College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

I don't need

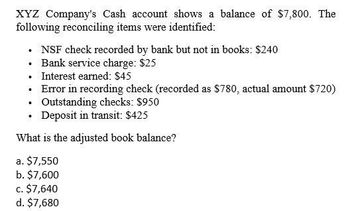

Transcribed Image Text:XYZ Company's Cash account shows a balance of $7,800. The

following reconciling items were identified:

NSF check recorded by bank but not in books: $240

⚫ Bank service charge: $25

⚫ Interest earned: $45

.

.

Error in recording check (recorded as $780, actual amount $720)

Outstanding checks: $950

Deposit in transit: $425

What is the adjusted book balance?

a. $7,550

b. $7,600

c. $7,640

d. $7,680

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the following information, prepare a bank reconciliation. Bank balance: $4,587 Book balance: $5,577 Deposits in transit: $1,546 Outstanding checks: $956 Interest income: $56 NSF check: $456arrow_forwardThe bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Prepare the correcting journal entry.arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $12,565. Book balance: $13,744. Deposits in transit: $2,509. Outstanding checks: $1,777. Bank charges: $125. Bank incorrectly charged the account for $412. The bank will correct the error next month. Check number 1879 correctly cleared the bank in the amount of $562 but posted in the accounting records as $652. This check was expensed to Utilities Expense.arrow_forward

- The bank reconciliation shows the following adjustments: Deposits in transit: $1,234 Outstanding checks: $558 Bank service charges: $50 NSF checks: $250 Prepare the correcting journal entry.arrow_forwardWhat is the journal entry to record an NSF check, from J. Smith for 250, that is returned with the bank statement? a. Cash 250 DR; NSF Check 250 CR b. Accounts Receivable 250 DR; Cash 250 CR c. NSF Check 250 DR; Accounts Receivable 250 CR d. Cash 250 DR; Accounts Receivable 250 CR e. Cash 250 DR; Miscellaneous Expense 250 DRarrow_forwardNeed help with this accounting questionsarrow_forward

- A company received a bank statement with a balance of $6,100. Reconciling items included a bookkeeper error of $300—a $300 check recorded as $800—two outstanding checks totaling $830, a service charge of $20, a deposit in transit of $250, and interest revenue of $21. What is the adjusted bank balance? A. $5,220 B. $5,061 C. $5,520 D. $4,721arrow_forwardA company received a bank statement with a balance of $6,400. Reconciling items included a bookkeeper error of $400 a $400 check recorded as $700—two outstanding checks totaling $800, a service charge of $23, a deposit in transit of $280,and interest revenue of $21. What is the adjusted bank balance? A. $5,480 B. $5,178 C. $5,880 D. $5624arrow_forwardPLEASE ANSWER WITHOUT IMAGEarrow_forward

- As of June 30, Year 1, the bank statement showed an ending balance of $18,181. The unadjusted Cash account balance was $17,028. The following information is available: 1. Deposit in transit, $2,795. 2. Credit memo in bank statement for interest earned in June: $14. 3. Outstanding check: $3,946. 4. Debit memo for service charge: $12. Required: Determine the true cash balance by preparing a bank reconciliation as of June 30, Year 1, using the preceding information. Note: Negative amounts should be indicated with minus sign. Bank Reconciliation Unadjusted bank balance 6/30/Year 1 True cash balance 6/30/Year 1 Unadjusted book balance 6/30/Year 1 True cash balance 6/30/Year 1 $ $ $ 18,181 18,181 4 0arrow_forwardThe following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6: 1. Cash balance according to the company's records at August 31, $26,070. 2. Cash balance according to the bank statement at August 31, $27,620. 3. Checks outstanding, $5,290. 4. Deposit in transit, not recorded by bank, $4,250. 5. A check for $170 in payment of an account was erroneously recorded in the check register as $710. 6. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown in Exhibit 13. Creative Design Co. Bank Reconciliation August 31, 20Y6 Cash balance according to bank statement Adjusted balance Cash balance according to company's records Adjusted balance b. If the balance sheet were prepared for Creative Design Co. on August 31, what amount should be reported for cash? c. Must a bank reconciliation always balance (reconcile)?arrow_forwardProvide answer in text Formatearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,