Related questions

Question

thumb_up100%

https://assets.gpb.org/sites/www.gpb.org/files/education/gpb_textbook_unit_6_final.pdf

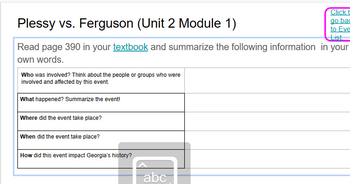

Transcribed Image Text:Plessy vs. Ferguson (Unit 2 Module 1)

List

Read page 390 in your textbook and summarize the following information in your

own words.

Who was involved? Think about the people or groups who were

involved and affected by this event.

What happened? Summarize the event!

Where did the event take place?

When did the event take place?

How did this event impact Georgia's history?

Click t

go bac

to Eve

abc

Expert Solution

arrow_forward

Step 1

Plessy V. Ferguson was a landmark US Supreme court case where the Supreme court upheld the separate but equal principles and the constitutionality of racial segregation laws in the US. It was one of the controversial decisions of the Supreme court to judge in favor of the segregation laws. However, the decision was overturned in the Brown v. Board of education case of 1954.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps