FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

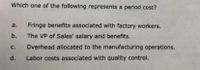

Transcribed Image Text:Which one of the following represents a period cost?

a.

Fringe benefits associated with factory workers.

b.

The VP of Sales' salary and benefits.

C.

Overhead allocated to the manufacturing operations.

d.

Labor costs associated with quality control.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is a method used to allocate overhead costs based on the activities that drive those costs? A) Job costing B) Process costing C) Activity - based costing (ABC) D) Variable costingarrow_forwardWhich of the following statements are true? I. In a job-order costing system, indirect labor is assigned to a job using information from the employee time ticket. II. If the allocation base in the predetermined overhead rate does not drive overhead costs, it will nevertheless provide reasonably accurate unit product costs because of the averaging process. III. In a job-order costing system, costs are traced to individual units of product. The sum total of such traced costs is called the unit product cost. Multiple Choice Only statement I is true. Statements I and II are true. Statements II and III are true. None of the statements are true.arrow_forwardWhich of the following is an “indirect labor” cost? Wages paid to factory janitors and factory security guards. Salaries paid to human resources (HR) personnel. All of the listed choices are correct. Wages paid to factory employees who convert raw materials into work-in-process and finished goods. Sales salaries and commissions paid to salespeople.arrow_forward

- Explain how the analysis of fixed manufacturing overhead costs differs for (a) planning and control and (b) inventory costing for financial reporting.arrow_forwardHharrow_forwardThink about a service you have been involved with and describe how job-costing might be implemented by that service provider, including overhead and stating where costs would fall.arrow_forward

- Please explain it properlyarrow_forwardHow would sales salaries be classified for a manufacturing company? Group of answer choices product cost - administrative overhead product cost - factory overhead period cost - administrative expense period cost - selling expensearrow_forwardFactors affecting the classification of a cost as direct or indirect include: A. cost behaviour patterns, cost drivers, and relevant ranges. B. materiality of the cost, available information-gathering technology, and design of operations. C. materials, labour, and factory overhead D. unit costs, inventory production stage, and contractual agreements.arrow_forward

- Dogarrow_forwardUnder a job order costing system, individual jobs are charged with actual overhead costs when they are transferred to finished goods. TRUE FALSEarrow_forwardIn Traditional product costing systems, the measure of product activity is usually some volume based cost driver, like direct labor hours. True or False?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education