ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

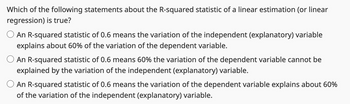

Transcribed Image Text:Which of the following statements about the R-squared statistic of a linear estimation (or linear

regression) is true?

An R-squared statistic of 0.6 means the variation of the independent (explanatory) variable

explains about 60% of the variation of the dependent variable.

O An R-squared statistic of 0.6 means 60% the variation of the dependent variable cannot be

explained by the variation of the independent (explanatory) variable.

O An R-squared statistic of 0.6 means the variation of the dependent variable explains about 60%

of the variation of the independent (explanatory) variable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You are the owner of a restaurant located in a beach resort in Hawaii and want to use regression analysis to estimate the demand for your fresh seafood dinners. You have collected data on the daily quantity of seafood dinners sold over the last summer season. In order to correctly specify your regression equation, which of the following variables should be considered? Select one: A. the prices charged for souvenirs in local stores B. the prices charged for scuba diving excursions at the resort C. the wages paid to your chef and servers D. the daily number of vacationers at the resortarrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Multicollinearity and give a reasonarrow_forwardThe data for this question is given in the file 1.Q1.xlsx(see image) and it refers to data for some cities X1 = total overall reported crime rate per 1 million residents X3 = annual police funding in $/resident X7 = % of people 25 years+ with at least 4 years of college (a) Estimate a regression with X1 as the dependent variable and X3 and X7 as the independent variables. (b) Will additional education help to reduce total overall crime (lead to a statistically significant reduction in crime)? Please explain. (c) Will an increase in funding for the police departments help reduce total overall crime (lead to a statistically significant reduction in total overall crime)? Please explain. (d) If you were asked to recommend a policy to reduce crime, then, based only on the above regression results, would you choose to invest in education (local schools) or in additional funding for the police? Please explain.arrow_forward

- Mita, the manufacturer of copiers, has been spending increasing amounts of money on radio and television advertising in recent years. An analyst employed by Mita wanted to estimate a simple linear regression of the company's annual copier sales versus advertising dollars. Th regression results included SSE = 12593 and SSR = 87663. What is the coefficient of determination for this regression? 0.874 0.935 0.144 0.126arrow_forwardDefine coefficients of the Linear Regression Model?arrow_forwardThe data below represent commute times (in minutes) and scores on a well-being survey. Complete parts (a) through (d) below. Commute Time (minutes), x Well-Being Index Score, y 5 72 105 20 25 35 60 69.2 68.0 67.5 67.1 65.9 66.0 63.8 (a) Find the least-squares regression line treating the commute time, x, as the explanatory variable and the index score, y, as the response variable. ŷ=x+ (Round to three decimal places as needed.) (b) Interpret the slope and y-intercept, if appropriate. First interpret the slope. Select the correct choice below and, if necessary, fill in the answer box to complete your choice. OA. For every unit increase in commute time, the index score falls by (Round to three decimal places as needed.) OB. For every unit increase in index score, the commute time falls by (Round to three decimal places as needed.) 1 D. For an index score of zero, the commute time is predicted to be (Round to three decimal places as needed.) on average. on average. OC. For a commute time…arrow_forward

- E3arrow_forwardIn a regression problem with one output variable and one input variable, we set up two cutpoints z1 and z2 for the input variable and we fit a step function regression model based on these two cutpoints of the input variable. If you write the regression problem in matrix form y = X%*%β + ε, how many rows would the vector β have?arrow_forwardGiven the estimated multiple regression equation ŷ = 6 + 5x1 + 4x2 + 7x3 + 8x4 what is the predicted value of Y in each case? a. x1 = 10, x2 = 23, x3 = 9, and x4 = 12 b. x1 = 23, x2 = 18, x3 = 10, and x4 = 11 c. x1 = 10, x2 = 23, x3 = 9, and x4 = 12 d. x1 = -10, x2 = 13, x3 = -8, and x4 = -16arrow_forward

- Imagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. what are the implications of Heteroscedasticity if this potential issue in your model?arrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Heteroscedasticity and give a reasonarrow_forwardRQ7. A teacher is trying to predict student test grades (Q). She believes test grades are a function of incoming GPA, hours studying, and hours spent on social media (a distraction). She runs a regression and it produces these coefficients: Variable Coefficient Intercept GPA Hours Studying Social Media 70.0 3.5 2.4 -4.0 For a given student Julian, his GPA is 2.0, he studies 4 hours for the exam, and he spends 6 hours on Facebook. Predict his exam score (round to the nearest whole number).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education