College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Hello There,

I really appreciate clarification on how to answer the 2 questions.

Thanks,

Chris

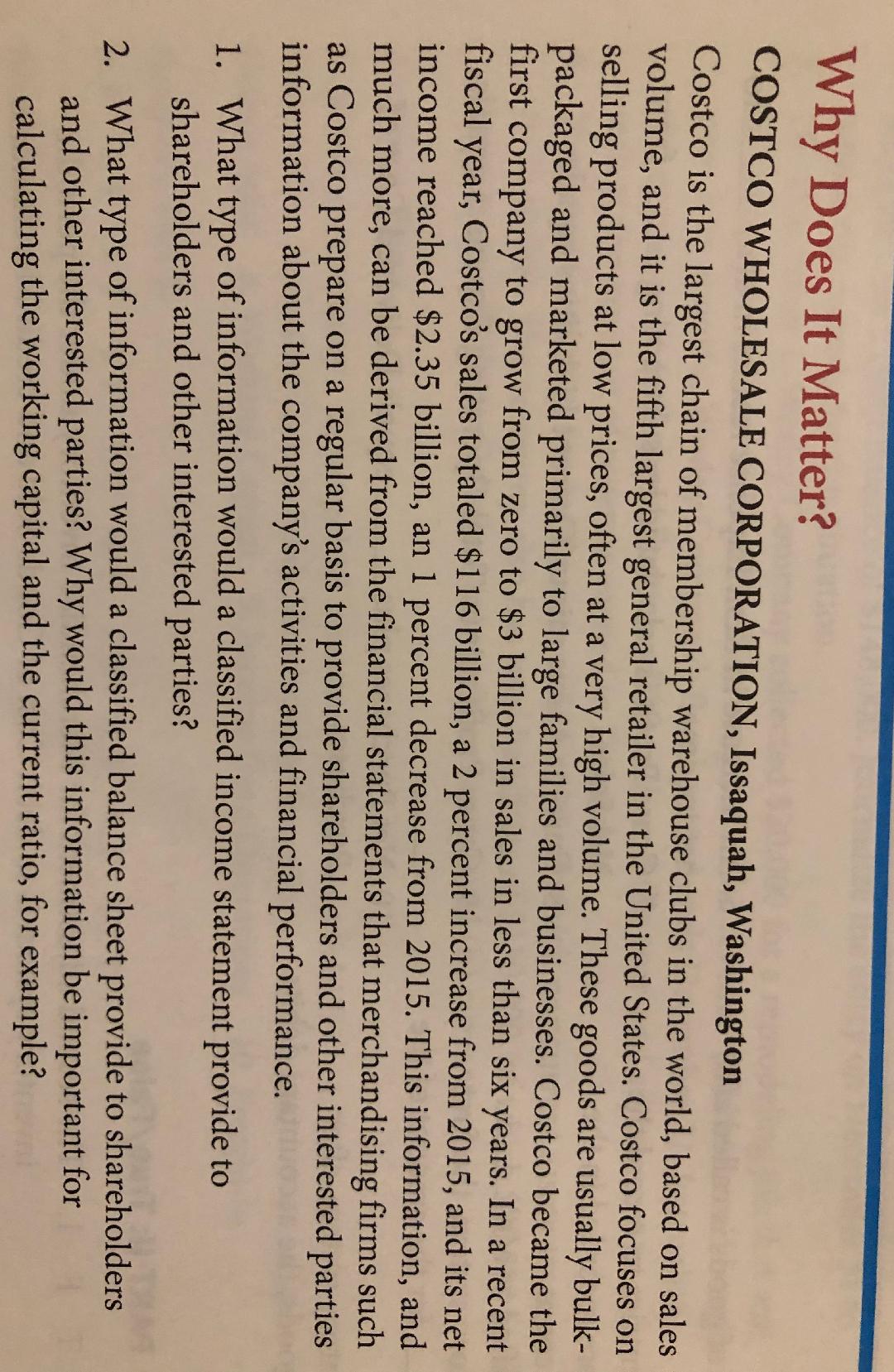

Transcribed Image Text:Why Does It Matter?

