Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

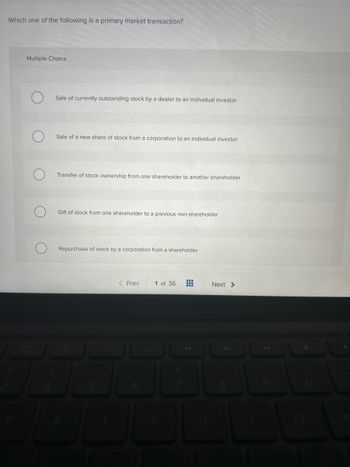

Transcribed Image Text:Which one of the following is a primary market transaction?

Multiple Choice

Sale of currently outstanding stock by a dealer to an individual investor

Sale of a new share of stock from a corporation to an individual investor

Transfer of stock ownership from one shareholder to another shareholder

Gift of stock from one shareholder to a previous non-shareholder

Repurchase of stock by a corporation from a shareholder

< Prev

1 of 36 #

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Under U.S. GAAP, ________ preferred shares are classified as a liability. Group of answer choices mandatorily redeemable convertible callable non-mandatorily redeemablearrow_forwardWhen a subsidiary liquidates into the parent corporation, the subsidiary recognizes both gains and losses on distributions to a minority shareholder. Question 11 options: TrueFalsearrow_forwardWhich among the following form of business organization can issue shares to the general public? a. Partnership firm b. Limited Liability Company c. Public limited company d. Private companyarrow_forward

- Can a Joint venture use equity method of accounting? how bout the share of net income of each individual corporation, how would you account for that?arrow_forwardStatement 1: Upon issue of share rights, the issuing corporation records the transaction by preparing a journal entry to recognize the additional number of shares that may be acquired through the exercise.Statement 2: When preference shares are issued with detachable warrants, the proceeds should be allocated between the preference shares and the warrants based on the fair values of the two securities at the time of issuance. a) Both statements are true. b) Both statements are false. c) Statement I is true; Statement II is false. d) Statement I is false; Statement II is true.arrow_forwardplease answer this question by choosing the right options.arrow_forward

- i. Compare and contrast forfeiture of shares and surrender ofshares. Explain in each case five circumstances under whichshares may be forfeited or surrendered. ii. Differentiate between the following kinds of companies: Statutory and Registered companiesarrow_forwardThe right of a shareholder to share proportionally in any new stock issue is called a/an ____________ right. Select one: a. coattail b. preemptive c. indenture d. secured e. charterarrow_forwardMatching Type. Choose the correct answer in the box provided. It entitles an employee to receive cash which is equal to the excess of market value of the entity's share over a pre-determined price for a stated number of shares. * These are actually deferred cash dividends. * It is a kind of appropriation for retained earnings supported by the trust fund doctrine. *arrow_forward

- State two effects of Forfeiture of shares.arrow_forwardA controlling financial interest traditionally has been defined as the investor corporation's ownership of more than 50% of the investee corporation's outstanding common stock Select one: True Falsearrow_forwardWill an acquiring corporation recognize gain or loss when it issues its stock to acquire the assets or stock of target corporation in a reorganization? Explain how it will work. How do exchanging shareholders and security holders determine their basis for the stock and securities received in a corporate reorganization? Give an examplearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education