FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

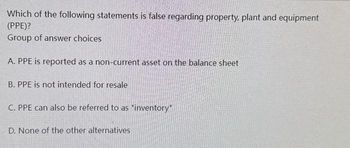

Transcribed Image Text:Which of the following statements is false regarding property, plant and equipment

(PPE)?

Group of answer choices

A. PPE is reported as a non-current asset on the balance sheet

B. PPE is not intended for resale

C. PPE can also be referred to as "inventory"

D. None of the other alternatives

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- All of the following statements regarding asset impairments are true EXCEPT which one? O After recording the impairment loss, the reduced carrying amount of the asset held for use becomes its new cost basis O An impaired asset held for disposal may not be written up O An impairment loss for an asset held for use may not be restored. An impaired asset held for disposal is treated like inventory, and therefore should be reported at the lower-of-cost or net-reaalizable value.arrow_forwardPut yes or no in front of each of the following statements: 1- () An inventory is the inventory of assets and liabilities in terms of quantity and peak 2- () The reducing premium represents a percentage of the net value of the fixed asset 3- () The imposition of the independence of the accounting unit states that the project has an independent legal personality over the personality of the owner 4- () One of the objectives of the inventory is to determine the real value of the liabilities and assets in the project 5- () Expenses paid in advance from other credit balances that appear on the right side of the balance sheet 6- () The principle of prudence and caution stipulates that one must be careful not to record potential expenses, other than potential revenuesarrow_forwardQ:How is accidental loss of goods treated in final account in case: a: Goods had not been insured or Goods have been insured and the insurance company has claims associated with it.arrow_forward

- Accounting depreciation is sometimes referred to more generally as asset depreciation. True or false?arrow_forwardWhich of the following is not affected by an error related to ending inventory? Multiple Choice O O O O O Sales. Net income. Current assets. Gross profit. Cost of goods sold.arrow_forwardThe main objective of IAS 36 Impairment of Assets is to prescribe the procedures that should ensure that an entity's assets are included in its statement of financial position at no more than their recoverable amounts. Where an asset is carried at an amount in excess of its recoverable amount, it is said to be impaired and IAS 36 requires an impairment loss to be recognized. Required: Define an impairment loss explaining the relevance of fair value less costs to sell and value in use and state how frequently assets should be tested for impairment. 2. Describe the possible incators of impairment. 3. Explain how an impairment loss is accounted for after it has been calculated.arrow_forward

- Which of the following is a limitation of the direct write-off method of accounting for uncollectible? The direct write-off method overstates assets on the balance sheet. The direct write-off method does not match expenses against revenue very well. The direct write-off method does not set up an allowance for uncollectible. All of the abovearrow_forward4. The cost of an asset and its fair value are Select answer from the options below: a) irrelevant when the asset is used by the business in its operations. b)never the same. c) the same on the date of acquisition. d) the same when the asset is sold. 6. If the sum of the debit column equals the sum of the credit column in a trial balance, it indicates Select answer from the options below: a. no errors can be discovered. b. no errors have been made. c. the mathematical equality of the accounting equation. d . that all accounts reflect correct balances. 7. The final step in the recording process is to Select answer from the options below: a. enter the transaction in a journal. b. prepare a trial balance. c. transfer journal information to ledger accounts. d. analyze each transaction. 8. The time period assumption states that Select answer from the options below: a. the economic life of a business can be divided into artificial time periods. b. estimates should not be made if a…arrow_forwardWhich limitation of an income statement occurs when one company uses an accelerated depreciation method while another company uses straight-line depreciation? O Companies omit from the income statement items they cannot measure reliably. O Income measurement involves judgment. O Income numbers are affected by the accounting methods employed. All of these answer choices are correct.arrow_forward

- Deciding whether to record a sale when the order for services is received or when the services are performed is an example of a :- a. classification issue. b. valuation issue. c. recognition issue. d. communication issue. e. none of the abovearrow_forwardState how each of the following items is reflected in thefinancial statements.(a) Change from FIFO to LIFO method for inventoryvaluation purposes.(b) Charge for failure to record depreciation in a previousperiod.(c) Litigation won in current year, related to prior period.(d) Change in the realizability of certain receivables.(e) Write-off of receivables.(f) Change from the percentage-of-completion to thecompleted-contract method for reporting net income.arrow_forwardTRUE OR FALSE? Current Assets differ from Quick assets when it comes to inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education