ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

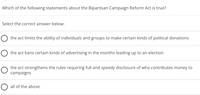

Transcribed Image Text:Which of the following statements about the Bipartisan Campaign Reform Act is true?

Select the correct answer below:

the act limits the ability of individuals and groups to make certain kinds of political donations

O the act bans certain kinds of advertising in the months leading up to an election

the act strengthens the rules requiring full and speedy disclosure of who contributes money to

campaigns

O all of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2- What are the behavioral effects of labor (income) taxes? Draw the graph and explain. 3- Do you think a unique equilibrium can emerge under majority rule? Why and why not? Please explain your answer with graphs.arrow_forwardWhich one of the following statements about our federal, state and local tax systems is true? All of our taxes are highly regressive Our Federal taxes tend to be more progressive than our State and local taxes. Our Federal taxes tend to be less progressive than our State and local taxes. Our Federal taxes tend to be less progressive than our State taxes,but, our local taxes are the most progressive of all taxes.arrow_forwardNegative Political advertisements generally have what effect on voters? They influence in change of party membership They convince some people not to vote O They make voters more engaged in the issues no effect- no change in voter behaver after ads none of the abovearrow_forward

- plz answer correctarrow_forwardIf their only concern were the cost of issuing municipal debt, how would you expect the mayors of most U.S. cities to respond to a revenue-neutral change in the federal income tax that sharply lowered the top marginal tax rate?arrow_forwardExplain the rationale behind the prevalence of electoral cycles in the world in macroeconomicsarrow_forward

- Canada's current election system prevents strategic voting. O True Falsearrow_forwardThe negative income tax has been proposed as a means The negative income tax has been proposed as a means of increasing both the efficiency and the equity of Canada’s tax system (see Applying Economic Concepts 18-1 on page 465). The most basic NIT can be described by two variables: the guaranteed annual income and the marginal tax rate. Suppose the guaranteed annual income is $8000 and the marginal tax rate on every dollar earned is 35 percent. With this NIT, after-tax income is given by After-tax income = 8000 + (1 – 0.35) X (Earned income) a. On a scale diagram with after-tax income on the vertical axis and earned income on the horizontal axis, draw the NIT relationship between earned income and after-tax income. b. What is the level of income at which taxes paid on earned income exactly equal the guaranteed annual income? c. The average tax rate is equal to total net taxes paid divided by earned income. Provide an algebraic expression for the average tax…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education