COSTCO WHOLESALE CORPORATION, Issaquah, Washington

Costco is the largest chain of membership warehouse clubs in the world, based on sales

volume, and it is the fifth largest general retailer in the United States. Costco focuses on

selling products at low prices, often at a very high volume. These goods are usually bulk-

packaged and marketed primarily to large families and businesses. Costco became the

first company to grow from zero to $3 billion in sales in less than six years. In a recent

fiscal

Costco's sales totaled $116 billion, a 2 percent increase from 2015, and its net

year,

income reached $2.35 billion, an 1 percent decrease from 2015. This information, and

much more, can be derived from the financial statements that merchandising firms such

as Costco prepare on a regular basis to provide shareholders and other interested parties

information about the company's activities and financial performance.

1. What type of information would a classified income statement provide to

shareholders and other interested parties?

2. What type of information would a classified balance sheet provide to shareholders

and other interested parties? Why would this information be important for

calculating the working capital and the current ratio, for example?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Costco is the largest chain of membership warehouse clubs in the world based on sales volume, and it is the fifth largest general retailer in the United States. Costco focuses on selling products at low prices, often at a very high volume. These goods are usually bulk-packaged and marketed primarily to large families and businesses. Costco became the first company to grow from zero to 3 billion in sales in less than six years. In a recent fiscal year, Costcos sales totaled 76.3 billion, a 29.3 percent increase from 2006, and its net income reached 1.30 billion, an 18.1 percent increase from 2006. This information, and much more, can be derived from the financial statements that merchandising firms such as Costco prepare on a regular basis to provide shareholders and other interested parties information about the companys activities and financial performance. 1. What type of information would a classified income statement provide to shareholders and other interested parties? 2. What type of information would a classified balance sheet provide to shareholders and other interested parties? Why would this information be important for calculating the working capital and the current ratio, for example?arrow_forwardFruity Co is a distributors of fresh good and vegetables. It currently has 15 warehouses in the US from which it supplies produce to grocery stores. Each warehouse has an average inventory level of 3.88 million $. Due to advances in transportation services and infrastructure, management believes that if they reduce the number of warehouses to 10, they would still be able to provide timely replenishment to the grocery stores. What would be the total inventory in the system in millions of dollars, if inventory was consolidated from the 15 warehouses to only 10 warehouses? (Enter your answer in millions of dollars. E.g. if you get 30.24 million $ simply enter 30.24 without the million$ sign. Round your answer to 2 decimal places.)arrow_forwardTom's Sports Wear is a retailer of sports hats located in Atlanta, Georgia. Although Tom's carries numerous styles of sports hats, each hat has approximately the same price and invoice purchase cost, as shown below. Sales personnel receive large commissions to encourage them to be more aggressive in their sales efforts. Currently the economy of Atlanta is really humming, and sales growth at Tom's has been great. However, the business is very competitive, and Tom has relled on its knowledgeable and courteous staff to attract and retain customers, who otherwise might go to other sports wear stores. Also, because of the rapid growth in sales, Tom is finding it more difficult to manage certain aspects of the business, such as restocking of inventory and hiring and training new salespeople. $ 32.00 Sales price Per-unit variable costs: Invoice cost Sales commissions Total per-unit variable costs Total annual fixed costs: Advertising Rent Salaries Total fixed costs The annual breakeven point…arrow_forward

- How is the behavior of the salespeople affecting the profit of KC Corporation? Is their behavior ethical? What could KC Corporation do to change the behavior of the salespeople?arrow_forwardWheelco, Inc., manufactures automobile and truck wheels. The company produces four basic, high-volume wheels used by each of the large automobile and pickup truck manufacturers. Wheelco also has two specialty wheel lines. These are fancy, complicated wheels used inexpensive sports cars. Lately, Wheelco's profits have been declining. Foreign competitors have been undercutting Wheelco's prices in three of its bread-and-butter product lines, and Wheelco's sales volume and market share have declined. In contrast, Wheelco's specialty wheels have been selling steadily, although in relatively small numbers, in spite of three recent price increases. At a recent staff meeting, Wheelco's president made the following remarks: "Our profits are going down the tubes, folks. It costs us 29 dollars to manufacture our A22 wheel. That's our best-seller, with a volume last year of 17,000 units. But our chief competitor is selling basically the same wheel for 27 bucks. I don't see how they can…arrow_forwardBubba's Western Cover is a western hat retailer in El Paso, Texas. Although Bubba's carries numerous styles of western hats, each hat has approximately the same price and invoice (purchase) cost, as shown in the following table. Sales personnel receive a commission to encourage them to be more aggressive in their sales efforts. Currently, the El Paso economy is really humming, and sales growth at Bubba's has been great. The business is very competitive, however, and Bubba, the owner, has relied on his knowledgeable and courteous staff to attract and retain customers who otherwise might go to other western hat stores. Because of the rapid growth in sales, Bubba is also finding the management of certain aspects of the business more difficult, such as restocking inventory and hiring and training new salespeople. Sales price Per unit variable expenses 24 80.00 Purchase cost 34.50 Sales commissions 20.50 Total per unit variable costs $ 55.00 Total annual fixed expenses Advertising $187, 500…arrow_forward

