FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

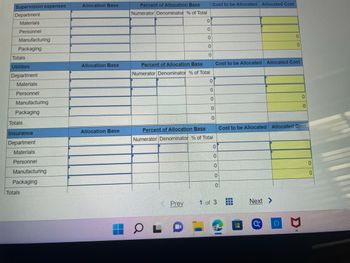

Transcribed Image Text:Supervision expenses

Department

Materials

Personnel

Manufacturing

Packaging

Totals

Utilities

Department

Materials

Personnel

Manufacturing

Packaging

Totals

Insurance

Department

Materials

Personnel

Manufacturing

Packaging

Totals

Allocation Base

Allocation Base

Allocation Base

Percent of Allocation Base

Numerator Denominator % of Total

0

0

OL

0

0

Percent of Allocation Base

Numerator Denominator % of Total

Prev

0

Cost to be Allocated Allocated Cost

0

0

0

0

Percent of Allocation Base

Numerator Denominator % of Total

0

Cost to be Allocated Allocated Cost

0

0

0

0

0

1 of 3

।

‒‒‒

‒‒‒

0

0

Cost to be Allocated Allocated Cost

Next >

*********

C

0

P

0

0

0

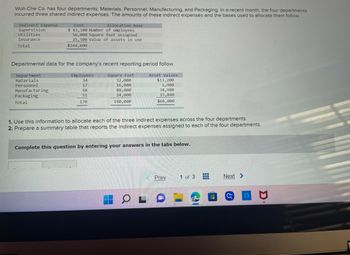

Transcribed Image Text:Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments

incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow.

Indirect Expense

Supervision

Utilities

Insurance

Total

Cost

$ 83,100 Number of employees

56,000 square feet occupied

25,500 Value of assets in use

$164,600

Allocation Base

Departmental data for the company's recent reporting period follow.

Department

Materials

Square Feet

Asset Values

32,000

$13,200

16,000

1,980

88,000

34,980

Personnel

Manufacturing

Packaging

Total

24,000

15,840

160,000

$66,000

Employees

34

17

68

51

170

1. Use this information to allocate each of the three indirect expenses across the four departments.

2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

Complete this question by entering your answers in the tabs below.

OL

Prev

1 of 3

-

---

‒‒‒

H

Next >

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compton Information Services, Inc., has two service departments: human resources and billing. Compton's operating departmen organized according to the special industry each department serves, are health care, retail, and legal services. The billing depart supports only the three operating departments, but the human resources department supports all operating departments and th billing department. Other relevant information follows. Number of employees Annual cost* Annual revenue Req A1 Billing Human Resources 10 $720,000 $1,428,000 $6,000,000 Department Req A2 Health Care Retail Legal Services Total Complete this question by entering your answers in the tabs below. Req B1 Human Resources *This is the operating cost before allocating service department costs. Required a. Allocate service department costs to operating departments, assuming that Compton adopts the step method. The company the number of employees as the base for allocating human resources department costs and department…arrow_forwardaducation.com/ext/map/index html?_con%3con&external_browser%-D0&launchUrl=https%253A%252F%252Fbbhosted.cuny.edu%252Fwebapps%252Fportal%252Ffra oks Login Module 5-Chap 18 H Office templates & t.. EChapter 4 Saved Help Save & Exit Major Co. reported 2021 income of $319,000 from continuing operations before income taxes and a before-tax loss on discontinued operations of $74,000. All income is subject to a 25% tax rate. In the income statement for the year ended December 31, 2021, Major Co. would show the following line-item amounts for income tax expense and net income: Multiple Choice $61,250 and $393,000 respectively. $79.750 and $183,750 respectively. $61,250 and $239,250 respectively.arrow_forwardThe centralized computer technology department of Hardy Company has expenses of $320,000. The department has provided a total of 4,000 hours of service for the period. The Retail Division has used 2,750 hours of computer technology service during the period, and the Commercial Division has used 1,250 hours of computer technology service. How much should each division be allocated for computer technology department services? Do not round interim calculations. Retail Division $fill in the blank 1 Commercial Division $fill in the blank 2arrow_forward

