FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

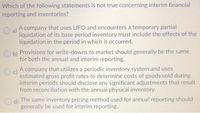

Transcribed Image Text:Which of the following statements is not true concerning interim financial

reporting and inventories?

A company that uses LIFO and encounters a temporary partial

a)

liquidation of its base period inventory must include the effects of the

liquidation in the period in which it occurred.

b)

Provisions for write-downs to market should generally be the same

for both the annual and interim reporting.

A company that utilizes a periodic inventory system and uses

c)

estimated gross profit rates to determine costs of goods sold during

interim periods should disclose any significant adjustments that result

from reconciliation with the annual physical inventory.

d)

The same inventory pricing method used for annual reporting should

generally be used for interim reporting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Because of increasing profits and inventory prices, the company changed from FIFO to LIFO inventory, which had a material effect on inventory and cost of sales. The change is adequately disclosed in the financial statements, and the auditor concurs with the change. The auditor will most likely issue a(an): Standard unmodified opinion O Unmodified opinion with explanatory paragraph O Unmodified opinion with changes to standard report wording Qualified oplon Disclaimer of opinion O Adverse opinionarrow_forwardIf material amount of inventory has been ordered through a formal purchase contract at the statement of financial position date for future delivery at firm prices [A] this fact must be disclosed [B] an appropriation of retained earnings is necessary [C] disclosure is required only if prices have since risen substantially [D] disclosure is required only if prices have declined since the date of the orderarrow_forward1. If ending inventory on December 31, 2019, is overstated, then, a) cost of goods sold for the year ended December 31, 2020, will be understated. b) gross profit for the year ended December 31, 2019, will be understated. c) gross profit for the year ended December 31, 2020, will be understated. d) cost of goods sold for the year ended December 31, 2019, will be overstated.arrow_forward

- Companies can use various methods to determine the cost of inventory, including FIFO, LIFO, and average cost. In a period in which the cost of inventory is rising, which of the following statements is true? The LIFO method will result in the lowest income tax expense. The LIFO method will result in the highest inventory balance at year-end. The average cost method will result in the highest net income. The LIFO method will result in the lowest cost of goods sold. The average cost method will result in the lowest inventory balance at year-end. The average cost method will result in the highest inventory balance at year-end. The FIFO method will result in the lowest net income. None of the listed choices are correct.arrow_forwardThe accountant for the Fred Company did not record a purchase of merchandise on credit or include the items in the ending inventory. The effect of these omissions on assets, liabilities, and retained earnings would be (assume a periodic inventory system): Assets Liabilities Retained Earnings a. Understate Understate Understateb. Understate Understate No effectc. No effect Understate No effectd. Understate No effect Understatearrow_forwardIdentify which of the following statement is correct for perpetual inventory system? When valuing ending inventory under a perpetual inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. When valuing ending inventory under a perpetual inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic inventory system. When valuing ending inventory under a perpetual inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. 5 Under the perpetual inventory system, on the purchase of inventory purchase account is debited. 7arrow_forward

- For each change or error below, indicate how it would be accounted for. 1. Change due to understatement of inventory. options: A.) accounted for prospectively b.) prior period adjustment 2. change from direct write-off to allowance method of accounting for bad debts. Options: a.) accounted for retrospectively b.) prior period adjustmentarrow_forwardWhen a company uses the perpetual inventory system in accounting for its merchandise inventory, which of the following is true? Multiple Choice The inventory account is updated after each sale The inventory account is updated throughout the year as purchases are made. Cost of goods sold is computed at the end of the accounting period rather than at each sale. None of the other alternatives are correct Purchases are recorded in the cost of goods sold account.arrow_forwardState how each of the following items is reflected in thefinancial statements.(a) Change from FIFO to LIFO method for inventoryvaluation purposes.(b) Charge for failure to record depreciation in a previousperiod.(c) Litigation won in current year, related to prior period.(d) Change in the realizability of certain receivables.(e) Write-off of receivables.(f) Change from the percentage-of-completion to thecompleted-contract method for reporting net income.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education