Concept explainers

Please check answer. What am I doing wrong?

World Company expects to operate at 80% of its productive capacity of 56,250 units per month. At this planned level, the company expects to use 27,900 standard hours of direct labor. Overhead is allocated to products using a predetermined standard rate of 0.620 direct labor hour per unit. At the 80% capacity level, the total budgeted cost includes $69,750 fixed overhead cost and $320,850 variable overhead cost. In the current month, the company incurred $361,000 actual overhead and 24,900 actual labor hours while producing 40,000 units.

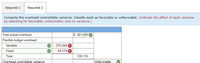

(1) Compute the overhead volume variance. Classify each as favorable or unfavorable.

(2) Compute the overhead controllable variance. Classify each as favorable or unfavorable.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Assume the following five facts: • budgeted fixed manufacturing overhead for the coming period of $308,750 • budgeted variable manufacturing overhead of $4.00 per direct labor hour, • actual direct labor hours worked of 64,000 hours, and • budgeted direct labor-hours to be worked in the coming period of 65,000 hours. The company allocates MOH based on direct-labor hours. The predetermined plantwide overhead rate for the period is closest to:A. $8.50 per dlh B. $8.82 per dlh C. $$8.75 per dlh D. $8.63 per dlharrow_forward[The following information applies to the questions displayed below.] Manuel Company predicts it will operate at 80% of its productive capacity. Its overhead allocation base is DLH and its standard amount per allocation base is 0.5 DLH per unit. The company reports the following for this period. Production (in units) Overhead Variable overhead Fixed overhead Total overhead Flexible Budget at 80% Capacity 51,000 Required 1 Required 2 $ 280,500 51,000 $ 331,500 Actual Results (1) Compute the overhead volume variance. Indicate variance as favorable or unfavorable. Volume variance 45,600 (2) Compute the overhead controllable variance. Indicate variance as favorable or unfavorable. $ 318,200 Complete this question by entering your answers in the tabs below. Volume Variance Compute the overhead volume variance. Indicate variance as favorable or unfavorable. Note: Indicate the effect of the variance by selecting favorable, unfavorable, or no variarrow_forwardKing Company estimated that it would operate its manufacturing facilities at 800,000 direct labour hours for the year, which served as the denominator activity in the predetermined overhead rate. The total budgeted manufacturing overhead for the year was $2,000,000, of which $1,600,000 was variable and $400,000 was fixed. The standard variable overhead rate was $2 per direct labour hour. The standard direct labour time was 3 direct labour hours per unit. The actual results for the year are presented below: Actual Finished Units Actual Direct Labour Hours Actual Variable Overhead Actual Fixed Overhead 250,000 764,000 $1,610,000 $ 392,000 A. What was the variable overhead spending variance for the year? B. What was the variable overhead efficiency variance for the year?arrow_forward

- Mcniff Corporation makes a range of products. The company's predetermined overhead rate is $17 per direct labor-hour, which was calculated using the following budgeted data: Variable manufacturing overhead $ 80,000 Fixed manufacturing overhead $ 260,000 Direct labor-hours 20,000 Management is considering a special order for 710 units of product O96S at $65 each. The normal selling price of product O96S is $76 and the unit product cost is determined as follows: Direct materials $ 38.00 Direct labor 17.00 Manufacturing overhead applied 17.00 Unit product cost $ 72.00 If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special…arrow_forwardKatherin, Ltd. is developing their manufacturing overhead budget for May, which is based on budgeted direct labor hours. The variable overhead rate is $16.05 per direct labor hour and 11,552 direct labor hours are budgeted for May. Fixed manufacturing overhead is budgeted at $102,000. All overhead costs are current cash flows except for $15,300 of depreciation. The predetermined overhead rate every month is recomputed every month. What should the predetermined overhead rate for May be? Select one: A. $24.88 B. $26.20 C. $8.83 D. $17.66 E. $17.37arrow_forwardNovak Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: Indirect labor: $1.10, Indirect materials: 0.80, Utilities: 0.50. Fixed overhead costs per month are Supervision $4, 000, Depreciation $1, 200, and Property Taxes $800. The company believes i will normally operate in a range of 7, 000-10, 000 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget for 2022 for the expected range of activity, using increments of 1, 000 direct labor hours. (List variable costs before fixed costs.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education