FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:4

7:23

k

t

nces

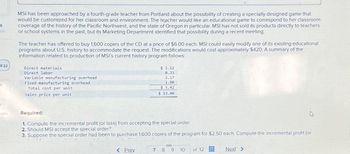

MSI has been approached by a fourth-grade teacher from Portland about the possibility of creating a specially designed game that

would be customized for her classroom and environment. The teacher would like an educational game to correspond to her classroom

coverage of the history of the Pacific Northwest, and the state of Oregon in particular. MSI has not sold its products directly to teachers

or school systems in the past, but its Marketing Department identified that possibility during a recent meeting.

The teacher has offered to buy 1,600 copies of the CD at a price of $6.00 each. MSI could easily modify one of its existing educational

programs about U.S. history to accommodate the request. The modifications would cost approximately $420. A summary of the

information related to production of MSI's current history program follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total cost per unit

Sales price per unit

$ 1.12

0.33

2.17

1.80

$5.42

$ 13.00

Required:

1. Compute the incremental profit (or loss) from accepting the special order.

2. Should MSI accept the special order?

3. Suppose the special order had been to purchase 1,600 copies of the program for $2.50 each. Compute the incremental profit (or

< Prev

S

7 8 9 10

of 12

www

588

www

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ! Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard Quantity and Cost 7 pounds @ $9 per pound 3 DLH @ $17 per DLH 3 DLH @ $13 per DLH Actual Results 59,200 pounds @ $9.10 per pound 25,000 hours @ $17.60 per hour $ 334,000 8,400 units Exercise 21-8 (Algo) Standard cost per unit, total budgeted and actual costs, and total cost variance LO P2 (1) Prepare the standard cost card showing standard cost per unit. (2) Compute total budgeted cost for June production. (3) Compute total actual cost for June production. (4) Compute total cost variance for June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute total budgeted cost for June production. Total budgeted (standard) costarrow_forwardPlease show your work.arrow_forwardMy Home * CengageNOWv2 | Online teachin- X m/takeAssignment/takeAssignmentMain.do?invoker=8ttakeAssignmentSessionLocator=&inprogress=false High-Low Method The manufacturing costs of Rosenthal Industries for the first three months of the year follow: Total Costs Production January $72,000 1,120 units February 84,640 1,690 March 112,000 2,720 Using the high-low method, determine (a) the varnable cost per unit and (b) the total fixed.cost. a. Variable cost per unit b. Total fixed cost All work saved. 44 °Farrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardanswer with must must explanation , computation for each parts and steps answer in text form no copy from other answerarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education