Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

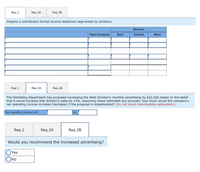

Transcribed Image Text:Req 1

Req 2A

Req 2B

Prepare a contributlon format Income statement segmented by dlvislons.

Division

Total Company

East

Central

West

Req 1

Req 2A

Req 2B

The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief

that it would increase that division's sales by 13%. Assuming these estimates are accurate, how much would the company's

net operating income increase (decrease) if the proposal is implemented? (Do not round intermediate calculations.)

Net operating income will

by

Req 1

Req 2A

Req 2B

Would you recommend the increased advertising?

OYes

No

Transcribed Image Text:Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most

recent monthly contribution format income statement:

$ 1,480,000

582,700

Sales

Variable expenses

Contribution margin

Fixed expenses

897,300

987,000

Net operating income (loss)

$

(89,700)

In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the

Accounting Department has developed the following information:

Division

East

Central

West

$350,000

51%

Sales

$630,000

$500,000

34%

Variable expenses as a percentage of sales

Traceable fixed expenses

38%

$277,000

$340,000

$191,000

Required:

1. Prepare a contribution format income statement segmented by divisions.

2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief that

it would increase that division's sales by 13%. Assuming these estimates are accurate, how much would the company's net operating

income increase (decrease) if the proposal is implemented?

2-b. Would you recommend the increased advertising?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi please help with the screenshots and this follow up question 2) The Marketing Department has proposed increasing the West Division's monthly advertising by $21,000 based on the belief that it would increase that division's sales by 16%. Assuming these estimates are accurate, how much would the company's net operating income increase or decrease if the proposal is implemented?arrow_forwardKyle Corporation provides the following information for the Product Division and Service Division for the year. Product Division Service Division 420,000 $ 650,000 195,000 245,000 640,000 610,000 14.0% 14.0% Net sales Operating income Average total assets Target rate of return $ Requirement 1. Calculate the return on investment for each division. (Enter answers as a percent rounded to the nearest hundredth percent, X.XX%) The return on investment for the Product Division is The return on investment for the Service Division is Requirement 2. Which division has the highest ROI? % % Requirement 3. Calculate the residual income for each division. (Round answers to the nearest whole dollar.) The residual income for the Product Division is The residual income for the Service Division is Requirement 4. Which division has the highest residual income?arrow_forwarddevratarrow_forward

- Case 1: ROI You are comparing the performance of two (2) separate divisions, segments A and B, using ROI Analysis. A B Sales P100,000.00 P500,000.00 Operating Expenses 30,000.00 300,000.00 Net Operating income 70,000.00 200,000.00 Average Operating Assets 10,000.00 40,000.00 Required: Using ROI Analysis, which segment is performing better? To answer this question, you need to: Compute the ROI of each segment and Compute the components of ROI of each segmentarrow_forwardProblem 15-49 (Algo) Segment Reporting (LO 15-5) Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a separate segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (dollars in thousands). BUS Charters $11,700 7,950 Ticket Revenues Costs Lodging Concerts Services $4,520 3,360 $5,400 3,550 $1,600 1,500 Bus Charters Division participates in a frequent guest program with Lodging Division. During the past year, Bus Charters reported that it traded lodging award coupons for travel that had a retail value of $1.3 million, assuming that the travel was redeemed at full fares. Concerts Division offered 20 percent discounts to Midwest's bus passengers and lodging guests. These discounts to bus passengers were estimated to have a retail value of $360,000. Midwest's lodging guests redeemed $130,000 in concert discount coupons. Midwest's hotels also…arrow_forwardThe following are selected data for the division for the consumer products of ABC Corp for 2020: Sales P 10,000,000 Average invested capital 4,000,000 Net Income 400,000 Cost of Capital 8% What is the return on sales for the division? 4% 8% 10% 20% Group of answer choices 1 2 3 4arrow_forward

- Consider the following data from two divisions of a company, P and Q: Divisional P Q Sales $ 1,100,000 $ 1,600,000 Operating Income $ 440,000 $ 960,000 Investment $ 1,870,000 $ 3,040,000 If the minimum rate of return is 12%, what is Division P's residual income (RI)? Multiple Choice $1,817,200. $215,600. $1,047,200. $664,400. $875,600.arrow_forwardThe following are selected data for the division for the consumer products of ABC Corp for 2020: Sales P 10,000,000 Average invested capital 4,000,000 Net Income 400,000 Cost of Capital 8% What is the return on sales for the division? 1. 4% 2. 8% 3. 10% 4. 20% O 1 O 2 O 3 O 4arrow_forwardPlease help mearrow_forward

- The following data are available for two divisions of Solomons Company. North Division $10,535,000 49,000,000 South Division $ 47,460,000 339,000,000 Division operating profit Division investment The cost of capital for the company is 8 percent. Ignore taxes. Required: a-1. Calculate the ROI for both North and South divisions. a-2. If Solomons measures performance using ROI, which division had the better performance? b-1. Calculate the EVA for both North and South divisions. (The divisions have no current liabilities.) b-2. If Solomons measures performance using economic value added, which division had the better p c. Would your evaluation change if the company's cost of capital was 17 percent? 1. When evaluated by ROI? 2. When evaluated by EVA? Complete this question by entering your answers in the tabs below. Req A1 Divisions North South Reg A2 estion 12- Hom... Calculate the ROI for both North and South divisions. (Enter your answers as a percentage rounded to 1 de 32.1).) ROI Req…arrow_forwardThe following are selected data for the division for the consumer products of ABC Corp for 2020: Sales P 10,000,000 Average invested capital 4,000,000 Net Income 400,000 Cost of Capital 8% What is the return on investment for the division? 1. 2% 2. 4% 3. 8% 4. 10% 0 1 O 2 O 3 O 4arrow_forwardbvsgarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College