FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Whitman Corporation, a merchandising company, reported sales of 7,400 units for May at a selling price of P 677 per unit. The cost of goods sold (all variable) was P 441 per unit and the variable selling expense was P 54 per unit. The total fixed selling expense was P 155,600. The variable administrative expense was P 24 per unit and the total fixed administrative expense was P 370,400. Prepare a traditional format and contribution format income statement for May. You may use the excel file in the practice sheet.

Please see the attatched photo for reference.

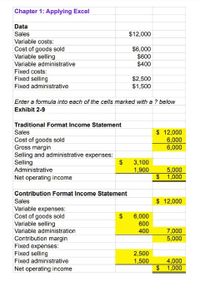

Transcribed Image Text:Chapter 1: Applying Excel

Data

Sales

$12,000

Variable costs:

Cost of goods sold

Variable selling

Variable administrative

$6,000

$600

$400

Fixed costs:

Fixed selling

$2,500

Fixed administrative

$1,500

Enter a formula into each of the cells marked with a ? below

Exhibit 2-9

Traditional Format Income Statement

$ 12,000

6,000

6,000

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling

Administrative

2$

3,100

1,900

5,000

$ 1,000

Net operating income

Contribution Format Income Statement

Sales

$ 12,000

Variable expenses:

Cost of goods sold

Variable selling

2$

6,000

600

Variable administration

400

7,000

5,000

Contribution margin

Fixed expenses:

Fixed selling

2,500

Fixed administrative

1,500

4,000

$ 1,000

Net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- am. 256.arrow_forwardCherokee Inc. is a merchandiser that provided the following information: Number of units sold 11,000 Selling price per unit $ 17.00 Variable selling expense per unit $ 1.00 Variable administrative expense per unit $ 1.00 Total fixed selling expense $ 21,000 Total fixed administrative expense $ 16,000 Beginning merchandise inventory $ 10,000 Ending merchandise inventory $ 26,000 Merchandise purchases $ 90,000 Required: 1. Prepare a traditional income statement. 2. Prepare a contribution format income statement.arrow_forwardThe following information is available about the operations of the Delaware Publishing Company for the month of January. Find the missing values. Revenue (total sales) Fixed costs Variable costs Total costs Net Income $28,400 $85,700 $29,200arrow_forward

- The Alpine House, Incorporated, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 2 Required 3 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement Required 1 Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Amount $ 1,428,000…arrow_forwardPlease give me correct answerarrow_forwardAmazin' 69 Corp. Income Statement For Month Ending May 31, 20XX Fixed Cost of Goods Sold Fixed Selling and Administrative Costs Sales Revenue Variable Cost of Goods Sold Variable Selling and Administrative Costs Operating Income Calculate the contribution margin and operating income for May Amazin' 69 Corp. Contribution Margin Income Statement For Month Ending May 31 20XXarrow_forward

- 1. Shown below is an income statement in the traditional format for Ellie Inc, which has a contribution margin ratio of 25%. Sales ...... Cost of goods sold... Gross profit...... Operating expenses: Selling... Administrative.... Operating income $100,000 (70,000) $ 30,000 (5,000) (10,000) $ 15,000 Prepare an income statement in the contribution margin format. b. Calculate the sales per unit, variable expense per unit, and contribution margin per unit if 10,000 units were produced and sold. c. Calculate the cost formula (Y=a+bX). d. Calculate the firm's break even point in units.arrow_forwardTodrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales $ 300,000 Beginning merchandise inventory $ 20,000 Purchases $ 200,000 Ending merchandise inventory $ 7,000 Fixed selling expense ?question mark Fixed administrative expense $ 12,000 Variable selling expense $ 15,000 Variable administrative expense ?question mark Contribution margin $ 60,000 Net operating income $ 18,000 3. Calculate the selling price per unit. 4. Calculate the variable cost per unit. 5. Calculate the contribution margin per unit.arrow_forwardProvide correct solutionarrow_forward

- Aidel Inc., a merchandising company, reported the following results for September. Cost of goods sold 205,837 Fixed selling and administrative expense 41,331 Variable selling and administrative expense, 86,269 Sales revenue 563,800 This question is independent of all other questions. Please use only the information in this question to calculate the answer. Based on the information provided above, calculate break – even in dollars. Cost of goods sold is a variable cost in this company. Enter only the amount for the break – even in dollars in the box provided below ( rounded to a whole number, based on general rounding rules). Enter the amount only. Do not enter letters, words, dollar signs or the calculation.arrow_forwardMorning Company reports the following information for March: E (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate the gross profit and operating income for March using absorption costing. Morning Company Income Statement (Absorption Costing) For the Month Ended March 31 Data Table Net Sales Revenue 67,850 Variable Cost of Goods Solłd 19,300 Operating income Fixed Cost of Goods Sold 8,400 Variable Selfing and Administrative Costs 16,500 Requirements Fixed Selling and Administrative Costs 3,800 1. Calculate the gross profit and operating income for March using absorption costing. 2. Calculate the contribution margin and operating income for March using variable costing. Print Donearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education