FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

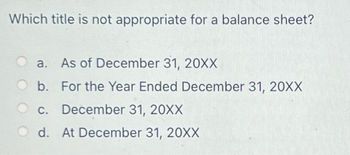

Which title is not appropriate for a balance sheet ? a. As of December 31, 20XX b. For the Year Ended December 31, 20XX December 31, 20XX C. d. At December 31, 20XX

Transcribed Image Text:Which title is not appropriate for a balance sheet?

a. As of December 31, 20XX

b.

For the Year Ended December 31, 20XX

C. December 31, 20XX

Od. At December 31, 20XX

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ok D Int = Print Compute the annual dollar changes and percent changes for each of the following accounts. (Decreases should be indicated with a minus sign. Round percent change to one decimal place.) 0 ferences # Short-term investments Accounts receivable Notes payable Percent Change = Short-term investments Accounts receivable Notes payable Type here to search Esc fo F1 1 X F2 $ Current Year $ 378,252 100,583 @ 2 0 Horizontal Analysis - Calculation of Percent Change Numerator: 1 Current Year F3 20 #m Prior Year $ 236,897 104,503 91,702 3 378,252 $ 100,583 F4 0 S4 Prior Year $ 236,897 104,503 91,702 F5 $ % 5 Denominator: Dollar Change F6 111,355 (3,920) (91,702) DELL F7 A Percent Change 29.4 % (26.7) % (100.0) % 6 F8 & 7 0 F9 * a 8 F10 9arrow_forwardNeed help please. Thank youarrow_forwardIf current assets are $20,000 and total assets are $187,000, what percentage of total assets are current assets? (Answer as a percentage to 1 decimal point with no % sign needed, e.g. xx.x or 12.3)arrow_forward

- Perform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth).arrow_forwardWhat is the adjusting journal entry on December 31, 2019? Debit Unrealized Holding Gain/Loss (P&L), P200,000; Credit Retained Earnings, P200,000 Debit Financial Asset FVPL, P500,000; Credit Retained Earnings, P500,000 Debit Retained Earnings, P100,000; Credit Financial Asset FVPL, P100,000 Debit Retained Earnings, P300,000; Credit Unrealized Gain (P&L), P300,000 Debit Retained Earnings, P200,000; Credit Unrealized Holding Gain/Loss (P&L), P200,000 None of the choicesarrow_forwardSubject;arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education