FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

₱26,860

₱42,100

₱45,400

₱49,660

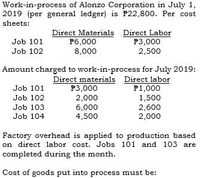

Transcribed Image Text:Work-in-process of Alonzo Corporation in July 1,

2019 (per general ledger) is P22,800. Per cost

sheets:

Direct Materials Direct Labor

Job 101

P6,000

8,000

P3,000

2,500

Job 102

Amount charged to work-in-process for July 2019:

Direct materials Direct labor

P1,000

1,500

2,600

2,000

Job 101

P3,000

2,000

6,000

4,500

Job 102

Job 103

Job 104

Factory overhead is applied to production based

on direct labor cost. Jobs 101 and 103 are

completed during the month.

Cost of goods put into process must be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3arrow_forwardSh18 Please help me Solution Thankyou.arrow_forwardExercise 12A-6 (Algo) Basic Present Value Concepts [LO12-7] The Caldwell Herald newspaper reported the following story: Frank Ormsby of Caldwell is the state's newest millionaire. By choosing the six winning numbers on last week's state lottery, Mr. Ormsby won the week's grand prize totaling $1.34 million. The State Lottery Commission indicated that Mr. Ormsby will receive his prize in 20 annual installments of $67,000 each. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1. If Mr. Ormsby can invest money at a 9% rate of return, what is the present value of his winnings? (Enter your answer in dollars and not in millions of dollars.) Present valuearrow_forward

- nku.4 give in table format or i will give you down votearrow_forwardattachedin ss thanks gw oy5 35 73 82 3arrow_forwardProblem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Problem 6-10 (Algo) Part 5 Westgate recognizes revenue over time according to percentage of completion. Costs incurred during the year Estimated costs to complete as of year-end Revenue Gross profit (loss) $ $ 2024 $ 2,610,000 6,390,000 2,100,000 1,850,000 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. X Answer is complete but not entirely correct. 2026 3,939,962 (110,038)…arrow_forward

- C = 250 + 0.30Y4 = 250 + 0.30(Y – T) I = 200 G = 500 T = 250 Key in all answers in 2-decimal places: The Marginal Propensity to Consume is 0.3 The Marginal Propensity to Save is 0.7 The Government Spending Multiplier is 1.43 The (absolute value) of the Tax-Multiplier is The Balanced Budget Multiplier isarrow_forward15arrow_forwardCinnamon Buns Company (CBC) started 2024 with $54,000 of inventory on hand. During 2024, $284,000 in inventory was purchased on account with credit terms of 2/10, 1/30 - All discounts were taken. Purchases were all made f.o.b. shipping point. CBC paid freight charges of $11,000. Inventory with an invoice amount of $4,800 was returned for credit. Cost of goods sold for the year was $320,000. CBC uses a perpetual inventory system. Assume instead that (a) freight costs were paid by the vendor, (b) no discounts were taken, and (c) the inventory on hand at the beginning of 2024 was determined by a physical count that failed to realize that $12,000 of inventory was being held on consignment for Frosting R Us Incorporated. What is cost of goods available for sale, assuming CBC uses the gross method to record purchase discounts? Multiple Choice $324,680 $344,200 $321.200 Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education