- The shirt factory sells dress shirts please solve this question ❓arrow_forwardCustomer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands): Wholesale Customers Retail Customers North America South America Wholesaler Wholesaler Green Energy Global Power Revenues at list prices Discounts from list prices Cost of goods sold Delivery costs Order processing costs $375,000 25,800 $590,000 $175,000 $130,000 47,200 8,400 590 285,000 510,000 144,000 95,000 2,230 2,180 4,550 6,710 2,145 3,820 5,980 1,130 Cost of sales visit 6,300 2,620 2,620 1,575 Enviro-Tech's annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company's annual corporate-sustaining costs, such as salary for top management and general- administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost- allocation base and corporate-sustaining costs. That is, Enviro-Tech could…arrow_forwardNik is a company that manufactures running shoes. It has a fixed cost of $300,000.00. Additionally, it costs $30 to produce each pair. They are sold at $80 a pair. A.Write the cost function, C, of producing x running shoes. B.Write the revenue function, R, from the sale of x running shoes. C.Suppose Nik produces too many running shoes- more than they can sell in the stores. How would this impact profits? Is there anything the managers can do to cut their losses? D.Suppose that we can sell all of the units that we produce. How many running shoes would Nik have to produce/sell in order for the company to make a profit? E.Determine the break-even point. Describe what this means. Graph the lines with at least three points each.arrow_forward

- Ronald Medical Supply is a retailer of home medical equipment. Last year, Ronald's sales revenues totaled $6,100,000. Total expenses were $2,590,000. Of this amount, approximately $1,342,000 were variable, while the remainder were fixed. Since Ronald's offers thousands of different products, its managers prefer to calculate the breakeven point in terms of sales dollars rather than units. Read the requirements. Requirement 1. What is Ronald's current operating income? Begin by identifying the formula to compute the operating income. Requirements G Operating income Print 1. What is Ronald's current operating income? 2. What is Ronald's contribution margin ratio? 3. What is the company's breakeven point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by the company's actual sales mix.) - X 4. Ronald's top management is deciding whether to embark on a $230,000 advertising campaign. The marketing firm has projected annual sales volume…arrow_forwardKindmart is an international retail store. Kindmart’s managers are considering implementing a new business-to-business (B2B) information system for processing merchandise orders. The current system costs Kindmart $2,000,000 per month and $55 per order. Kindmart has two options, a partially automated B2B and a fully automated B2B system. The partially automated B2B system will have a fixed cost of $6,000,000 per month and a variable cost of $45 per order. The fully automated B2B system has a fixed cost of $14,000,000 per month and a variable cost of $25 per order. Based on data from the past two years, Kindmart has determined the following distribution on monthly orders: Required: Prepare a table showing the cost of each plan for each quantity of monthly orders. What is the expected cost of each plan? In addition to the information system’s costs, what other factors should Kindmart consider before deciding to implement a new B2B system?arrow_forwardKindmart is an international retail store. Kindmart’s managers are considering implementing a new business-to-business (B2B) information system for processing merchandise orders. The current system costs Kindmart $2,000,000 per month and $55 per order. Kindmart has two options, a partially automated B2B and a fully automated B2B system. The partially automated B2B system will have a fixed cost of $6,000,000 per month and a variable cost of $45 per order. The fully automated B2B system has a fixed cost of $14,000,000 per month and a variable cost of $25 per order. Based on data from the past two years, Kindmart has determined the following distribution on monthly orders: Monthly Number of Orders Probability 300,000 0.25 500,000 0.45 700,000 0.30 Q2. What is the expected cost of each plan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning