FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

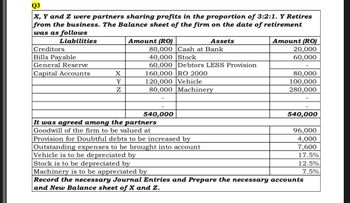

Transcribed Image Text:Q3

X, Y and Z were partners sharing profits in the proportion of 3:2:1. Y Retires

from the business. The Balance sheet of the firm on the date of retirement

was as follows

Liabilities

Creditors

Bills Payable

General Reserve

Capital Accounts

X

Y

Z

Amount (RO)

80,000 Cash at Bank

40,000 Stock

60,000 Debtors LESS Provision

160,000 RO 2000

120,000 Vehicle

80,000

Assets

540,000

Machinery

Amount (RO)

20,000

60,000

80,000

100,000

280,000

540,000

It was agreed among the partners

Goodwill of the firm to be valued at

Provision for Doubtful debts to be increased by

Outstanding expenses to be brought into account

Vehicle is to be depreciated by

Stock is to be depreciated by

Machinery is to be appreciated by

Record the necessary Journal Entries and Prepare the necessary accounts

and New Balance sheet of X and Z.

96,000

4,000

7,600

17.5%

12.5%

7.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following condensed balance sheet is for the partnership of Hardwick, Saunders, and Ferris, who share profits and losses in the ratio of 4:3:3, respectively: Cash Other assets Hardwick, loan Total assets $ 93,000 815,000 44,000 Beginning balances Sold assets $952,000 Accounts payable Ferris, loan Hardwick, capital Saunders, capital Ferris, capital Adjusted balances Max loss on remaining noncash assets Paid liabilities Safe payments Total liabilities and capital The partners decide to liquidate the partnership. Forty percent of the other assets are sold for $125,000. Prepare a proposed schedule of liquidation at this point in time. (Amounts to be deducted should be entered with a minus sign.) HARDWICK, SAUNDERS, AND FERRIS Proposed Schedule of Liquidation Cash Other Assets $ 48,000 54,000 380,000 240,000 230,000 $952,000 Accounts Payable Hardwick, Loan and Capital Saunders, Capital Ferris, Loan & Capitalarrow_forwardGerald and Julia are joining their separate business to form a partnership and they agreed to share profits in the manner of 55% for Gerald and 45% for Julia. Property is to be contributed for a total capital of P800,000. The partners agreed to make their capital accounts equal after formation. How much cash must be contributed by each of the partners after they contributed their properties? Gerald Julia Book Value Fair Value Book Value Fair Value Accounts Receivable 60,000 60,000 - - Inventories 60,000 90,000 160,000 180,000 Equipment 100,000 80,000 180,000 190,000 Accounts Payable 30,000 30,000 20,000 20,000arrow_forwardA and B are combining their separate businesses to form a partnership. Presented here are the Statements of Financial Position before any adjustments: Current Assets Non-current Assets Total Liabilities ● A 617,500 848,000 150,000 B 672,500 970,000 178,000 They agreed to set up P5,000 each as uncollectible accounts on their accounts receivable. They also found out that their Non-current assets (all depreciable assets) were under-depreciated by P80,000 each. The partners agreed to equalize their capital balance upon formation. Compute the total capital of the partnership.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education