FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

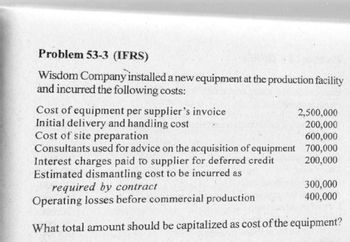

Transcribed Image Text:Problem 53-3 (IFRS)

Wisdom Company installed a new equipment at the production facility

and incurred the following costs:

Cost of equipment per supplier's invoice

Initial delivery and handling cost

Cost of site preparation

Consultants used for advice on the acquisition of equipment

Interest charges paid to supplier for deferred credit

Estimated dismantling cost to be incurred as

required by contract

Operating losses before commercial

production

What total amount should be capitalized as cost of the equipment?

2,500,000

200,000

600,000

700,000

200,000

300,000

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company's research department incurred $1,000,000 in material, labor, and overhead costs to construct a prototype of a new product and $100,000 to test and modify the prototype. Which of the following statements correctly describes the accounting treatment of prototype costs incurred by the company? 1. Capitalize $1,100,000 and amortize it over the expected sales life of the new product 2. Capitalize $1,100,000 and amortize it over the life of the prototype. 3. Capitalize $1,000,000 and amortize it over the life of the prototype and expense $100,000 as incurred. 4. Expense $1,100,000 as incurred.arrow_forwardSandhill Communications contracted to set up a call center for the City of Phoenix. Under the terms of the contract, Sandhill Communications will design and set-up a call center with the following costs: Design of call center $18000 Computers, servers, telephone equipment $510000 Software $150000 Installation and testing of equipment $26000 Selling commission $46000 Annual service contract $80000 In addition, Sandhill Communications will maintain and service the equipment and software to ensure smooth operations of the call center for an annual fee of $160000. Ownership of equipment installed remains with the City of Phoenix. The contract costs that should be capitalized is $678000. $830000. $660000. $750000.arrow_forwardDorman company purchased a new machine for its production process. The following costs were incurred for the new machine. Training costs for workers who will operate the machine $15,000 Wages paid to workers who operate the machine during production 109,000 Ordinary repairs to the machine before the first production run 1,000 1 Cost of platform used to properly secure the machine 30,000 Costs of tests run which took place before the first production run 8,000 WHICH COSTS SHOULD BE ADDED TO THE COST OF MACHINE?arrow_forward

- Candalibra Company incurred the following costs during the year ended December 31, 2018: Laboratory research aimed at discovery of new knowledge $300,000 Costs of testing prototype and design modifications (economic viability not achieved) 55,000 Quality control during commercial production, including routine testing of products 210,000 Construction of research facilities having an estimated useful life of 12 years but no alternative future use 440,000 What is the total amount to be classified and expensed as research and development in 2018 under U.S. GAAP? 79arrow_forward35.During 2021, King Co. incurred the following costs: Testing in search for process alternatives 720,000 Costs of testing prototype and design modifications 500,000 Modification of the formulation of a process 1,220,000 Research and development services performed by Queen Corp. for King 650,000 In King's 2021 statement of profit or loss, research and development expense should be 1,220,000 1,870,000 2,590,000 3,090,000arrow_forwardA Company is trying to decide which one of two contracts it will accept. The costs and revenues associated with each are listed below: Contract revenue Materials Contract X Contract Z $ 260,000 $ 200,000 10,000 10,000 Labor costs 88,000 120,000 Depreciation on 8,000 10,000 equipment Cost incurred for 1,500 1,500 consulting advice Allocated portion of overhead 5,000 3,000 The equipment was purchased last year and has no resale value. Which of these amounts is relevant for the selection of one contract over another? OA. Contract revenue and labor costs OB. Materials, consulting advice, and allocated overhead OC. Cost of consulting advice and allocated overhead OD. Contract revenue, labor costs, depreciation on equipment and allocated portion of overhead OE. None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education