FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

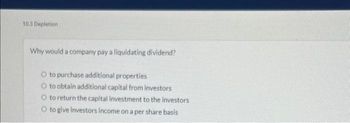

Transcribed Image Text:10.3 Depletion

Why would a company pay a liquidating dividend?

O to purchase additional properties

O to obtain additional capital from investors

O to return the capital investment to the investors

O to give investors income on a per share basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- What is the most appropriate goal for a publicly-traded company? O Maximize stock price O Maximize sales O Maximize market share O Maximize earnings O Maximize cash flowsarrow_forwardESPAÑOL INGLÉS FRANCÉS The distribution of a dividend that represents a partial return of the original investment made by the shareholders is known as a. participatory dividend (participatory dividend). b. dividend in liquidation. С. property dividend (property dividend). Enviar com Parrow_forwardWhich of the following scenarios does a donated capital arise? * Forgiveness of an existing loan from the government An equipment from a manufacturer Shares donated by a shareholder to the corporation Financial aid from the government Which of the following is true about share split? * It increases the total number of outstanding shares It increases the aggregate par value of shares It decreases the retained earnings of the corporation All of the above.arrow_forward

- ESPAÑOL INGLÉS FRANCÉS The distribution of a dividend that represents a partial return of the original investment made by the shareholders is known as to. participating dividend. b. liquidating dividend. C. property dividend. Enviar comenta Guardado Contribuir MacBook Aiarrow_forwardHow and why should the cost of capital change when the Company must rely on new issues of common stock v retained earnings when obtaining capital from equity?arrow_forwardTrue (t) or False (f) _____ A reason some companies purchase investments is because they generate a significant portion of their earnings from investment income.arrow_forward

- At the date of declaration, all are true about a property dividend except: O A property dividend results in a reduction to Additional Paid-In Capital. O A property dividend results in a reduction to Retained Earnings O A property dividend results in a reduction of Total Stockholders' Equity O A property dividend can generate a gain or loss based on the property's relative fair value and book value. Which of the following is true about direct costs companies incur to sell stock? O All of these answers are correct. O These costs include underwriting costs. O They are accounted for as a reduction to additional paid-in capital. O They do not meet the definition of an expense.arrow_forwardM-M theroy with perfect market suggests that divident payment: A.It dependes on the company's capital structure and retained earnings B.Has a positive impact on the value of a firm C.Has a negative impact on the value of a firm D.Has no impact on the value of a firmarrow_forwardAn increase in the corporate tax rate for company X will generally Increase X's cost of equity capital Increase X's cost of debt capital Increase X's weighted average cost of capital Reduce X's cost of debt capitalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education