FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

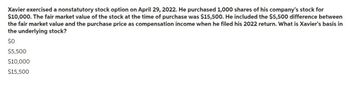

Transcribed Image Text:Xavier exercised a nonstatutory stock option on April 29, 2022. He purchased 1,000 shares of his company's stock for

$10,000. The fair market value of the stock at the time of purchase was $15,500. He included the $5,500 difference between

the fair market value and the purchase price as compensation income when he filed his 2022 return. What is Xavier's basis in

the underlying stock?

$0

$5,500

$10,000

$15,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2022, Gwen purchased an XYZ September 50 Put for $450. The option expired on September 17, 2022. How should this be reported on Gwen's 2022 return? No gain or loss. $450 of capital gain. $450 of capital loss. $450 of investment expense.arrow_forwardMake a tabular summary of the effects (check pic)arrow_forwardKim holds an executive position at Taylors and Taylors, Incorporated. Her compensation package includes incentive stock options. She was granted 100 ISOs on October 1, XX01, when the stock was selling for $62 per share. The exercise pri of the options is $75 per share. Kim has to wait until January 1, XX02 to exercise h options. The options expire on September 30, XX03. Kim exercised her options on August 27, XX03 when the stock was selling for $107 per share. She sold her 100 shares on March 5, XX04 for $118 per share. Calculate and characterize the gain K must recognize from the March 5, XX04 sale. A) $0 B) $4,300 long-term capital gain C) $3,200 ordinary income; $1,100 short-term capital gain D) $1,300 ordinary income; $4,300 short-term capital gainarrow_forward

- James purchased 100 shares of stock on December 5, 2022 for $10,000 ($100p/s). James then re-purchased 50 shares on February 1, 2023 for $1000 ($20 p/s). What are the tax consequences for 2023 tas filings?arrow_forwardMr. Hippo owns 10,000 shares of Lowland Corporation common stock, which he purchased on March 8, 2011, for $200,000. On October 3, 2018, Hippo purchases an additional 4,000 shares for $76,000. On October 12, 2018, he sells the original 10,000 shares for $170,000. On November 1, 2018, he purchases an additional 4,000 shares for $66,000. Read the requirements. Requirement a. What is Mr. Hippo's recognized gain or loss as a result of the sale on October 12, 2018? Amount Gain or loss $ 6,000 loss Gain or loss to be recognized Requirement b. What are the basis and the holding period of the stock he continues to hold? (Do not round interim calculations. Only round the amount you input in the input field to the nearest dollar.) Basis Holding period begins 4,000 purchased on October 3, 2018 4,000 purchased on November 1, 2018arrow_forwardJohn Broward owns 1,500 shares of Silver Fox Corporation common stock. John purchased the 1,500 shares on April 17, 2011, for $21,000. On December 8, 2018, John sells 750 shares for $5,000. On January 2, 2019, John buys 250 shares of Silver Fox Corporation common stock for $1,750 and 50 shares of Silver Fox Corporation preferred stock for $1,000. The preferred stock is nonvoting, nonconvertible. Read the requirements. Requirement a. What is John's realized and recognized loss on the December 8 sale of stock? (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest whole dollar.) John has a realized loss of John has a recognized loss of 8000 3571 Requirement b. What is his basis and the holding periods of the shares purchased in 2011 and in 2019? Basis Holding period begins April 17, 2011 April 17, 2011 April 17, 2011 250 shares of Silver Fox common stock Remaining 750 shares of Silver Fox common stock 50 shares of Silver Fox preferred…arrow_forward

- D purchased 2,000 units of a private company’s shares for $45,000 in 2020. If he sold the 2,000 units for $60,000 in 2021. What is the capital gain or loss on his disposition in 2021? ____________arrow_forwardFor the last two years, Margaret Lane has Invested in the shares of Garod Inc. Details of her purchases and sales of these shares are as follows: January 2020 Purchase July 2020 Purchase November 2020 Sale Shares Purchased (Sold) 300 200 (250) 400 (150) Per Share Value $4.75 5.25 5.40 5.50 4.80 July 2021 Purchase December 2021 Sale Determine Ms. Lane's taxable capital gains and allowable capital losses for 2020 and 2021.arrow_forwardLO.2 On May 9, 2018, Calvin acquired 250 shares of stock in Hobbes Corporation, a new startup company, for $68,750. Calvin acquired the stock directly from Hobbes, and it is classified as § 1244 stock (at the time Calvin acquired his stock, the corporation had $900,000 of paid-in capital). On January 15, 2020, Calvin sold all of his Hobbes stock for $7,000. Assuming that Calvin is single, determine his tax consequences as a result of this sale.arrow_forward

- Chi has the following transactions in Smoke Corp. and Mirrors Corp. shares: Smoke Mirror May 1, 2018 Purchase @ $25.00 100 @ $22.50 100 December 20, 2018 Sale 100 @ $28.00 100 @ $24.00 January 3, 2019 Purchase N/A 100 @ $23.20 June 1, 2019 Sale N/A 100 @ $26.00 Chi's taxable capital gains for 2018 and 2019 are: $275 for 2018, $140 for 2019 $225 for 2018, $90 for 2019 $275 for 2018, $90 for 2019 $225 for 2018, $140 for 2019arrow_forwardArnold exercised an incentive stock option in 2019, acquiring 1,500 shares of stock at an option price of $80 per share. The FMV of the stock at the date of exercise was $110 per share. In 2021, the rights became freely transferable and were not subject to a substantial risk of forfeiture. Arnold sells the shares in 2022 for $165 per share. Required: How do these transactions affect his AMTI in 2019, 2021, and 2022? Note: Negative amounts should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required.arrow_forwardUnderstand the reporting effect: If Brooke sells the stock and includes the $80,000 gain in pretax income, will she get her bonus? Assume any bonus paid to Brooke is not included in calculating pretax income. Specify the options: Instead of reporting the gain as part of pretax income, how else might Brooke report the gain on the sale? Identify the impact: Does Brooke's decision to classify the gain on the sale of treasury stock as part of pretax income affect the company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education