Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Which of the following statements is not true about mortgages?

The ending balance of an amortized loan contract will be zero.

Mortgages are examples of amortized loans.

The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and

the interest due.

O Mortgages always have a fixed nominal interest rate.

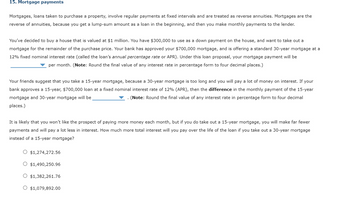

Transcribed Image Text:15. Mortgage payments

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the

reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender.

You've decided to buy a house that is valued at $1 million. You have $300,000 to use as a down payment on the house, and want to take out a

mortgage for the remainder of the purchase price. Your bank has approved your $700,000 mortgage, and is offering a standard 30-year mortgage at a

12% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be

per month. (Note: Round the final value of any interest rate in percentage form to four decimal places.)

Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your

bank approves a 15-year, $700,000 loan at a fixed nominal interest rate of 12% (APR), then the difference in the monthly payment of the 15-year

mortgage and 30-year mortgage will be

(Note: Round the final value of any interest rate in percentage form to four decimal

places.)

It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer

payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage

instead of a 15-year mortgage?

O $1,274,272.56

O $1,490,250.96

O $1,382,261.76

O $1,079,892.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A "mortgage" is a loan contract and is actually made up of which two contracts: O Index & Margin O Note & Deed Fixed & Adjustable O Amortized & Interest-Onlyarrow_forwardYou have a choice among three types of loan (discount loan, interest - only loan, and amortized loan), and wish to pay the LEAST expensive cost of borrowing. An amortized loan will the cheapest option. true or falsearrow_forwardA mortgage that allows the borrower to pay less than the interest due for a few year (A) negative-amortization mortgage.. B credit-default swap. C) traditional, thirty-year fixed-rate mortgage. D "liar loan".arrow_forward

- A Collateralized Mortgage Obligation (CMO) allows you to create some AAA rated tranches from a pool of subprime mortgages by ordering the tranches by payback precedence. Question 36 options: True Falsearrow_forwardCan you Discuss the Reverse Annuity Mortgage ,(RAM)? and also Identify and explain briefly the types of derivatives in a financial systemarrow_forwardAssume you are lending money to company X. A credit default swap (CDS) consists of an agreement by a third party to pay the lost principal and interest of a loan to you (the CDS buyer) if a borrower defaults on a loan. Which of the following is false? O A. A Swap completely solves the problem that company X might default OB. A Swap solves the default problem from Company X on the condition that the third party (CDS provider) will not default. O C. When financial crisis happens, the CDS seller may have to pay recovery to many CDS buyers, and then the CDS seller could default. O D. B and C are part of the reasons for 2008 Global financial crisis.arrow_forward

- Explain Reverse Annuity Mortgages (RAMs) loan?arrow_forwardWhy are the credit default swaps, in essence, an insurance contract against the default of one or more borrowers?arrow_forwardThe maturity value of a note receivable is equal to the sum of the face amount of the note O plus the interest O plus nothing else O none of these answers are correct Ominus the interestarrow_forward

- When purchasing a vehicle or obtaining a mortgage, you are most likely to get what kind of loan: O pure discount O interest only amortized loan with fixed payment amortized loan with fixed principal paymentarrow_forwardA subprime mortgage is a mortgage given to a borrower with excellent credit. True Falsearrow_forwardNon-performing loans are defined as loans that: a. are either in default or close to being in default and are at least 90 days in arrears. b. have been written off and loans that are at least 80 days in arrears. c. are either in default or close to being in default and are at least 60 days in arrears. d. have been written off and loans that are at least 60 days in arrears.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education