- 7arrow_forwardNovak's Medical operates three support departments and two operating units. Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $273400, $156400, and $62000, respectively. Information on the hours used are as follows: Hours in Acct Hours in Admin Hours in HR Acct O $16416. O $0. O $17186. O $17897. 16 8 Admin 20 4 HR 48 8 Surgery ER 360 120 65 220 80 130 What amount of costs would be allocated from the administrative department to the other support departments (Acct and HR) using the reciprocal method to allocate costs? (Do not round the intermediate calculations.)arrow_forwardInformation from the records of the Conundrum Company for September 2018 was as follows: Sales $307,500 Selling and administrative expenses 52,500 Direct materials used 66,000 Direct labor 75,000 Variable factory overhead 50,000 Factory overhead 51,250 Inventories Sept. 1, 2018 Sept 30, 2018 Direct materials $ 8,000 $10,500 Work in process 18,750 21,000 Finished goods 17,250 14,250 Conundrum Corporation produced 20,000 units.What are the total variable costs per unit? a.$2.175 b.$6.25 c.$7.05 d.$9.55arrow_forward

- Solexx Corporation allocates its service department overhead costs to producing departments. This information is for the month of June: Service Departments Maintenance Utilities Overhead costs incurred $ 108,000 $630,000 Service provided to departments Maintenance - 5% Utilities 10% - Producing-A 20 40 Producing-B 70 55 Totals 100% 100% Required: What is the amount of maintenance and utilities department costs distributed to producing departments A and B for June using (1) the direct method, (2) the step method (maintenance department first), and (3) the reciprocal method? (Do not round intermediate calculations. Round final answers to the nearest dollar.)arrow_forwardervice Department Charges The centralized computer technology department of Hardy Company has expenses of $372,600. The department has provided a total of 13,800 hours of service for the period. The Retail Division has used 6,762 hours of computer technology service during the period, and the Commercial Division has used 7,038 hours of computer technology service. How much should each division be charged for computer technology department services? Do not round interim calculations. Retail Division $fill in the blank 1 Commercial Division $fill in the blank 2arrow_forwardSupport Department Allocations The centralized computer technology department of Hardy Company has expenses of $458,500. The department has provided a total of 13,100 hours of service for the period. The Retail Division has used 5,109 hours of computer technology service during the period, and the Commercial Division has used 7,991 hours of computer technology service. How much should each division be allocated for computer technology department services? Do not round interim calculations. Retail Division $ Commercial Division $arrow_forward

- Habib Manufacturing has five manufacturing departments and the following operating and cost information for the two most recent months of activity: April May Units produced 4,000 6,000 Costs in each department Department 1 $ 16,000 $ 18,000 Department 2 16,000 26,000 Department 3 20,000 20,000 Department 4 32,000 48,000 Department 5 16,000 24,000 Required: Identify whether the cost in each department is fixed, variable, or mixed.arrow_forwardThe Ferre Publishing Company has three service departments and two operating departments. Selected data from a recent period on the five departments follow: Service Department Operating Department A B C 1 2 Total Overhead costs £ 100,000 £ 115,000 £ 73,000 £ 266,500 £ 289,000 £ 843,500 Number of employees 57 33 132 297 198 717 Square feet of space occupied 12,600 7,100 21,000 42,000 105,000 187,700 Hours of press time 34,000 68,000 102,000 The company allocates service department costs by the step method in the following order: A (number of employees), B (space occupied), and C (hours of press time). The company makes no distinction between variable and fixed service department costs. Required: Using the step method, allocate the service department costs to the operating departments. (Do not round intermediate calculations. Amounts to be deducted…arrow_forwardPrepare summary journal entries to record the following transactions for a company in its first month of operations. Raw materials purchased on account, $90,000. Direct materials used in production, $36,500. Indirect materials used in production, $19,200. Paid cash for factory payroll, $50,000. Of this total, $38,000 is for direct labor and $12,000 is for indirect labor. Paid cash for other actual overhead costs, $11,475. Applied overhead at the rate of 125% of direct labor cost. Transferred cost of jobs completed to finished goods, $56,800. Sold jobs on account for $82,000 g(2). The jobs had a cost of $56,800 g(1).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education