FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:WileyPLUS

A https://edugen.wileyplus.com/edugen/Iti/main.uni

Return to Blackboard

Jeter, Advanced Accounting, 6e

Help | System Announcements

CALCULATOR

PR

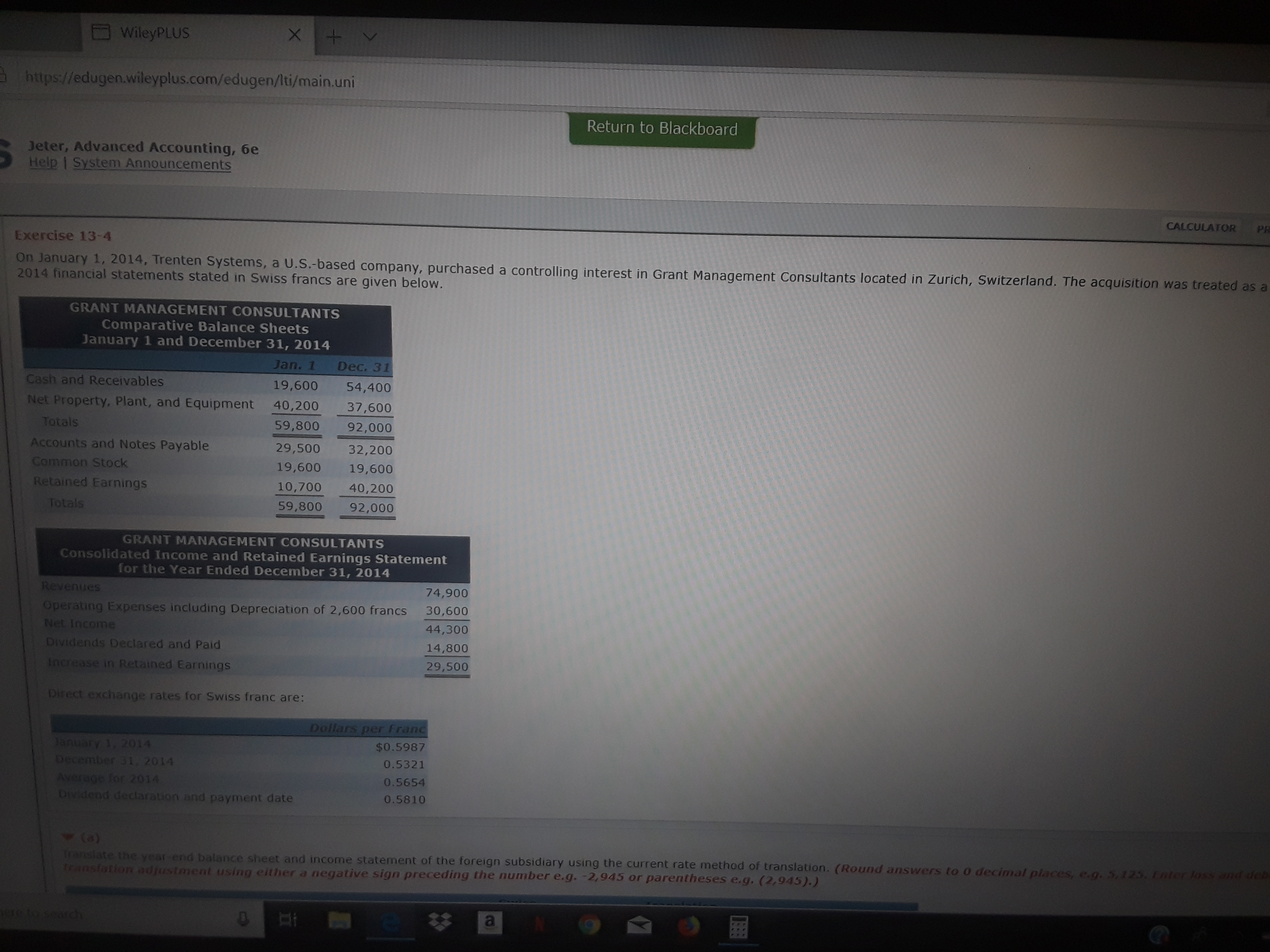

Exercise 13-4

On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a

2014 financial statements stated in Swiss francs are given below.

GRANT MANAGEMENT CONSULTANTS

Comparative Balance Sheets

January 1 and December 31, 2014

Jan. 1

Dec. 31

Cash and Receivables

19,600

54,400

Net Property, Plant, and Equipment

40,200

37,600

Totals

59,800

92,000

Accounts and Notes Payable

29,500

32,200

Common Stock

19,600

19,600

Retained Earnings

10,700

40,200

Totals

59,800

92,000

GRANT MANAGEMENT CONSULTANTS

Consolidated Income and Retained Earnings Statement

for the Year Ended December 31, 2014

Revenues

74,900

Operating Expenses including Depreciation of 2,600 francs

Net Income

Dividends Declared and Paid

30,600

44,300

14,800

Increase in Retained Earnings

29,500

Direct exchange rates for Swiss franc are:

Dollars per Franc

January 1, 2014

December 31, 2014

Average for 2014

Dividend declaration and payment date

$0.5987

0.5321

0.5654

0.5810

(a)

Translate the year-end balance sheet and income statement of the foreign subsidiary using the current rate method of translation. (Round answers to o decimal places, e.g. 5,125. Enter lass and deb

Transfation adjustment using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).)

105arch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Similar questions

- Please do not give solution in image format and give solution in step by step and give calculations also and give solution in table format......arrow_forwardA corporate restructuring arrangement where a group of a company's employees acquire part of the company's business with the intention of running it as a separate, independent business is usually known as? A. a sell-off B. a spin-off C. a buy-out D. a buy-in. Need typed answer only.Please give answer with in 45 minutesarrow_forwardQuestion 1Facebook Inc. bought WhatsApp Inc. for a total of $19 billion in cash and shares in October 2014. The Balance day of Facebook Inc. is 31 December. RequiredIndicate and explain how the acquisition of WhatsApp should be accounted in Facebook’s financial statements on the day of purchase and the following balance day periods. Hint: research about the WhatsApp Inc. acquisition by Facebook Inc.arrow_forward

- Wolverine World Wide, Incorporated, designs, markets, and licenses casual, industrial, performance outdoor, and athletic footw apparel under a variety of brand names, such as Hush Puppies, Wolverine, Merrell, Sperry, and Saucony, to a global market. Th following transactions occurred during a recent year. Dollars are in millions. a. Issued common stock to investors for $14.4 cash (example). b. Purchased $1,685.6 of additional inventory on account. c. Paid $57.1 on long-term debt principal and $4.6 in interest on the debt. d. Sold $2,350 of products to customers on account. e. Cost of the products sold was $1,448.6. f. Paid cash dividends of $23 to shareholders. g. Purchased for cash $34.4 in additional property, plant, and equipment. h. Incurred $706.6 in selling expenses, paying three-fourths in cash and owing the rest on account. i. Earned $1 of interest on investments, receiving 80 percent in cash. j. Incurred $32 in interest expense to be paid at the beginning of next year.…arrow_forwarda1arrow_forwardDon't use chatgpt and do not give solution in image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education