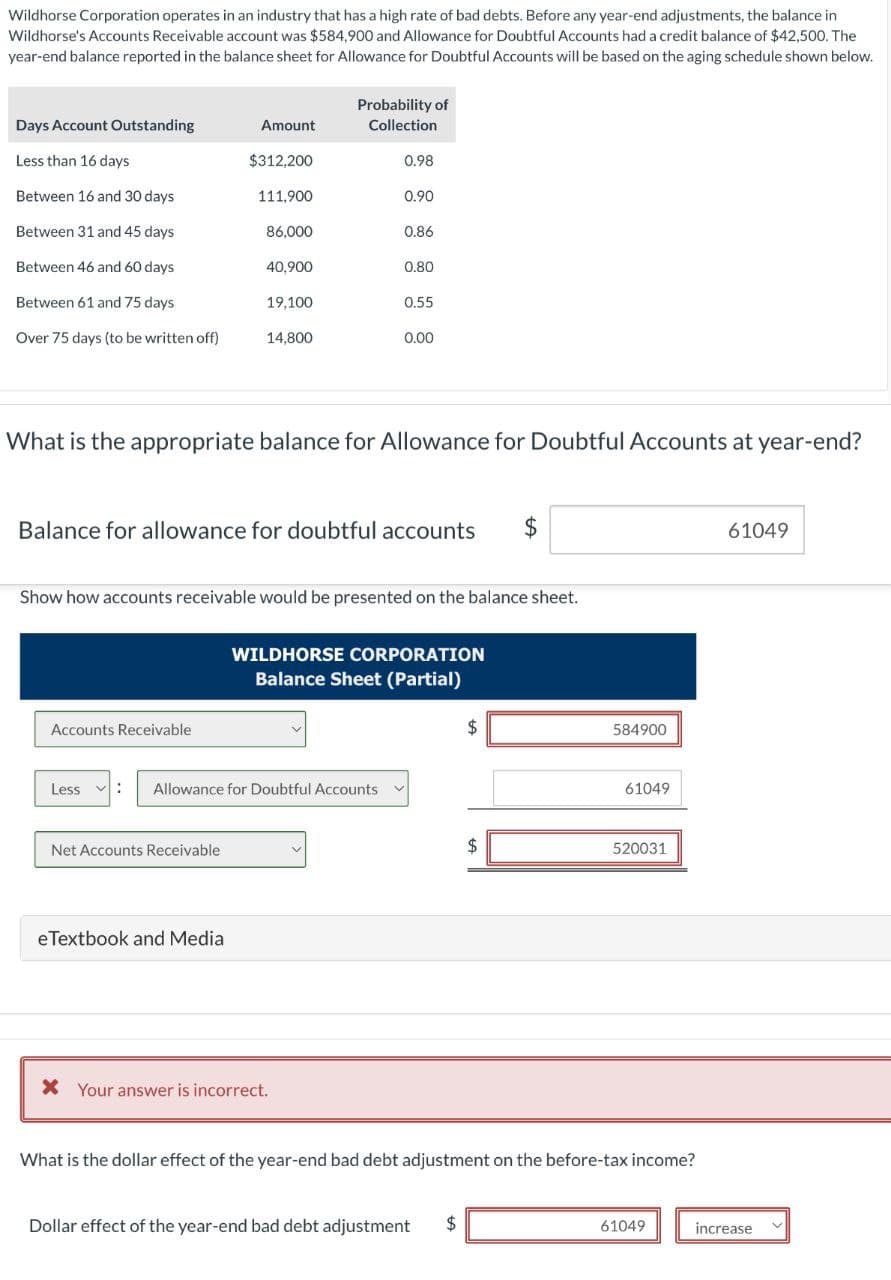

Wildhorse Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Wildhorse's Accounts Receivable account was $584,900 and Allowance for Doubtful Accounts had a credit balance of $42,500. The year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below. Days Account Outstanding Less than 16 days Between 16 and 30 days Between 31 and 45 days Between 46 and 60 days Between 61 and 75 days Over 75 days (to be written off) Amount Accounts Receivable $312,200 111.900 Net Accounts Receivable 86,000 40,900 eTextbook and Media 19,100 14,800 Probability of Collection 0.98 0.90 Less : Allowance for Doubtful Accounts 0.86 What is the appropriate balance for Allowance for Doubtful Accounts at year-end? 0.80 Balance for allowance for doubtful accounts 0.55 Show how accounts receivable would be presented on the balance sheet. 0.00 WILDHORSE CORPORATION Balance Sheet (Partial) $ $ 584900 61049 520031 61049

Wildhorse Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Wildhorse's Accounts Receivable account was $584,900 and Allowance for Doubtful Accounts had a credit balance of $42,500. The year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below. Days Account Outstanding Less than 16 days Between 16 and 30 days Between 31 and 45 days Between 46 and 60 days Between 61 and 75 days Over 75 days (to be written off) Amount Accounts Receivable $312,200 111.900 Net Accounts Receivable 86,000 40,900 eTextbook and Media 19,100 14,800 Probability of Collection 0.98 0.90 Less : Allowance for Doubtful Accounts 0.86 What is the appropriate balance for Allowance for Doubtful Accounts at year-end? 0.80 Balance for allowance for doubtful accounts 0.55 Show how accounts receivable would be presented on the balance sheet. 0.00 WILDHORSE CORPORATION Balance Sheet (Partial) $ $ 584900 61049 520031 61049

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 85APSA: Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto...

Related questions

Question

Please avoid solutions in an image format thanks

Transcribed Image Text:Wildhorse Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in

Wildhorse's Accounts Receivable account was $584,900 and Allowance for Doubtful Accounts had a credit balance of $42,500. The

year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below.

Days Account Outstanding

Less than 16 days

Between 16 and 30 days

Between 31 and 45 days

Between 46 and 60 days

Between 61 and 75 days

Over 75 days (to be written off)

Amount

Accounts Receivable

$312,200

111.900

Net Accounts Receivable

86,000

eTextbook and Media

40,900

19,100

14,800

Probability of

Collection

0.98

Less : Allowance for Doubtful Accounts

0.90

What is the appropriate balance for Allowance for Doubtful Accounts at year-end?

0.86

Balance for allowance for doubtful accounts

X Your answer is incorrect.

0.80

Show how accounts receivable would be presented on the balance sheet.

0.55

0.00

WILDHORSE CORPORATION

Balance Sheet (Partial)

$

Dollar effect of the year-end bad debt adjustment $

$

584900

61049

520031

What is the dollar effect of the year-end bad debt adjustment on the before-tax income?

61049

61049

increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Introduce to ending balance for allowance for doubtful account

VIEWStep 2: Working for balance for allowance for Doubtful Account

VIEWStep 3: Working for ending balance of accounts receivable and ending balance of allowance for Doubtful Accou

VIEWStep 4: Working for bad debt expense

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning