18 percent rate is used.) Internal rate of return %arrow_forwardTyped plz annd Asap thanksarrow_forward

- Exercise 16-34 Profitability Index; Taxes (Section 2) (LO 16-7) The owner of Atlantic City Confectionary is considering the purchase of a new semiautomatic candy machine. The machine will cost $23,000 and last 9 years. The machine is expected to have no salvage value at the end of its useful life. The owner projects that the new candy machine will generate $3,500 in after-tax savings each year during its life (including the depreciation tax shield). Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the profitability index on the proposed candy machine, assuming an after-tax hurdle rate of (a) 8 percent, (b) 1O percent, and (c) 12 percent. (Round your final answers to 2 decimal places.) Profitability Index (a) 8 percent (b) 10 percent (c) 12 percentarrow_forwardSaved Exercise 12-12 Uncertain Cash Flows (LO12-4] The Cambro Foundation, a nonprofit organization, is planning to invest $104,950 in a project that will last for three years. The project will produce net cash inflows as follows: Year 1 $30,000 Year 2 $40,000 Year 3 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: Assuming that the project will yield exactly a 12% rate of return, what is the expected net cash inflow for Year 3? Net cash inflow Graw 10 tv MacBook Air 80 88 DII DD F2 F3 F4 FS F6 FB F9 F11 23 2$ % ) + 1 3 4 6 7 Q W E T Y U { A D F H J C. V B M .. .. * 00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education