FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

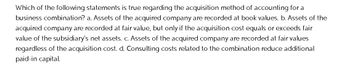

Transcribed Image Text:Which of the following statements is true regarding the acquisition method of accounting for a

business combination? a. Assets of the acquired company are recorded at book values. b. Assets of the

acquired company are recorded at fair value, but only if the acquisition cost equals or exceeds fair

value of the subsidiary's net assets. c. Assets of the acquired company are recorded at fair values

regardless of the acquisition cost. d. Consulting costs related to the combination reduce additional

paid-in capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- From a consolidated point of view, the intercompany gain or loss on a parent’s sale of a non-depreciable asset to subsidiary is realized when: a. The parent company sells the asset to the subsidiary b. The subsidiary start to use the asset c. The subsidiary resells the asset to the parent d. The subsidiary resells the asset to the outsiderarrow_forwardWhich of the following costs generally would be capitalized to a property, plant and equipment account? O installation costs related to the machine O import duties incurred on purchase O freight-out O Interest on debt incurred to purchase the itemarrow_forwardWhat is one of the primary objectives of accounting for business amalgamations? A) To recognize the fair value of the acquired assets and liabilities. B) To minimize tax liabilities for the acquiring company. C) To maintain separate accounting records for the acquiring and acquired entities. D) To increase shareholder dividends in the acquiring company.arrow_forward

- Which of the following statements is true? Multiple Choice The pooling of interests for business combinations is an alternative to the acquisition method. The purchase method for business combinations is an alternative to the acquisition method. Neither the purchase method nor the pooling of interests method is allowed for new business combinations. Any previous business combination originally accounted for under purchase or pooling of interests accounting method will now be accounted for under the acquisition method of accounting for business combinations. Companies previously using the purchase or pooling of interests accounting method must report a change in accounting principle when consolidating those subsidiaries with new acquisition combinations.arrow_forwardWhat is a good response to? The unrealized intercompany profits can assuredly have an impact on the consolidated financial statements, as true profits and losses will not be recognized until inventory is sold to an unrelated entity. Prior to this third-party sale the intercompany profit or loss in unrealized and must be removed from the reports consolidation to avoid overstating the consolidated net income (Hoyle, Schaefer, & Doupnik, 2024). It is also important to determine if the inventory sale was upstream or downstream, as the considerations will vary based on the sale in relation to the parent company. For an upstream sale (subsidiary to parent company) any unrealized profit or loss can be partially allocated to non-controlling interests assuming such entities exist, and once the inventory has been resold the recognized revenue is subsequently split accordingly. During a downstream sale (parent to subsidiary company) the unrealized revenue is allocated to the parent company,…arrow_forwardWhen the parent's Investment in S account is eliminated in the consolidation process, what replaces this item on the consolidated financial statements? A) The acquisition-date fair values of S's net assets, adjusted for any post-acquisition amortization of Differential. B) The acquisition-date book values of S's net assets, adjusted for any post-acquisition amortization of Differential. C) The book value of S's net assets and S's beginning retained earnings only. D) Only the new goodwill generated from the transaction.arrow_forward

- 16.Explain the process of accounting for mergers and acquisitions. How are the assets and liabilities of the acquired company recorded on the balance sheet of the acquiring company? Discuss the treatment of goodwill and any adjustments that might be necessary post-acquisition. Provide an example of a hypothetical merger and the journal entries that would be recorded.arrow_forwardThis distinguishes a business combination from other types of investment transactions. Obtaining of control Acquisition of stocks Acquisition of assets All of these The entity that obtains control over another business in a business combination called the Controller Acquiree Acquirer Controllee Entity A obtained control of Entity B in a business combination. When computing for goodwill, Entity A would least likely account for which of the following? Entity B’s research and development projects that were already charged as expenses, but have a fair value as at the acquisition date. Entity B’s unrecorded identifiable intangible assets Operating lease between Entity A and Entity B, wherein Entity B is the lessee. Entity A’s expected costs of exiting or terminating some or all of Entity B’s activities after the combination. A contingent liability assumed in a business combination Is not accounted for by the acquirer if the contingent liability has an improbable outflow of economic…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education