FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

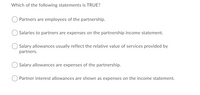

Transcribed Image Text:Which of the following statements is TRUE?

Partners are employees of the partnership.

Salaries to partners are expenses on the partnership income statement.

Salary allowances usually reflect the relative value of services provided by

partners.

Salary allowances are expenses of the partnership.

Partner interest allowances are shown as expenses on the income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- compare the benefits and detriments of being a general partner versus a limited partner of a limited partnership.arrow_forwardTax Drill - Effect of Partnership Operations on Basis Indicate whether the following items "Increase" or "Decrease" a partner's basis in the partnership. a. A partner's proportionate share of nondeductible expenses. b. A partner's proportionate share of any increase in partnership liabilities. c. A partner's proportionate share of partnership income. d. A partner's proportionate share of any reduction in partnership liabilities.arrow_forwardWhen preparing Form 1065, U.S. Return of Partnership Income, what entries must be made in order for the partners to claim the qualified business income (QBI) deduction? The appropriate adjustments must be made on the partnership's balance sheet and reported correctly on page 5 of Form 1065. Each partner's Schedule K-1 (Form 1065) should report the amount of their QBI deduction in Part III, box 13, other deductions. The information each partner will need to calculate their share of the QBI deduction should be reported on their Schedule K-1 (Form 1065), box 20, other information, or an attached statement. The QBI deduction will reduce the amount of the partnership's ordinary business income and must be included in total deductions reported on page 1 of Form 1065.arrow_forward

- A comparative income statement is given below for McKenzie Sales, Limited, of Toronto: McKenzie Sales, Limited Comparative Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Total expenses Net operating income Interest expense Net income before taxes This Year $ 7,350,000 4,610,000 2,740,000 1,390,000 706,000 2,096,000 644,000 101,000 $ 543,000 Last Year $ 5,586,000 3,511,500 2,074,500 1,079,500 613,500 1,693,000 381,500 87,000 $ 294,500 Members of the company's board of directors are surprised to see that net income increased by only $248,500 when sales increased by $1,764,000. Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).)arrow_forwardWhich of the following best describes the articles of partnership agreement? Multiple Choice The articles of partnership are a legal covenant that may be expressed orally or in writing, and forms the central governance for a partnership's operations. The articles of partnership are an agreement that limits partners' liability to partnership assets. The articles of partnership are a legal covenant and must be expressed in writing to be valid. The purpose of the partnership and partners' rights and responsibilities are required elements of the articles of partnership.arrow_forwardThe characteristic of a partnership where a partner is an agent for other partners and the partnership when transacting partnership business is: a. a fiduciary relationship b. tenancy in partnership c. mutual agency d. the proprietary theoryarrow_forward

- Blue and Grey are discussing how income and losses should be divided in a partnership they plan to form. What factors should be considered in determining the division of net income or net loss?arrow_forwarda) How is a sec 707(a) payment to a partners for service treated by the partners and the partnership? when will it be recongnise by a cash basis partner? when will it be deducted by a partnership? b) How is a guaranteed payment for services treated by the partner and the partnership? What is it recongnized or deducted?arrow_forwardA company is considering two mutually exclusive investments with a discount rate of 10%.The cash flows of the projects over time follows: Time Project A Project B 0 - RM300,000 - RM405,000 1 - RM387,000 RM134,000 2 - RM193,000 RM134,000 3 - RM100,000 RM134,000 4 RM600,000 RM134,000 5 RM600,000 RM134,000 6 RM850,000 RM134,000 7 - RM180,000 RM0 A. What is the Net Present Value (NPV) for each project? B. Since the projects are mutually exclusive, which project would you recommend?Justify your recommendation. C. Suppose that the projects are independent projects, which project (s) would yourecommend? Justify your recommendation.arrow_forward

- Which of the following is an election or calculation made by the partner rather than the partnership? Calculation of a section 199A(qualified business income) deduction amount. Claiming a section 179 deduction related to property acquired by the partnership. Tax treatment (e.g., credit, amortization) of research and experimental costs. The partnership's accounting method (e.g.. cash, accrual).arrow_forwardWhen a partnership is created, what is the contract called that gives the amounts invested by each partnership, how income and losses should be distributed, etc.? Group of answer choices partnership charter partnership partnership agreement none of thesearrow_forwardFor partnerships, the qualified business income (QBI) items reported on Schedule K-1 should include the Section 199A business income, the W-2 wages of any qualified trade or business, and: Guaranteed payments made to the partners in lieu of salary. Recapture of investment credit. The unadjusted basis of qualified property. The adjusted basis of qualified property.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education