Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

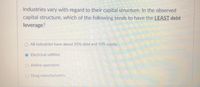

Transcribed Image Text:Industries vary with regard to their capital structure. In the observed

capital structure, which of the following tends to have the LEAST debt

leverage?

All industries have about 50% debt and 50% equity.

Electrical utilities

O Airline operators

O Drug manufacturers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The activity ratios measure which of the following? Select one: O a the efficiency of the company's supply chain O b. the efficiency with which a company generates sales from its assets Oc the profitability of the company's activities Od the production efficiency of a company's fixed assets If the assumption of financial distress costs is added, then Modigliani and Miller (with taxes) predicts that the optimal capital structure is 100% debt Select one: O True O Falsearrow_forwardAbcarrow_forwardIlumina Corp is trying to determine its optimal capital structure. The company’s capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: Percent financed with debt (wd) Percent financed with equity (wc) Debt-to-equity ratio (D/S) After-tax cost of debt (%) 0.25 0.75 0.25/0.75 = 0.33 6.9% 0.35 0.65 0.35/0.65 = 0.5385 7.1% 0.50 0.50 0.50/0.50 = 1.00 8.0% The company uses the CAPM to estimate its cost of common equity, rs. The risk-free rate is 5% and the market risk premium is 6%. Ilumina estimates that its beta with 10% debt is 1. The company’s tax rate, T, is 40%. On the basis of this information, what is the company’s optimal capital structure, and what is the firm’s cost of capital at this optimal capital structure? (Please show work)arrow_forward

- As an Analyst you were tasked to compute for the Weighted Average Cost of Capital of variouscompanies given the following information. Income tax rate is 25% a. What is the cost of equity of each companies?b. What is the after tax cost of debt of each companies?c. What is the WACC of each companies? W Corp A Corp Co. Corp Ca Corp Risk Free rate 4.00% 3.00% 2.00% 3.50% Beta 1.25 % 1.50% 1.30% 1.40% Market Return 12.00% 11.00 % 10:00% 8:00% Debt to Equity Ratio 2.5 3 4 3.5 Credit Spread om BPS 200 300 250 150arrow_forward21 Which of the following best describes the efficiency ratios? OOOO Review Later These ratios measure how efficiently a company is utilizing its assets and resources. These ratios measure the company's ability to pay both short-term and long-term debt. These ratios evaluate the ability of a company to generate income relative to revenue, assets, operating costs, and equity. These ratios measure the amount of capital that comes from debt. They show how solvent the company is.arrow_forwardThe cost of equity is _______. A. the interest associated with debt B. the rate of return required by investors to incentivize them to invest in a company C. the weighted average cost of capital D. equal to the amount of asset turnoverarrow_forward

- Sainsbury is financed by both debt and equity. calculate the weighted average cost of capital (WACC) of Sainsbury.arrow_forwardAaron Athletics is trying to determine its optimal capital structure. The company’s capital structure consists of debt and common equity. In order to estimate the cost of capital at various debt levels the company has constructed the following table: Percent financed with debt (wD) Percent financed with equity (ws) Before tax cost of debt 0.10 0.90 7.0% 0.20 0.80 7.2% 0.30 0.70 8.0% 0.40 0.60 8.8% 0.50 0.50 9.6% The company uses the CAPM to estimate its cost of equity, rS . The risk-free rate is 4% and the market risk premium is 5%. Aaron estimates that if it had no debt its beta would be 1.0. (It’s unlevered beta equals 1.0). The company’s tax rate is 40%. On the basis of this information, what is the company’s optimal capital structure, and what is the WACC at that capital structure? (Show your calculations at each debt level).arrow_forwardFinancial Accountingarrow_forward

- The financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 7 % 10 4 7 20 4 7 30 4 9 40 5 10 50 5 12 60 8 13 70 8 15 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of debt…arrow_forwardEach of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm’s control? Check all that apply. Interest rates in the economy The performance of index funds, such as the S&P 500 The firm’s dividend payout ratio The impact of cost of capital on managerial decisions Consider the following case: National Petroleum Refiners Corporation (NPR) has two divisions, L and H. Division L is the company’s low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company’s high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division H is considering a project with an expected return of 12%. Should National Petroleum…arrow_forwardAssume that your company is trying to determine its optimal capital structure, which consists only of debt and common stock. To estimate the cost of debt, the company has produced the following table: 09.86% 9.56% Percent Financed With Debt 10.16% 8.96% 9.26% 0.10 0.20 0.30 0.40 0.50 Percent Financed With Equity 0.90 0.80 0.70 0.60 0.50 Debt/Equity Ratio Now assume that the company's tax rate is 40 percent, that the company uses the CAPM to estimate its cost of common equity, Ks, that the risk-free rate is 5 percent and the market risk premium is 6 percent. Finally assume that if it has no debt its WACC would be equal to its cost of equity which would be equal to 11 percent (you should now be able to determine its "unlevered beta," bu). 0.10/0.90 0.11 0.20/0.80 0.25 Given this information, determine the firm's cost of capital if it finances with 40 percent debt and 60 percent equity. 0.30/0.70=0.43 0.40/0.600.67 0.50/0.50 = 1.00 Bond Rating AA A A BB B Before-Tax Cost of Debt 7.0% 7.2%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning