FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

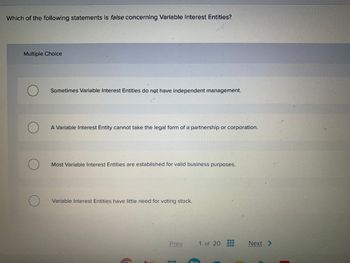

Transcribed Image Text:Which of the following statements is false concerning Variable Interest Entities?

Multiple Choice

Sometimes Variable Interest Entities do not have independent management.

A Variable Interest Entity cannot take the legal form of a partnership or corporation.

Most Variable Interest Entities are established for valid business purposes.

Variable Interest Entities have little need for voting stock.

C

Prev

C

1 of 20

www

www

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward[S1] A proxy fight involves having shareholders looking for board members that will allow an acquisition. [S2] A tender offer can be made with or without plans for an acquisitiona. Only S2 is true.b. Both are true.c. Only S1 is true.d. Neither is true.arrow_forwardWhich of the following statements is true about different types of firms? O Corporations do not have limited liability O Owners of a corporation are liable for any obligations it enters into O Partnerships are the most common type of business firms in the world O A limited liability company is like a corporation because its owners are not personally liable for the firm's debtsarrow_forward

- 'Control' exists when the parent owns less than half of the voting power of an entity when: Select one alternative: the remaining investors act in unison to outvote the parent. other shareholders actively cooperate when exercising their votes. all other shareholdings are widely dispersed. other shareholders in the entity are passive investors.arrow_forward9 You are trying to decide if an entity you are reviewing is a government or a not-for-profit. Which of the following would indicate it is a government rather than a not-for-profit entity? Multiple Choice Absence of profit motive. A primary source of revenues is taxes. Resource providers do not expect benefits proportional to the resources provided. Absence of a defined ownership interest that can be sold, transferred, or redeemed.arrow_forwardTransferring corporate assets to shareholders for less than fair market value is a form of Multiple Choice looting. piercing. authorizing. capitalizing.arrow_forward

- Please indicate which of the following statements is true regarding types of business entities? Multiple Choice O None of the choices are true. Ownership in a partnership is represented by having shares of common stock. For accounting purposes a sole proprietorship is not a separate entity from its owner. Sole proprietorships are subject to double taxation.arrow_forwardProxy access allows a shareholder to circulate an alternative proxy card with a rival slate of board candidates. Question options: a) True b) Falsearrow_forwardTrue or False: An S Corporation will not be treated as having more than one class of stock solely because of differences in voting rights (i.e. both voting and non-voting common stock).arrow_forward

- True/False. In their Articles of Incorporation, corporations that want to maintain flexibility about future business ventures they might engage in often state a very generic corporate purpose (e.g., “engage in any activity that is lawful for domestic corporations”) or do not include a purpose at all if listing a purpose is optional.arrow_forwardA trustee for a company that is being liquidated voids a preference transfer. What has happened, and why did the trustee take this action?arrow_forwardWhat advantages does a sole proprietor offer? What is a major drawback of this type of organization?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education