ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Need typed answers.Please give answer within 45 minutes

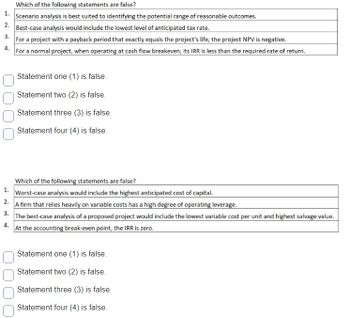

Transcribed Image Text:Which of the following statements are false?

1. Scenario analysis is best suited to identifying the potential range of reasonable outcomes.

2. Best-case analysis would include the lowest level of anticipated tax rate.

3. For a project with a payback period that exactly equals the project's life, the project NPV is negative.

4. For a normal project, when operating at cash flow breakeven, its IRR is less than the required rate of return.

Statement one (1) is false.

Statement two (2) is false.

Statement three (3) is false.

Statement four (4) is false.

Which of the following statements are false?

1. Worst-case analysis would include the highest anticipated cost of capital.

2. A firm that relies heavily on variable costs has a high degree of operating leverage.

3.

4.

The best-case analysis of a proposed project would include the lowest variable cost per unit and highest salvage value.

At the accounting break-even point, the IRR is zero.

Statement one (1) is false.

Statement two (2) is false.

Statement three (3) is false.

Statement four (4) is false.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Imagine you are the mayor of a town and you are trying to decide if you should pay for a fireworks show. Your staff survey your 400 citizens who say that they each value a fireworks show at $10. The fireworks show only costs $3,000 so you put on the show but when you ask for donations to pay for the fireworks you only receive $25 total. What does this result show? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. You staff's survey must have overestimated the value of a fireworks show. b The fireworks cost must have been greater than their economic benefit. The firework show suffered from the Tragedy of the Commons problems d The town's citizens were free-riders.arrow_forwardHow can we determine the number of payment periods?arrow_forwardA sentence that contains a metaphorarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education