ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

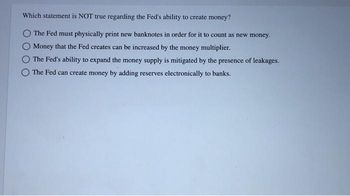

Transcribed Image Text:Which statement is NOT true regarding the Fed's ability to create money?

The Fed must physically print new banknotes in order for it to count as new money.

O Money that the Fed creates can be increased by the money multiplier.

The Fed's ability to expand the money supply is mitigated by the presence of leakages.

The Fed can create money by adding reserves electronically to banks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- . If the required reserve ratio decreases, the money multiplier increases. money multiplier decreases. the economy will experience immediate stagflation. money multiplier stays the same.arrow_forwardPlease answer fast please arjent help please answer following the a and b are required please answer fastarrow_forwardSuppose the Federal Reserve set the reserve requirement at 20%. Assume that banks lend all reserves that are not required to be held. Instructions: Round your answers to two decimal places. a. Complete the table below based on this information. Fractional Reserve Banking Transaction Sean receives $1,000 in cash and deposits the funds into his checking account. Sean's bank loans Maria all reserves that are not required to be held. Maria's bank loans Jackson all reserves that are not required to be held. Transaction Sean receives $1,000 in cash and deposits the funds into his checking account. Sean's bank loans Maria all reserves that are not required to be held. Deposit Maria's bank loans Jackson all reserves that are not required to be held. $1,000.00 Jackson's bank loans Paul all reserves that are not required to be held. Total Money Created by Transactions b. Suppose Instead that the reserve requirement is 15%. Complete the table using the new reserve requirement. Fractional Reserve…arrow_forward

- No written by hand solution and no imagearrow_forwardIf you have the following data The monetary Items Value in M. Currency in circulation, 675 Demand deposits, 1500 Excess reserves, 100 required reserve, 0.1 Find the following: Money supply M1 The currency ratio, c The excess reserve ratio, er The money multiplier marrow_forwardSuppose the Federal Reserve increases the amount of reserves by $150 million and the total money supply increases by $600 million. Instructions: Enter your answers as a whole number. a. What is the money multiplier? b. Using the money multiplier from part a, how much will the money supply change if the Federal Reserve increases reserves by $40 million? $ millionarrow_forward

- Suppose the Federal Reserve increases the amount of reserves by $150 million and the total money supply increases by $750 million. Instructions: Enter your answers as a whole number. a. What is the money multiplier? b. Using the money multiplier from part a, how much will the money supply change if the Federal Reserve increases reserves by $50 million? 2$ millionarrow_forwardThe reserve requirement, open market operations, and the money supply Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is checkable deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the simple money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 5 10 A lower reserve requirement is associated with a ______(SMALLER/LARGER) money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to _____(BUY/SELL)$ ________ worth of U.S. government bonds. Now, suppose that, rather than…arrow_forwardAnswer it correctly please. Iarrow_forward

- Assume that the banking system has total reserves of Rs.200 billion. Assume also that required reserves are 12.5 percent of checking deposits and that banks hold no excess reserves and households hold no currency.If the State Bank of Pakistan now raises required reserves to 20 percent of deposits, Calculate the money multiplier? What will be the effect on Reserves? (write only one word “Increase”, “Decrease”, or “No Change” ) The amount of money supply will decline toarrow_forwardPls help with below homework.arrow_forwardexplain this statement in details " money is a difficult concept to define, partly because it fufill several function and partly because of other liquid asset that can serve as substitute for money" explainarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education