FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Kk.344.

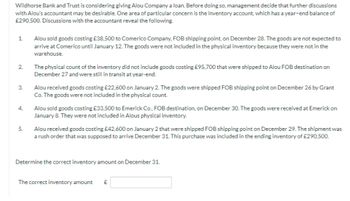

Transcribed Image Text:Wildhorse Bank and Trust is considering giving Alou Company a loan. Before doing so, management decide that further discussions

with Alou's accountant may be desirable. One area of particular concern is the inventory account, which has a year-end balance of

£290,500. Discussions with the accountant reveal the following.

1.

2.

3.

4.

5.

Alou sold goods costing £38,500 to Comerico Company, FOB shipping point, on December 28. The goods are not expected to

arrive at Comerico until January 12. The goods were not included in the physical inventory because they were not in the

warehouse.

The physical count of the inventory did not include goods costing £95,700 that were shipped to Alou FOB destination on

December 27 and were still in transit at year-end.

Alou received goods costing £22,600 on January 2. The goods were shipped FOB shipping point on December 26 by Grant

Co. The goods were not included in the physical count.

Alou sold goods costing £33,500 to Emerick Co., FOB destination, on December 30. The goods were received at Emerick on

January 8. They were not included in Alous physical inventory.

Alou received goods costing £42,600 on January 2 that were shipped FOB shipping point on December 29. The shipment was

a rush order that was supposed to arrive December 31. This purchase was included in the ending inventory of £290,500.

Determine the correct inventory amount on December 31.

The correct inventory amount £

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E14.7arrow_forward0.2KB/s O 68 4G+ 12:18 PM O 00:41:23 Remaining Multiple Choice Which of the following is part of the PAS 38's definition of intangible assets? Future economic benefits Without physical substance Controlled by the entity Identifiable monetary assets 13 of 25arrow_forwardWhat is the value of (F/G, 3.2%, 9)? O a.1.3278 O b. 38.8212 O c.10.2423 O d. 29.2383 O e. 3.7903arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education