FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

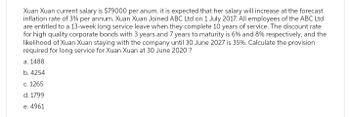

Transcribed Image Text:Xuan Xuan current salary is $79000 per anum. it is expected that her salary will increase at the forecast

inflation rate of 3% per annum. Xuan Xuan Joined ABC Ltd on 1 July 2017. All employees of the ABC Ltd

are entitled to a 13-week long service leave when they complete 10 years of service. The discount rate

for high quality corporate bonds with 3 years and 7 years to maturity is 6% and 8% respectively, and the

likelihood of Xuan Xuan staying with the company until 30 June 2027 is 35%. Calculate the provision

required for long service for Xuan Xuan at 30 June 2020?

a. 1488

b. 4254

c. 1265

d. 1799

e. 4961

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Godoarrow_forwardToefungus Ltd. issued $8,000,000 face value bonds, with an interest rate of 4.0 %, on July 1, 2020. The bonds mature in seven years time, on July 1, 2027 and pay interest semi-annually on July 1 and January 1. The company’s financial advisors have indicated that the yield the market is expecting to receive on their investment is 3.5 %. Toefungus Ltd. has a December 31 year end for financial and tax reporting and uses straight line amortization for allocating premium or discount. Required: a. Calculate the issue price for the bond. Show all steps and calculations. b. Prepare all journal entries required to account for bond transactions during the first full year the bond is outstanding. c. Clearly disclose all information related to this bond that would appear in the Company’s 2020 year-end financial statements.arrow_forwardGoldenSeal Pharmacy borrowed $630,000 on January 2, 2025, by issuing a 15% serial bond payable that must be paid in three equal annual installments plus interest for the year. The first payment of principal and interest comes due January 2, 2026. Complete the missing information. Assume bonds are issued at face value. (Complete all input fields. For accounts with a $0 balance, make sure to enter a 0 in the appropriate cell.) Current Liabilities: Bonds Payable Interest Payable Long-Term Liabilities: Bonds Payable 2025 December 31 2026 2027arrow_forward

- Viking Voyager specializes in the design and production of replica Viking boats. On January 1, 2021, the company issues $1,860,000 of 7% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year. 2. If the market interest rate is 8%, the bonds will issue at $1,699,184. Record the bond issue on January 1, 2021, and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest dollar amount.)arrow_forwardSheffield Corporation issued a 3-year, $66,000, 6% note to Oriole Company on January 1, 2017, and received an excavator that normally sells for $57,936. The note requires annual interest payments each December 31. The market rate of interest for a note of similar risk is 11%. Prepare Sheffield's journal entries for (a) the January 1 issuance and (b) the December 31 interest. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (a) (b)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education